Updated: 2024-10-08

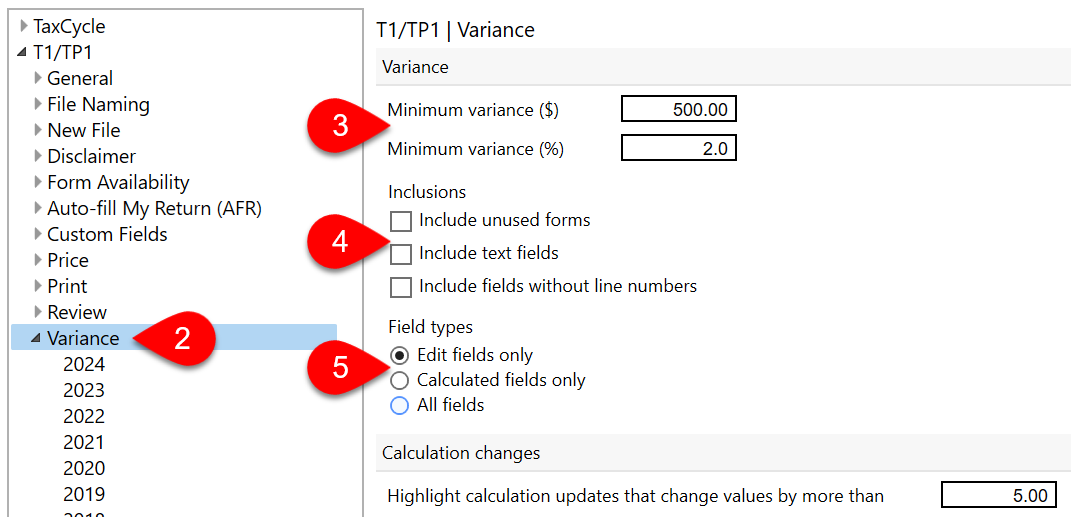

Variance options allow you to customize when review messages appear when comparing the data in snapshots with the data in a tax return. Read the Snapshots and Variance help topic to learn more.

You can adjust the thresholds for triggering variance as well as the types of fields that can have variance:

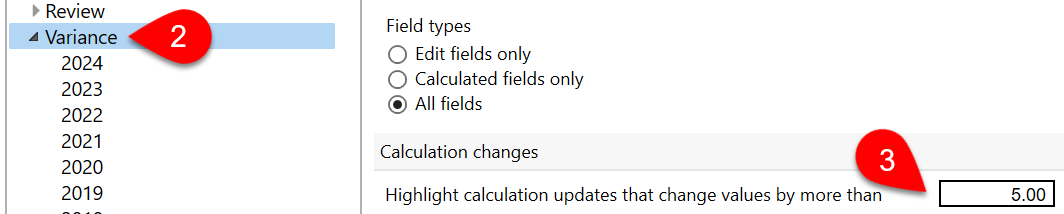

Under module options, you can set the dollar threshold that triggers calculation change messages: