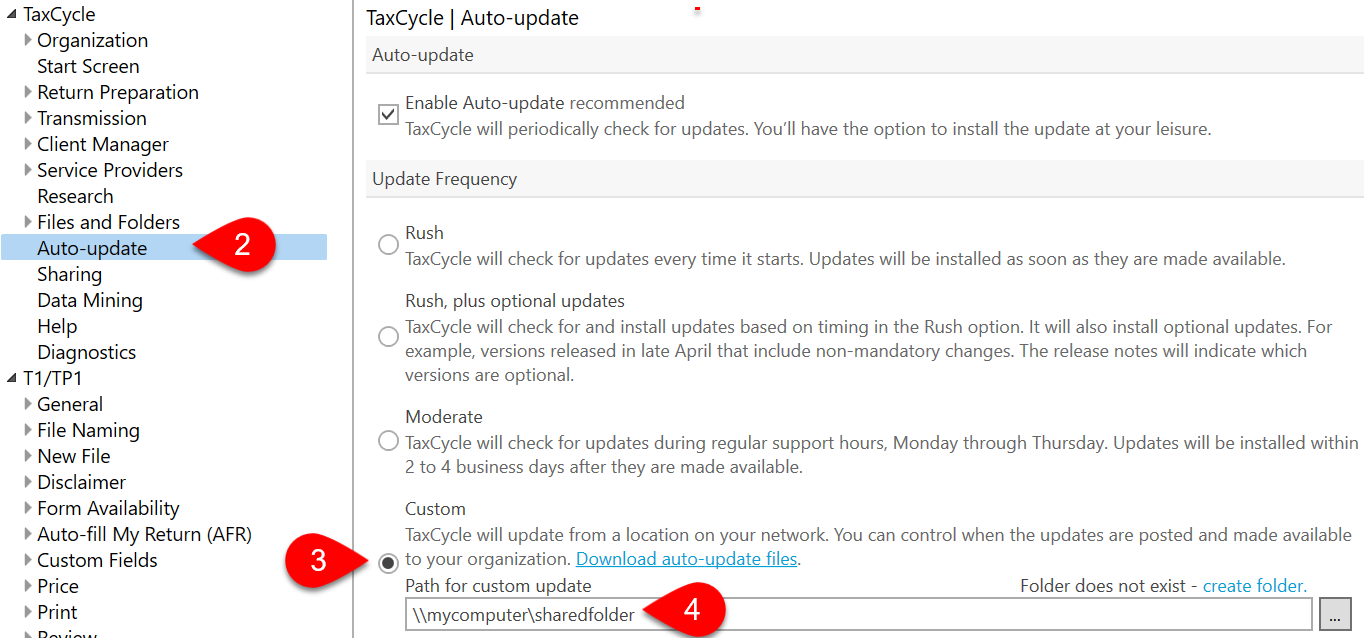

Configure TaxCycle to automatically update from a location on your office network or on the web (URL).

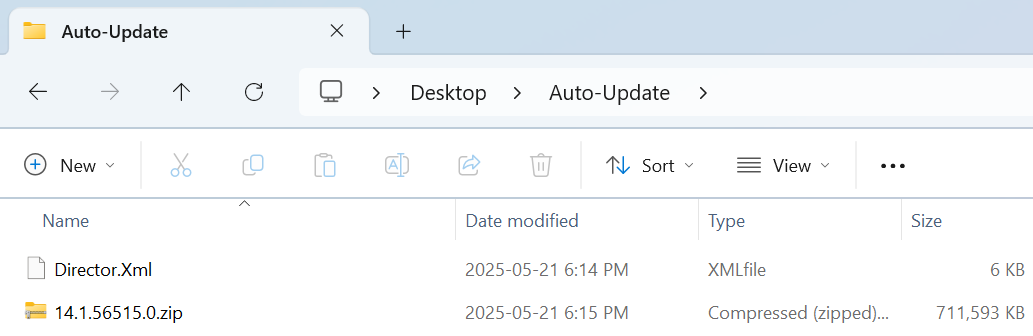

Download the latest auto-update file from the list, then follow the instructions (below) to set the update location.

This release adds the 2025 T1/TP1 module with forms in preview mode and updated rates and calculations for 2025 personal tax returns.

Download Auto-Update FilesThis certified release of TaxCycle T2 and AT1 extends the supported corporate tax year ends up to October 31, 2025.

Download Auto-Update FilesThis TaxCycle release rolls over the T3/TP-646 and T5013/TP-600 modules to 2025.

Download Auto-Update Files