Updated: 2024-12-11

TaxCycle T1 is EFILE certified software. EFILE “certified” tax preparation software means that TaxCycle has gone through a process with the Canada Revenue Agency (CRA) to verify that it is compatible with the CRA EFILE electronic tax filing service.

T1 EFILE is just one of over 40 electronic filing and data download services TaxCycle supports. See EFILE and Electronic Services Available in TaxCycle for a complete list.

EFILE Number and Password

To file electronically with the CRA, you must have an EFILE number and password:

- To register for EFILE and receive these credentials, go to the CRA’s EFILE for electronic filers page.

- If you already have an EFILE number, you must complete a yearly renewal to receive a new password for the latest T1 tax season. Always use the latest password given to you.

The registration or renewal process includes a suitability screening. This process may take up to 30 days. To allow enough time for the review of your application before the filing season starts, we encourage you to renew your application as soon as possible.

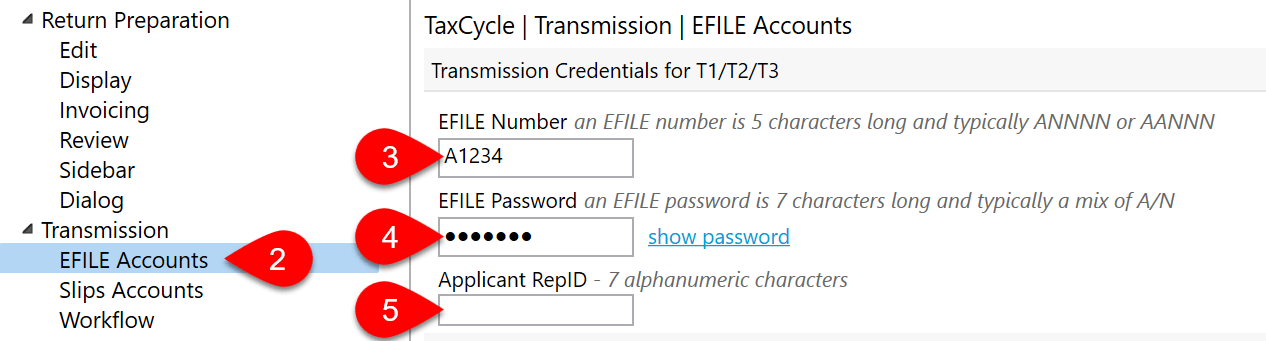

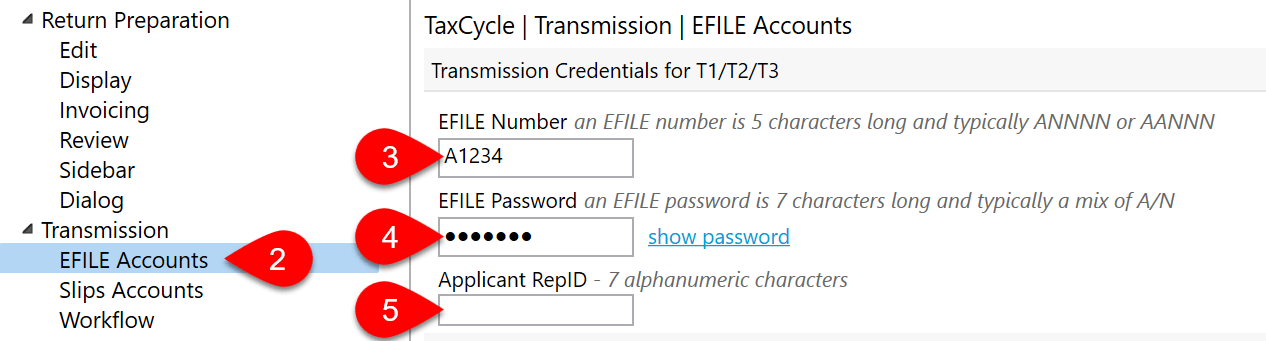

Enter the CRA EFILE number and password in TaxCycle options:

- If you have a file open, go to the File menu, then click Options. To open Options from the Start screen, click Options in the blue bar on the left side. (You can also access these EFILE options any time by clicking on the wrench icon in the Transmit sidebar.)

- On the left side of the screen, expand Transmission, then click on EFILE Accounts.

- Enter your CRA EFILE Number.

- Enter your current CRA EFILE Password. (As soon as you renew your account, you can use it to transmit returns.)

- (Optional) Enter your CRA RepID. This field is optional for the 2023 filing season; leave it blank if you do not have a valid RepID within the list of EFILE applicants.

Step 1: Resolve Outstanding Errors

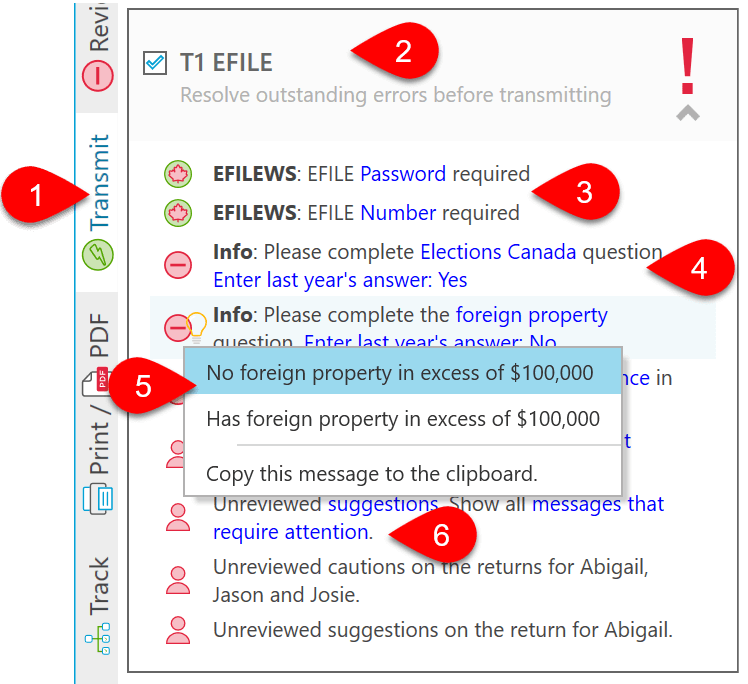

To resolve outstanding errors before transmitting:

- Click Transmit in the sidebar or press F12.

- Click once on the T1 EFILE box to expand it and see a list of all outstanding errors. TaxCycle checks for errors that prevent EFILE and lists them in this box.

- If a message reminds you to complete your EFILE Number or Password, click the blue link to enter them in Options.

- Double-click on a message to jump to the related field or form.

- Some messages have Quick Fix suggestions, so you can fix the error without jumping to the form. Hover over the message and click on the light bulb to see the suggestions.

- In any message, click the blue links to the form, field, spouse or dependant, options page or message that needs attention.

Step 2: Confirm Signature of Form T183

The CRA requires that a taxpayer sign the appropriate sections on the T183, Information Return for Electronic Filing of an Individual’s Income Tax and Benefit Return, before a preparer can electronically file on their behalf. Learn how to complete form in the T183 Form help topic. It is important to keep a signed copy of this form in your files should the CRA ask for it. They regularly check with preparers.

As a temporary measure, the CRA permits electronic signatures on this form. When collecting an e-signature, the T183 form must report the date and time the form was electronically signed. This information is then transmitted to the CRA through T1 EFILE.

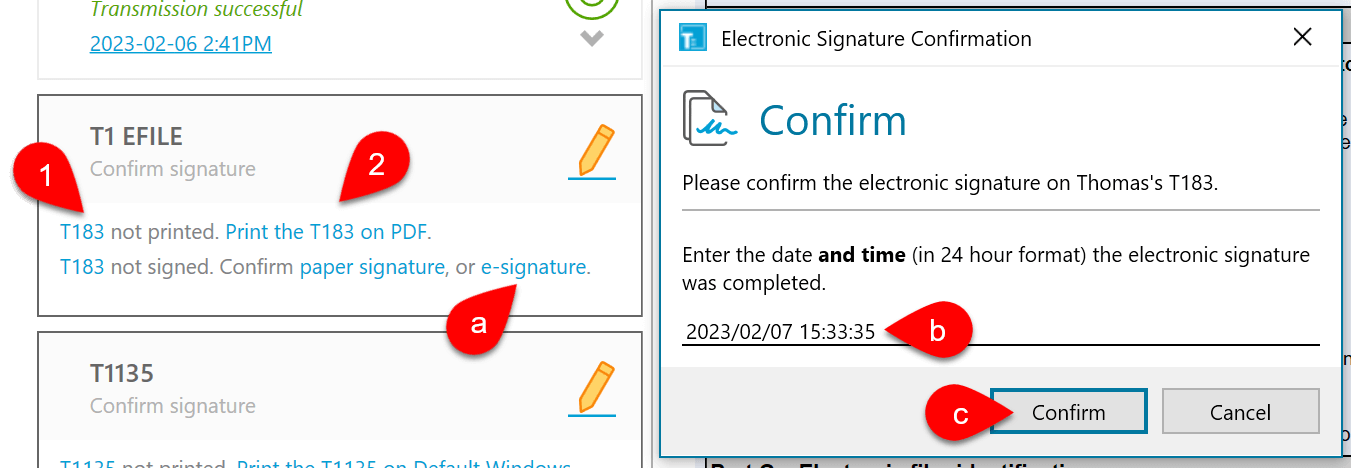

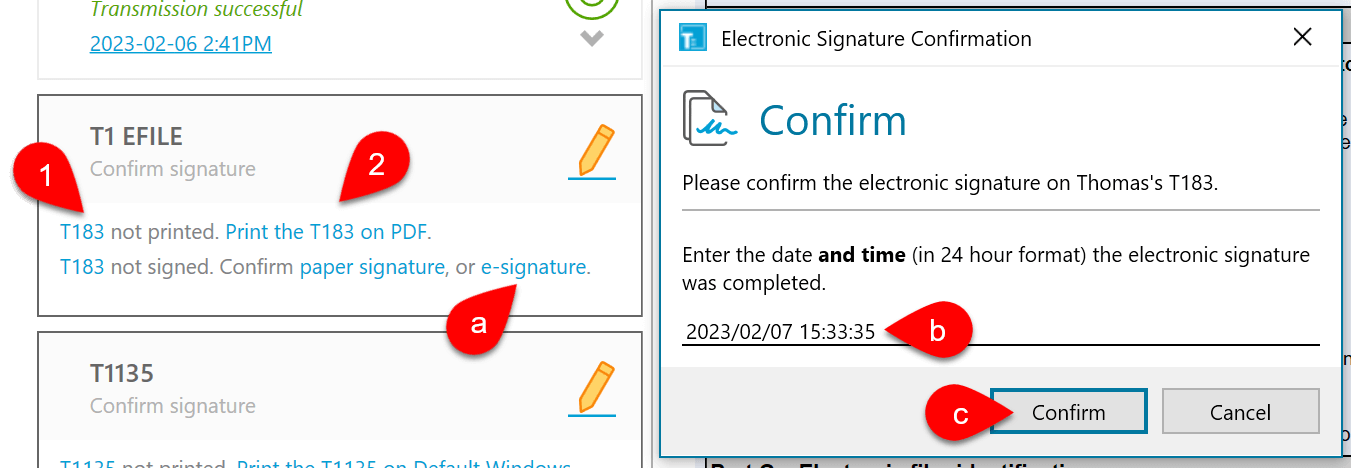

To confirm the taxpayer has signed the T183 before transmitting:

- Click on the T183 link to open the form for data entry and review. For details on how to complete the forms, see the T183 Form help topic.

- Click Print the T183 link to print the form or to send it for electronic signature. TaxCycle records the date and the name of the person who printed the form.

- If you send the form for electronic signature through TaxFolder or DocuSign®, TaxCycle automatically records the signing date and time when the document was signed.

- If you collect an electronic signature by any other method (such as collecting a scanned copy or using Adobe® Reader), you must enter this information when confirming the signature before T1 EFILE transmission:

- Click the e-signature link to confirm receipt of the signature.

- TaxCycle automatically enters the current date and time using the 24-hour format.

- Adjust the date and time if required and click the Confirm button to save.

If required, you can disable the signature confirmation step (not recommended). See the “Disable signature confirmation” section in the Transmission Options help topic.

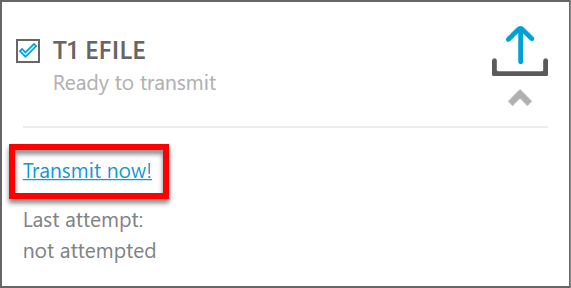

Step 3: Transmit the Return

After confirming the signatures, the return is ready to transmit. Click the Transmit Now! link to begin the transmission.

You can also transmit other requests and forms (like the T1135) at the same time using Transmit family or Transmit multiple. Learn how in the Transmit Family and the Transmit Multiple help topics.

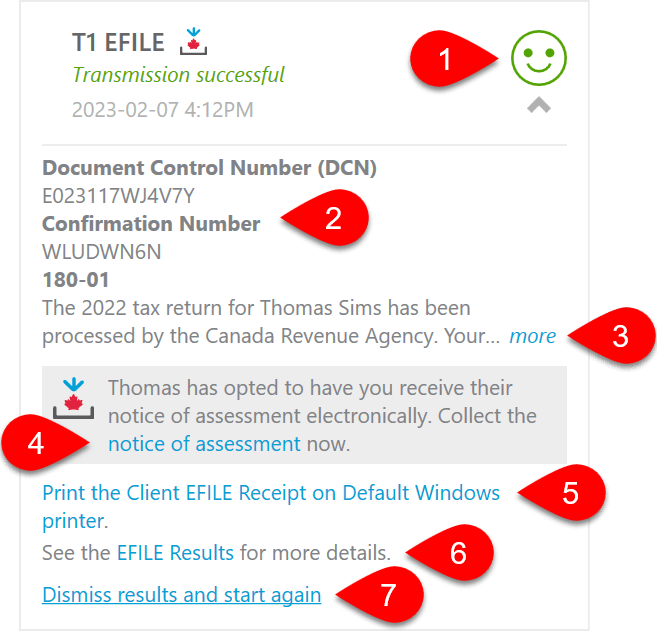

Transmission Results

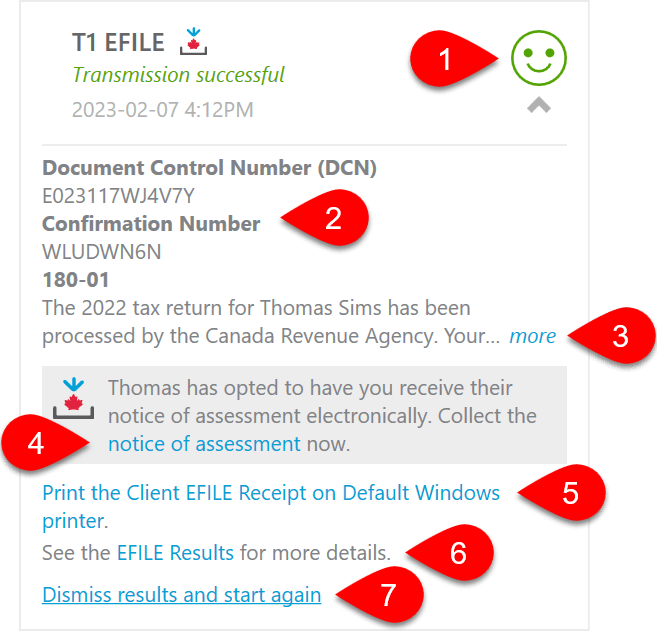

- When a transmission succeeds, you will see the words Transmission successful in green text and green happy face. This symbol also appears in the Client Manager for returns that are successfully filed, and in the blue bar at the bottom of the window of any open tax return.

- The box also shows the Document Control Number (DCN) and the Confirmation number for future reference.

- Any messages returned from the CRA appear in this box. Click the more link to see the full message.

- If the taxpayer opted to receive their notice of assessment through online mail or through Express NOA, an additional message appears. If applicable, click the link to sign into Express NOA and collect the notice of assessment. Learn more in the Express NOA help topic.

- Click the Print the Client EFILE Receipt link to give a copy of this information to your client.

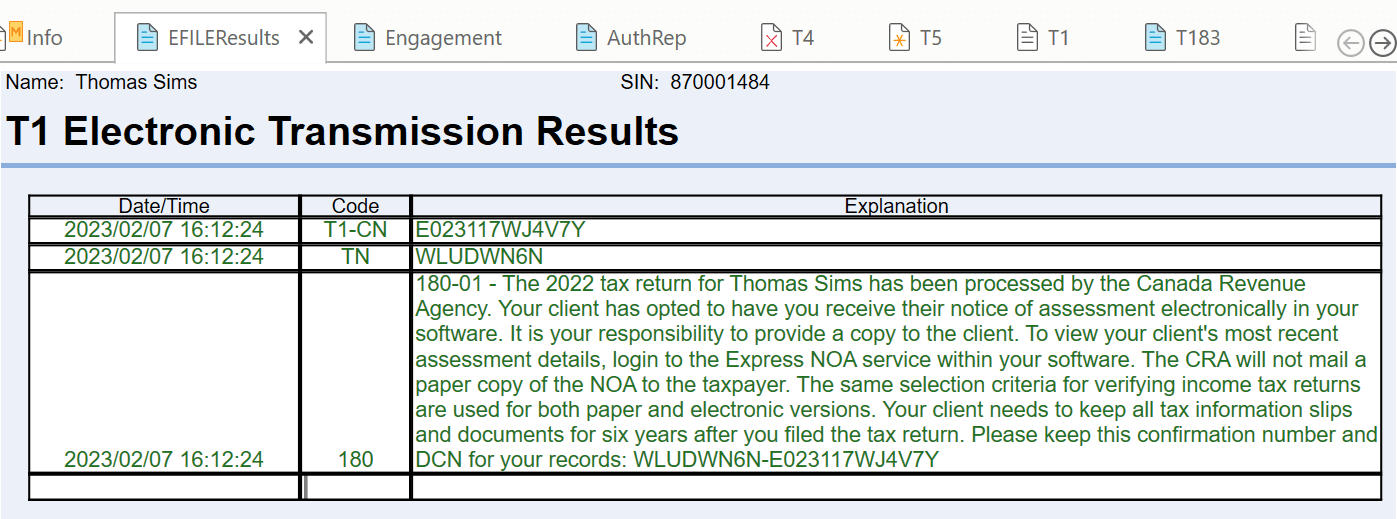

- Click the EFILE Results link to view the worksheet which contains a full list of the results from all transmission attempts.

- If you need to retransmit the return, click Dismiss results and start again.

Rejected or Failed Transmission (EFILE error)

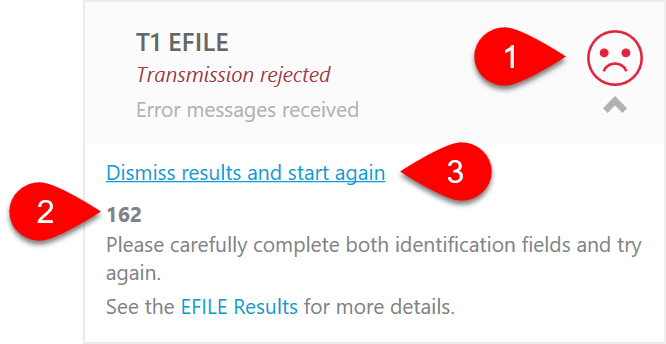

- If the CRA rejects a transmission due to errors, you will see the words Transmission rejected and a red sad face.

- Any error messages received from the CRA also appear in this box, starting with the EFILE error number. This number may be useful if you need to contact the CRA regarding an error. The longer error description usually contains information on what went wrong with the transmission, so you can work to correct it.

- When you resolve the issue, click Dismiss results and start again to retransmit. This rechecks the return for outstanding errors before returning to the transmission step.

If a transmission fails due to an issue with your Internet connection, you will see the words Transmission failed and two computers with red dots between them. This means that TaxCycle could not connect with the CRA system and did not attempt to file the return. Click the Diagnose Internet connectivity link to see whether your Internet connection is working.

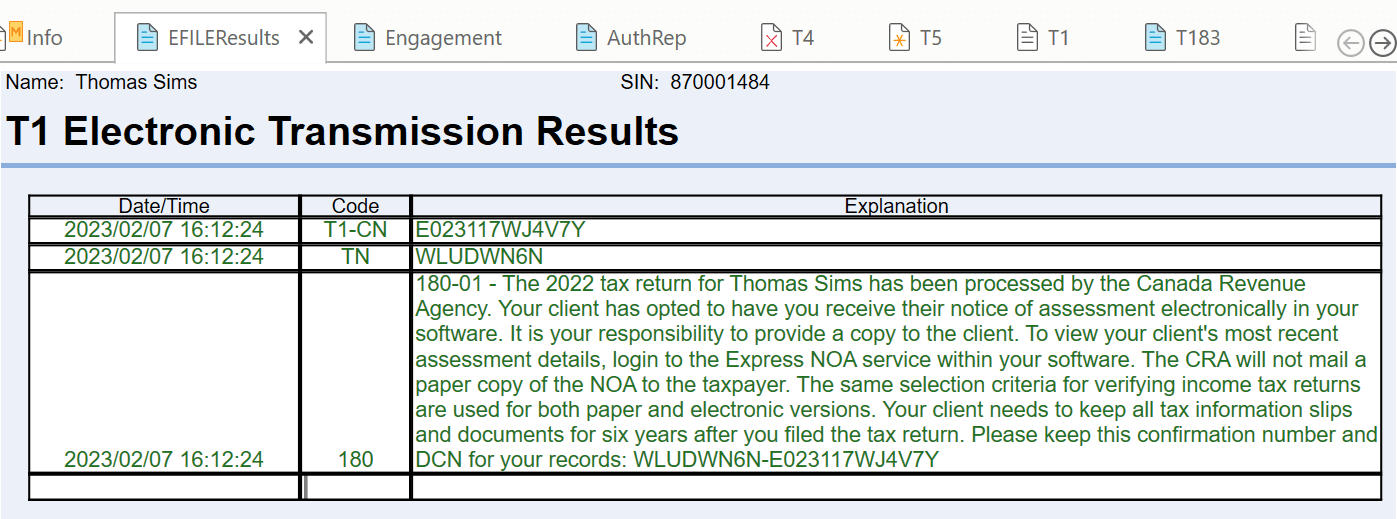

EFILEResults Worksheet

The EFILEResults worksheet lists the results of any attempts to file a T1 return. Regardless of a successful or failed transmission, TaxCycle records the time and the result of the transmission, so you always have a complete record of transmission attempts and returned messages, even if you have to retransmit the return.

Transmission History

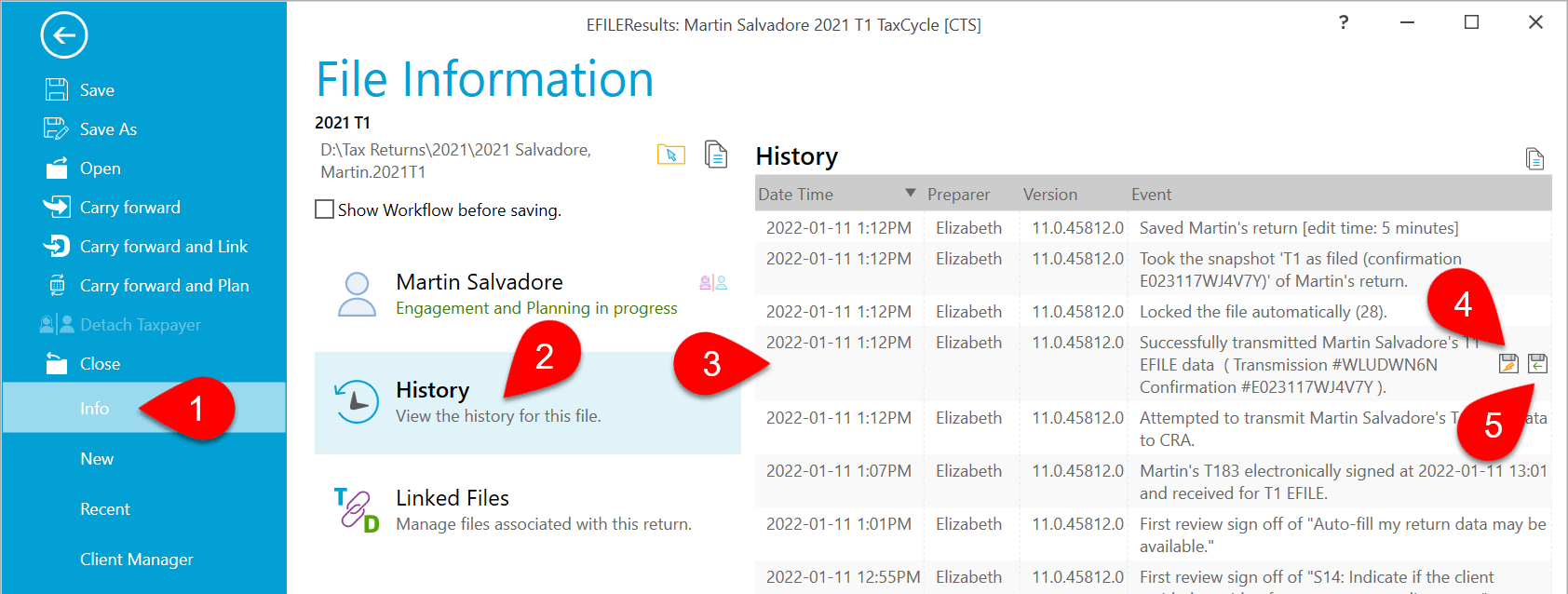

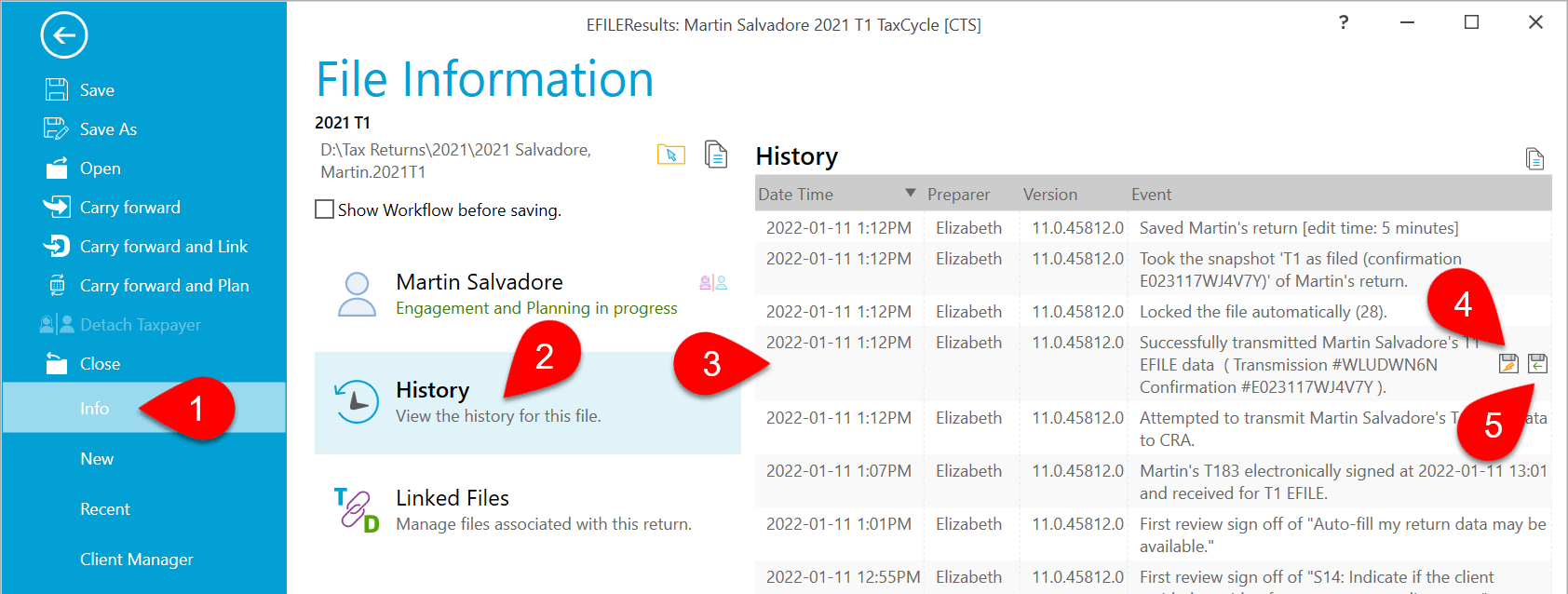

TaxCycle saves each transmission attempt in the file history:

- Go to the File menu, then click on Info.

- Click on History.

- Find the record of the transmission in the list.

- Click the first save button (the one with the lightning bolt) to save a copy of the XML file that was transmitted to the CRA.

- Click the second save button (the one with the green arrow) to save a copy of the response sent back from the CRA. See the Save XML Response File and Update EFILE Workflow help topic.

- TaxCycle also updates the workflow information for the taxpayer. See the Workflow Groups and Tasks help topic.