Updated: 2024-11-05

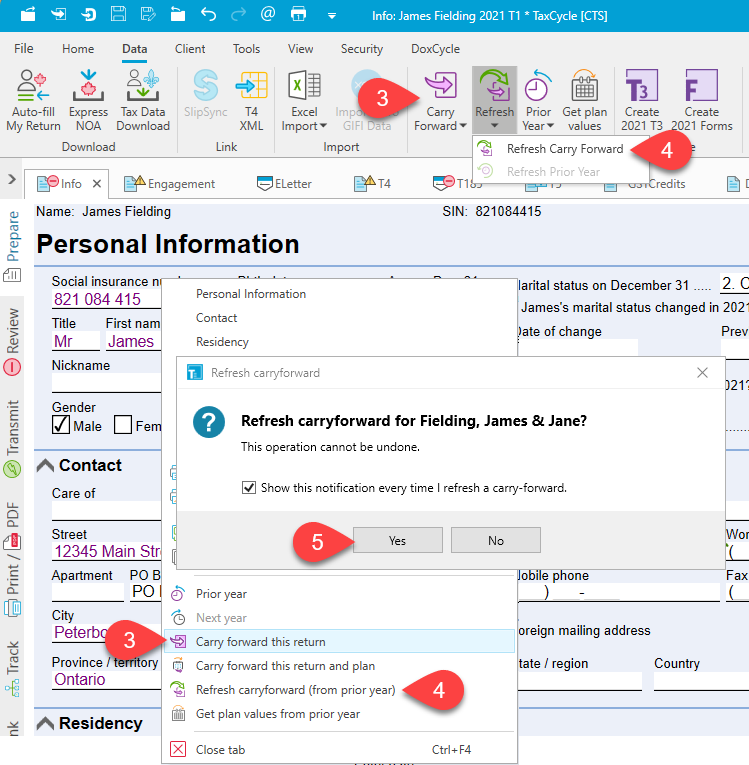

If you carry forward a file to the following year and then make changes to the earlier tax return, you can update the data in the later return. This is especially handy when a client has multiple years of returns to prepare.

In the past, if you needed to prepare two years of returns for a client, you would have prepared the prior year return first and then carried it forward to prepare the current return. If the client discovered a forgotten slip or missing piece of information for the prior year after you had carried forward and prepared current return, you either needed to start again or enter the information manually.

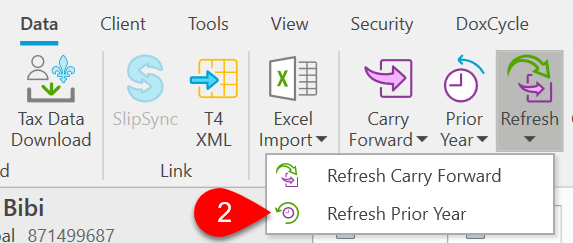

To update the prior-return with any changes in the current-year file: