Updated: 2025-02-21

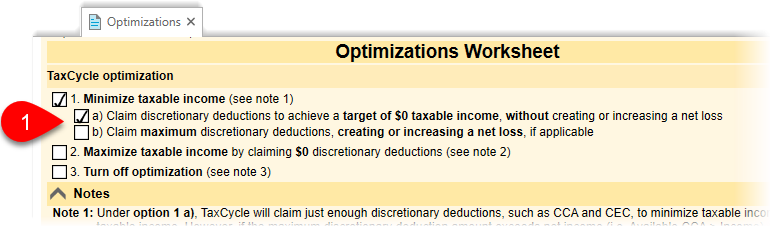

The Optimizations worksheet in TaxCycle T2 allows you to control optimizations in corporate tax returns, determine whether to optimize for minimizing or maximizing taxable income, or to turn off optimizations altogether.

The Optimizations worksheet allows you to see and customize optimizations for the taxpayer.

When optimizations are enabled, TaxCycle applies the deductions in the following order:

Read the following scenario for an explanation of the various optimization goals.

| Name of corporation | Company XYZ |

| Net income from S125 | $12,000 |

| Class 1, opening UCC | $987,986 |

| Maximum available annual CCA ($987,986 × 4%) |

$39,519 |

The results of each optimization goal are:

[SCREENSHOT]

TaxCycle applies the deductions in the following order:

The last option consists of first claiming the T2 jacket deductions, such as donations and non-capital losses, before claiming Schedule 1 deductions, such as CCA and CEC.

This option may be useful, for example, if a non-capital loss or donation is going to expire soon and you prefer to use it first and preserve as much CCA and CEC claim for the following year.

For an explanation of this option, let’s look at Company XYZ with some variations:

| Name of corporation | Company XYZ |

| Net income from S125 | $12,000 |

| Class 1, opening UCC | $500,000 |

| Maximum available annual CCA ($500,000 × 4%) |

$20,000 |

| Non-capital loss due to expire soon | $11,000 |

By choosing to claim the non-capital loss first before CCA, TaxCycle will preserve as much future CCA as it can.

[SCREENSHOT]

To select this, choose Option 1 WITHOUT selecting sub-option a or b.