Updated: 2025-03-25

Use the Dep and DepEx worksheets to enter dependant information and expenses and have it flow to the related schedules of the tax return. The DepCredSum worksheet provides a list of most dependant credits claimed in the return.

If you want to prepare a complete tax return for a dependant and have it linked to the supporting taxpayer(s) so that credits can be automatically transferred, read the Dependant and Family Returns help topic.

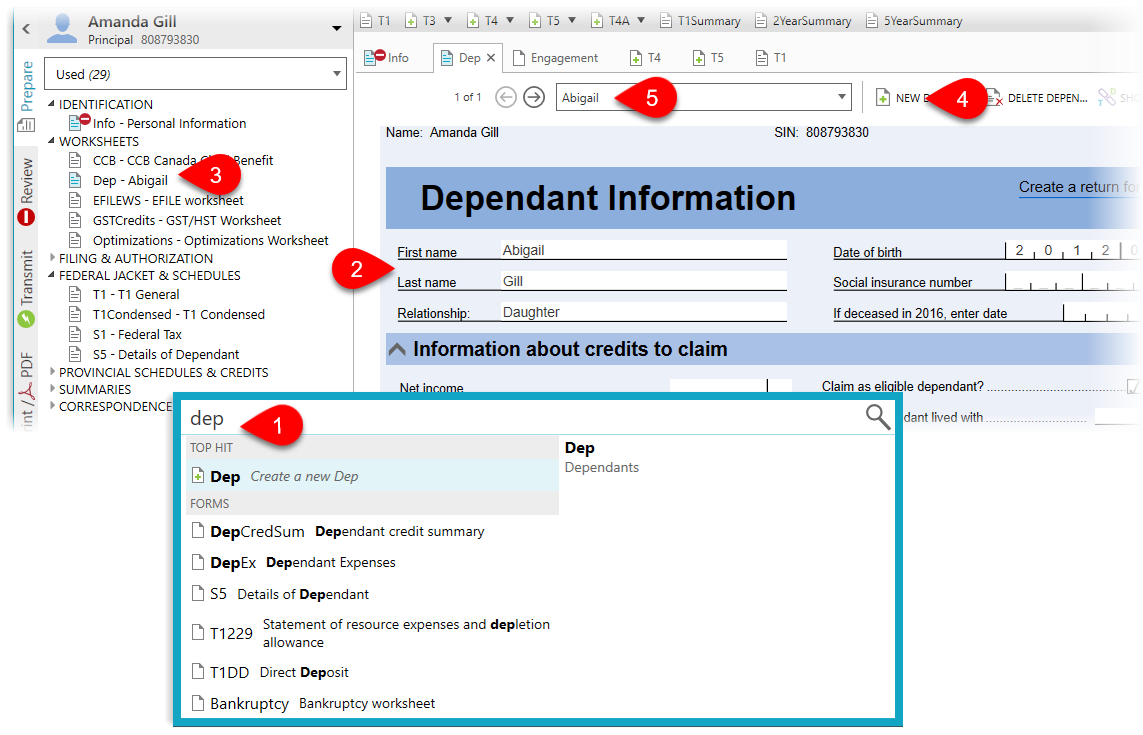

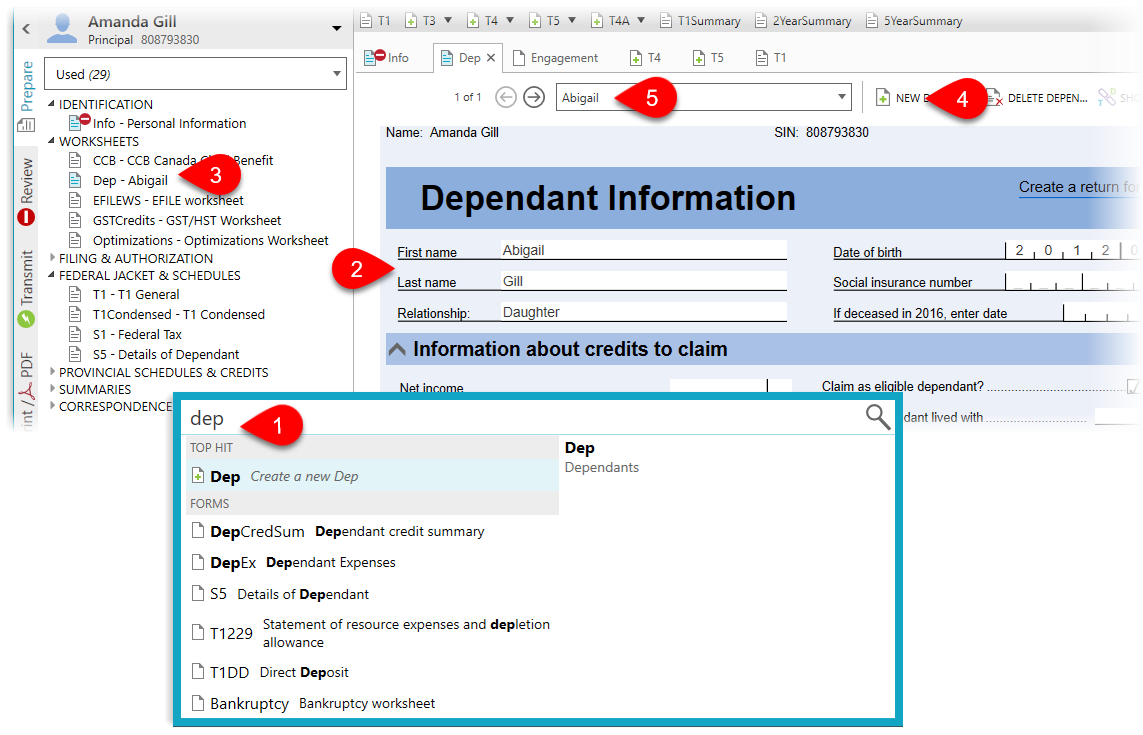

Add a Dependant (Dep worksheet)

If you are not completing a full return for the dependant, and the principal taxpayer and/or spouse/partner needs to claim dependant tax credits, enter dependant information on the Dep worksheet. There is no need to create a full tax return for the dependant.

- Press F4, type Dep and press Enter to create a new Dependant Information worksheet.

- Enter the dependant’s First name, Last name, Relationship to the taxpayer, Date of birth and social insurance number (SIN). This is used to determine which credits the dependant is eligible for.

- As soon as you enter the name, this dependant’s entry shows up as a separate form in the Prepare index on the left.

- To enter a second dependant, click the New button or press Ctrl+Enter to open a new blank form.

- Move between dependants by selecting the dependant from the drop-down list at the top of the worksheet, or pressing the left and right buttons.

Claim Dependant Amounts and Tax Credits (Dep Worksheet)

The remaining sections on the Dep worksheet provide detailed calculations or data entry for specific dependant-related credits. Expand or collapse these sections by clicking on the arrow on the left of the section heading to show only those you need.

Use the Dep worksheet in the supporting taxpayer’s return even if you are preparing a full return for the dependant (learn more in the Dependants and Family Returns help topic. In cases where the amounts transfer from data entered on the dependants tax return, they will appear in blue on the Dep worksheet.

For details on calculating and claiming specific credits, see:

- Disability amount transfer—Check the claim the disability amount checkbox at the top of the Dep worksheet and enter a few other amounts in the appropriate section on the Dep worksheet. See the Disability Amount (T2201) help topic.

- Fitness and art expenses—Enter receipts for one child directly on the Dep worksheet, or enter all the receipts for several children on the DepEx worksheet and let TaxCycle organize them. See the Fitness and Art Amounts help topic for more information.

- Tuition, education and textbook transfers from a child—Enter amounts on the dependant’s Tuition worksheet and select the option to transfer credits at the top of the dependant’s S11. Learn more in the Tuition (S11, T2202A, TL11) help topic.

- Canada caregiver credit (CCC)—In 2017, this credit replaced three previous credits: the caregiver credit, the family caregiver credit, and the credit for infirm dependants age 18 or older. However, unlike the previous caregiver credit, it does not apply to people supporting a parent or grandparent, who is 65 years of age or older, living with them, and who does not have a physical or mental impairment. For full details on eligibility for the CCC, read this page on the CRA website.

- Universal Child Care Benefit (UCCB) and Canada Child Benefit (CCB)—For 2016 and prior returns, enter any UCCB received on the RC62. See the RC62 (UCCB Statement) help topic for more information. For 2016 and onward, the CCB is non-taxable and does not require you enter information. However, you can estimate the CCB payments for the coming year on the CCB worksheet.

- Provincial claims on the Dep worksheet are calculated beside the federal claims whenever possible.

Dependant Expenses (DepEx) Worksheet

The Dependant Expenses (DepEx) worksheet allows you to enter all the receipts related to expenses for dependants in one data entry form and then let TaxCycle share them with the other worksheets and forms. This saves time when entering multiple receipts for multiple dependants.

The worksheet allows you to enter the following types of expenses:

- Child care expenses—Enter receipts on the DepEx worksheet or directly on the T778 federal form. See the Child Care Expenses (T778) help topic for more information.

- Children’s fitness and art expenses—Enter receipts for one child directly on the Dep worksheet, or enter all the receipts for several children on the DepEx worksheet and let TaxCycle organize them. See the Fitness and Art Amounts help topic for more information.

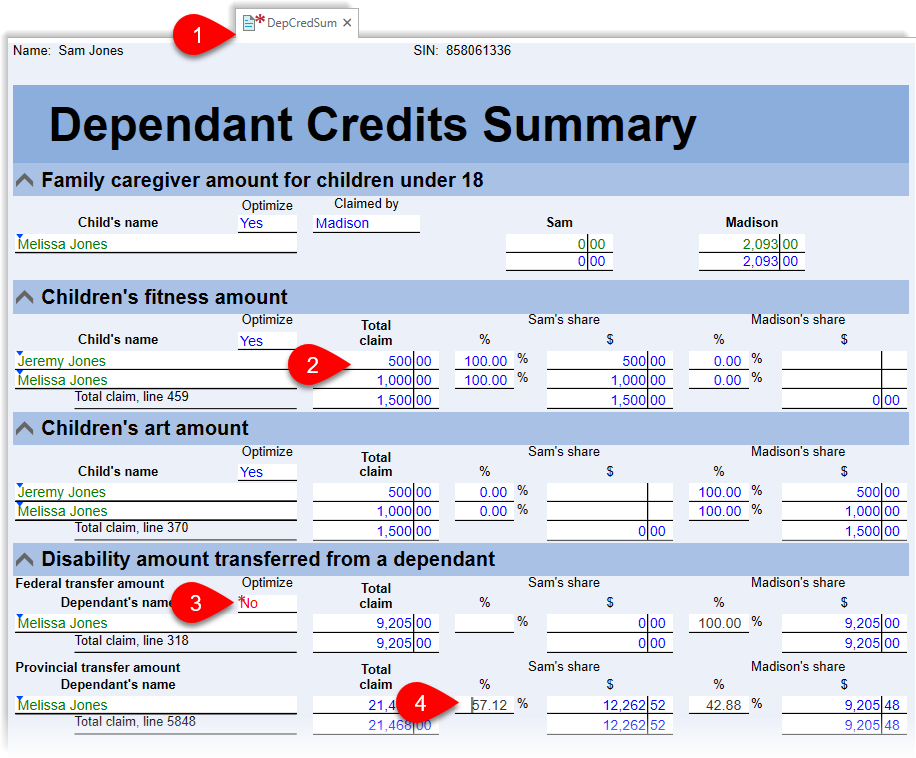

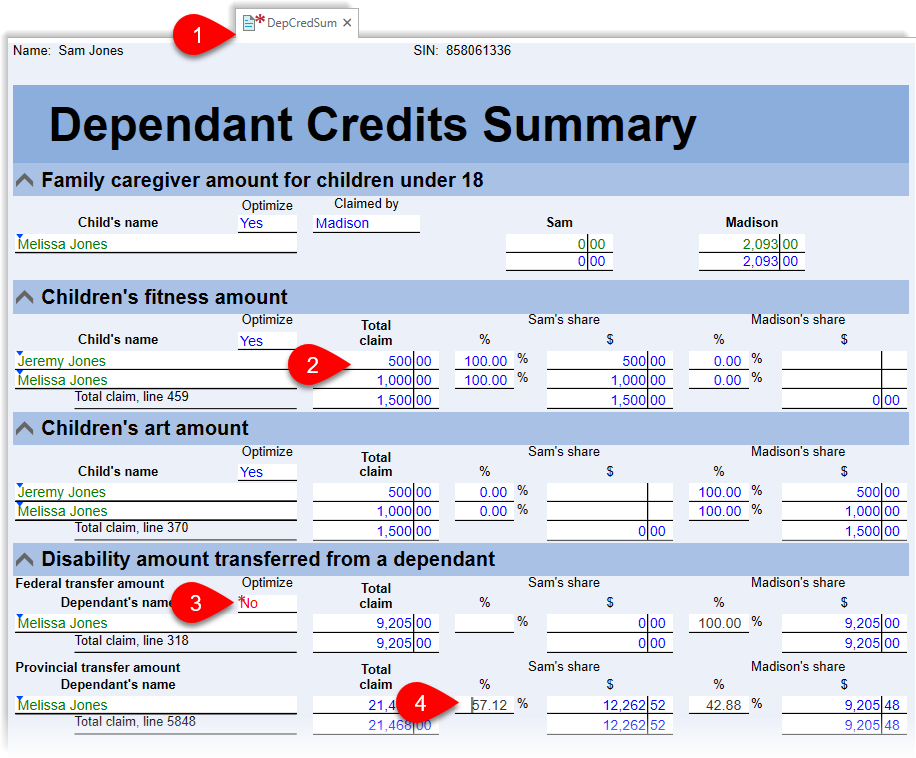

Dependant Credit Summary (DepCredSum)

- The DepCredSum lists all the dependant credits claimed in the return, whether or not you prepare a full return or just the Dep worksheet for the dependant. If the form is blank, no dependant-related credits were claimed.

- In coupled returns, it also shows the optimized claims between spouses, so you can see whether the taxpayer or spouse will receive the claim.

- To change which spouse receives the credit, or adjust the amount claimed, override the Optimize drop-down by entering No. (You will need to sign off on this override before filing the return.)

- The percent fields will then become editable so that you can assign the full amount to one person.

- The amount for an eligible dependant is not summarized on the DepCredSum worksheet. Instead, it appears on Schedule 5 (S5).