Updated: 2025-04-02

If you filed a client’s T1 tax return using Canada Revenue Agency (CRA) T1 EFILE, you can use ReFILE to make adjustments to prior year returns.

The ReFILE service lets you change the same lines that taxpayers can change in CRA My Account. Just like EFILE, you will receive an immediate confirmation of whether the CRA system accepted or rejected the ReFILE submission.

As a preparer, you can use the ReFILE service if the following conditions apply:

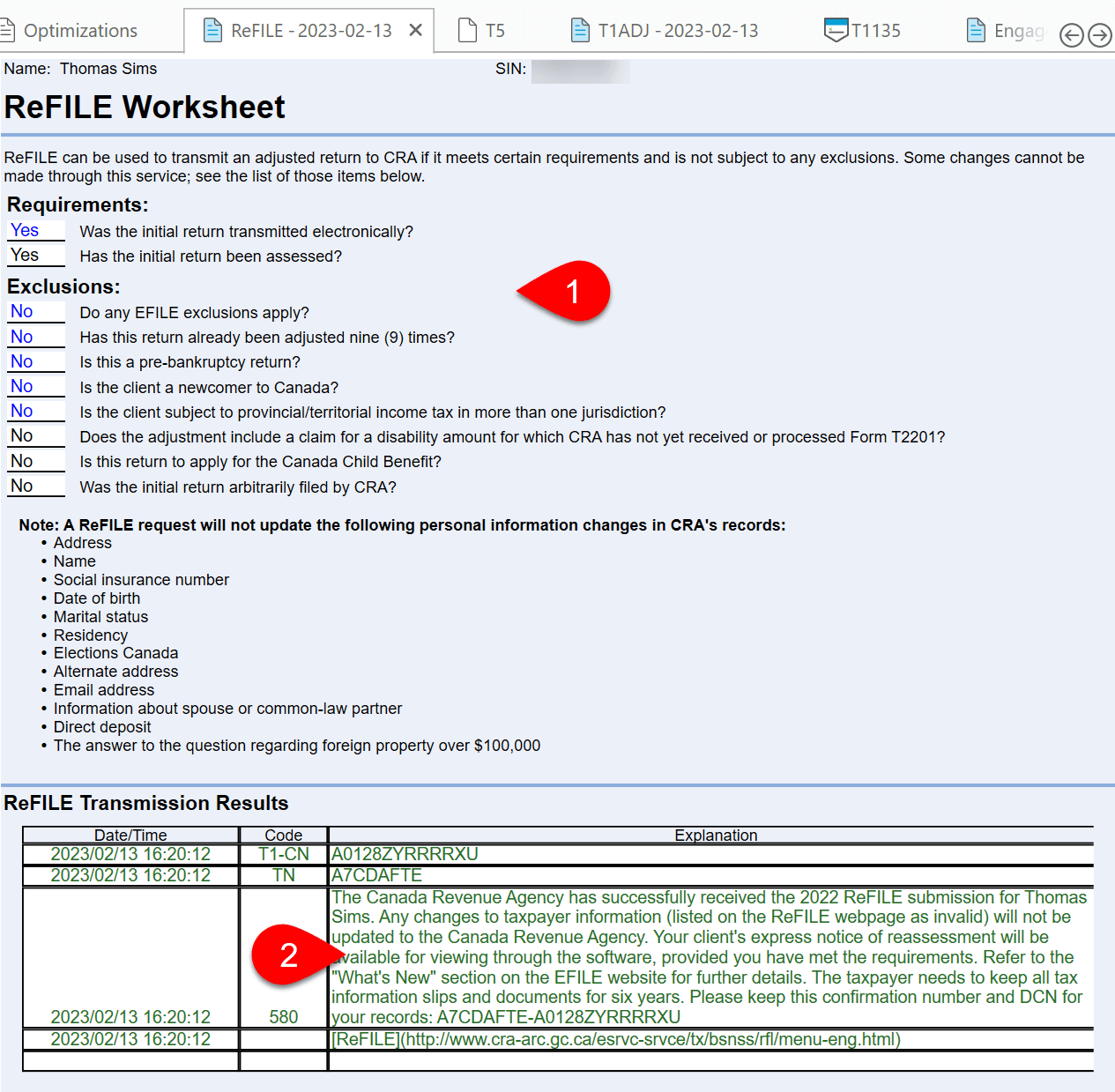

The CRA excludes certain returns from adjustment through ReFILE. For example, you cannot use ReFILE if an assessment or reassessment is in progress, and you cannot change anything on page 1 of the T1 jacket. See the CRA’s ReFILE for individuals who use NETFILE: Online adjustments for income tax and benefit returns page for a list of exclusions.

TaxCycle displays a review message if a return contains an exclusion preventing ReFILE. More details about the exclusion appear on the ReFILE worksheet.

If a return is excluded from ReFILE, print the T1-ADJ form and mail it to the CRA. See Print and Mail the T1-ADJ, below.

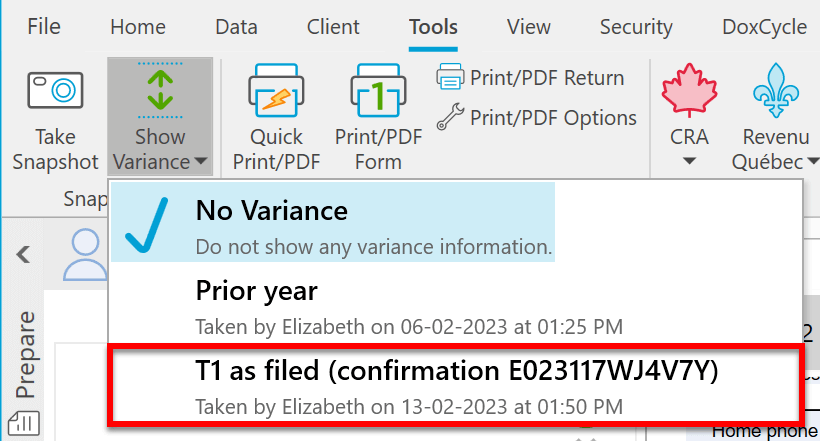

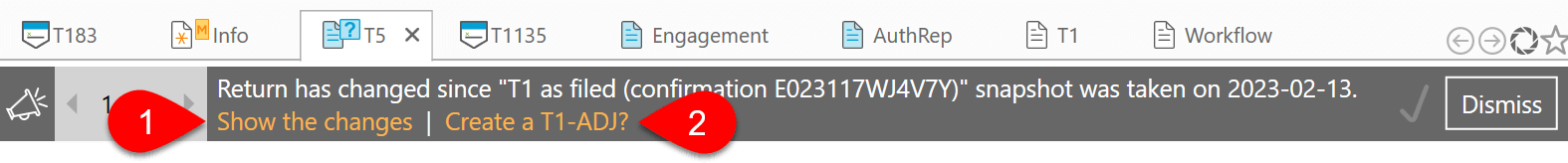

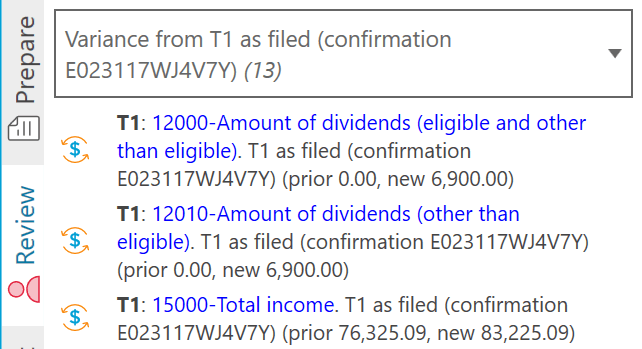

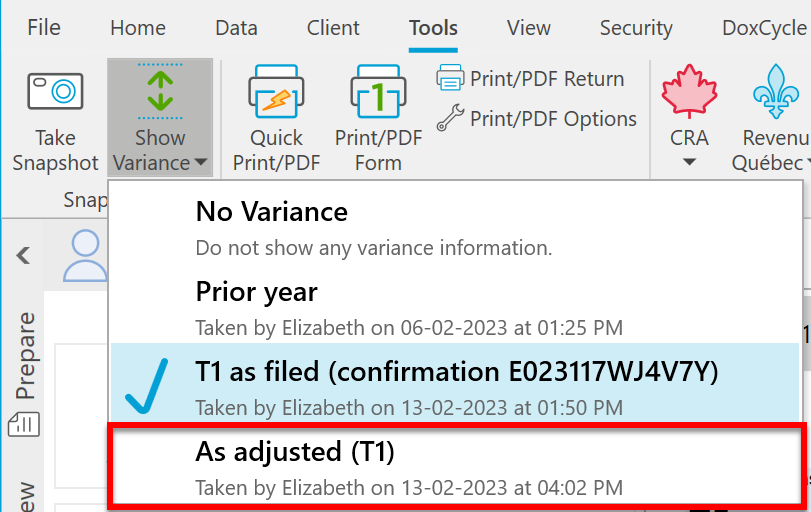

To prepare an adjusted return automatically, the return must contain an as-filed snapshot. An “as-filed” snapshot records the data in key fields used for filing the return. Then, if you make changes to the return, TaxCycle uses it to detect any variance and triggers an adjustment.

TaxCycle automatically creates an as-filed snapshot when you successfully transmit a T1 return or print the T1Condensed for filing on paper. When you open a completed file, TaxCycle checks for an as-filed snapshot. If it’s missing, you will see a prompt suggesting you create one. When you do this, make sure to create an as filed snapshot type.

Learn more about creating snapshots in the Snapshots and Variance help topic.

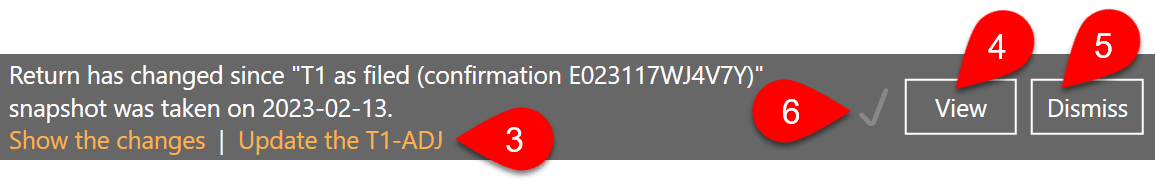

If a completed return contains an as-filed snapshot, TaxCycle automatically uses it to detect changes to the return that could require filing an adjustment. If it finds one, a bulletin appears above the form area and in the Review sidebar.

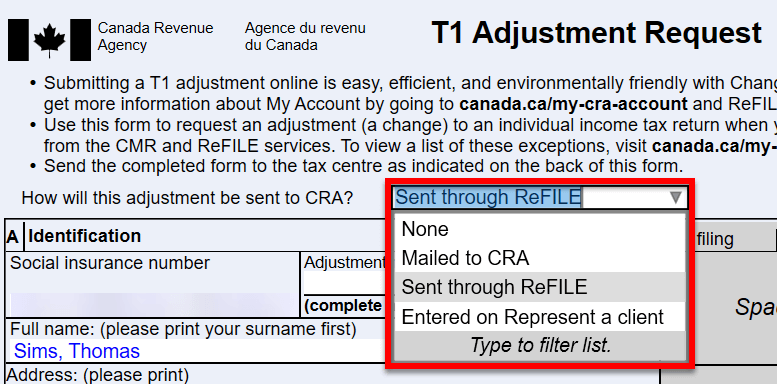

At the top of the T1-ADJ, answer the question to indicate how the adjustment will be sent to the CRA. Select:

The T1 ReFILE box in the Transmit sidebar will change based on your response to this question.

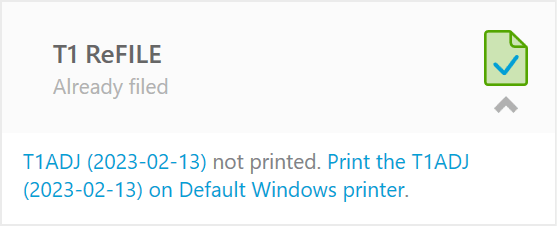

If you chose Mailed to CRA at the top of the T1-ADJ, or the return contains exclusions preventing you from electronically filing the adjustment, you’ll be prompted to print the form instead.

Please review the ReFILE worksheet before paper-filing the return.

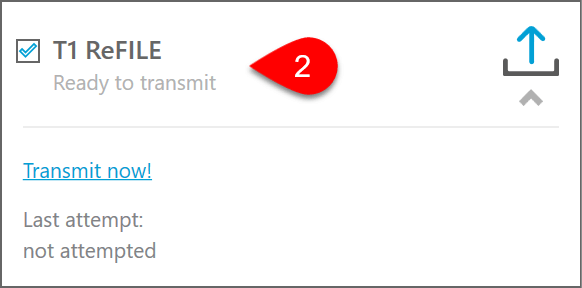

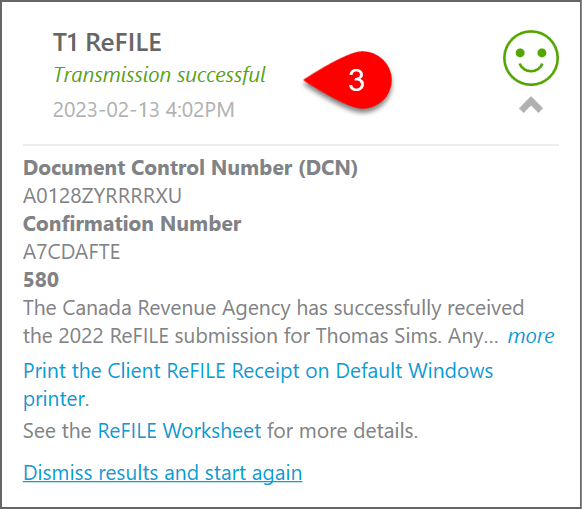

ReFILE transmissions are very similar to EFILE transmissions. After resolving any outstanding errors in the return:

After transmitting, TaxCycle will:

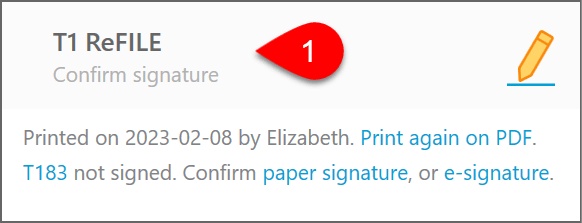

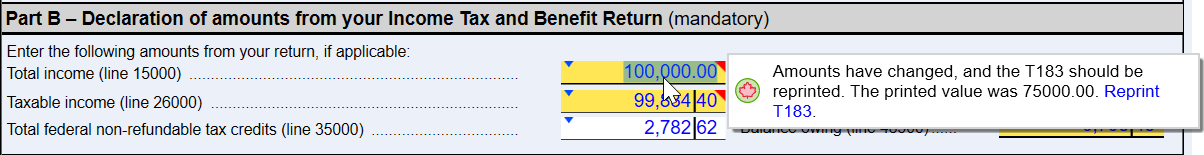

If your client signed a T183 early in the season, and you later need to change the return before filing, you don’t always need to reprint the form and have your client sign it again before you can transmit the return. The instructions on the back of the form state that as long as the refund or balance owing shown in Part B does not change by more than $300, you have authorization to transmit or retransmit the return.

If changes to the return require that your client sign a new copy of the form, TaxCycle will display a review message to alert you to reprint the form. Note this only applies to the original EFILE transmission. If the return is accepted and then later needs to be adjusted, a new T183 needs to be signed.

TaxCycle automatically creates a ReFILE worksheet for each T1-ADJ.

If needed, you can produce additional adjustments from TaxCycle.

When you print the T1-ADJ or transmit it through ReFILE, TaxCycle automatically takes an As-adjusted snapshot and uses this snapshot to alert you if you make changes to the return and to file another adjustment. If a subsequent adjustment is required, the bulletin reappears so you can start the process over with a new T1-ADJ.

Both the T1-ADJ and the ReFILE worksheet are multi-copy forms and TaxCycle adds the date to the form description, making it easy to distinguish between copies filed on different dates.