Updated: 2020-11-23

With a goal of minimizing the administrative burden on the taxpayer, the CRA introduced a new version of T1134 Summary and Supplements (2021). The 2021 version offers a new reporting option to file one set of T1134 for a group of related reporting entities.

Use the 2021 version of the form if the taxpayer’s taxation year begins in 2021 or later. TaxCycle T2 automatically displays the correct version of the form based on the taxation year-end. If a corporation taxation year ends before 2021, the earlier version of the form displays.

T1134 Due Date

With the introduction of the 2021 version, the filing due date is further shortened to 10 months after the end of the taxation year. The following due date is summarized as follows:

| Taxation/Fiscal Year |

Due Date |

| Beginning before 2020 |

15 months after the end of the taxation year |

| Beginning in 2020 |

12 months after the end of the taxation year |

| Beginning in 2021 or later |

10 months after the end of the taxation year |

For further information, please refer to the CRA page Information returns relating to foreign affiliates.

Filing T1134/T1134Sup on Behalf of All Members of a Related Group

For taxation years that begin after 2020, reporting entities that are members of a related group, as defined in subsection 251(4) of the Act, have the option of filing one set of T1134 Summary and T1134 Supplements in respect of all foreign affiliates for which any one of its members would have otherwise been required to file separate T1134 returns. A group of reporting entities refers to a group where all members are part of the same related group, and who have jointly agreed to file form T1134.

To file one set of T1134 Summary and Supplements:

- All members of the related group must have the same year-end. If members of the related group have different year-end dates, then only those members that share the same year-end can file as a group. Members whose year-end dates differ from others within the related group must file their T1134 Summary and Supplements separately.

- All members of the related group must be reporting in Canadian currency or, if a functional currency election has been made, must be reporting in the same functional currency in that taxation year.

When preparing a T1134 for a group of related reporting entities in TaxCycle T2, you may prepare the T1134 for the entire group in the T2 file of any single entity in the reporting group.

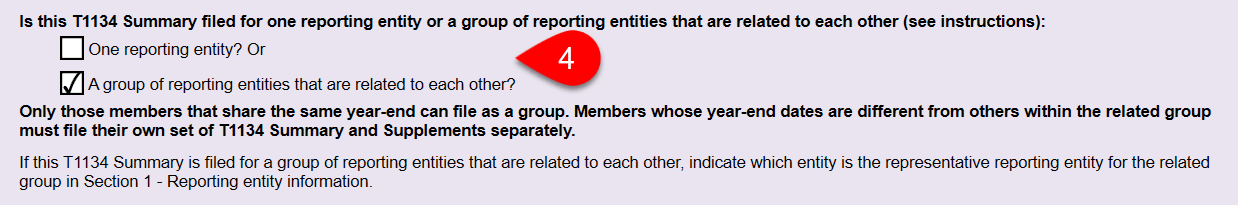

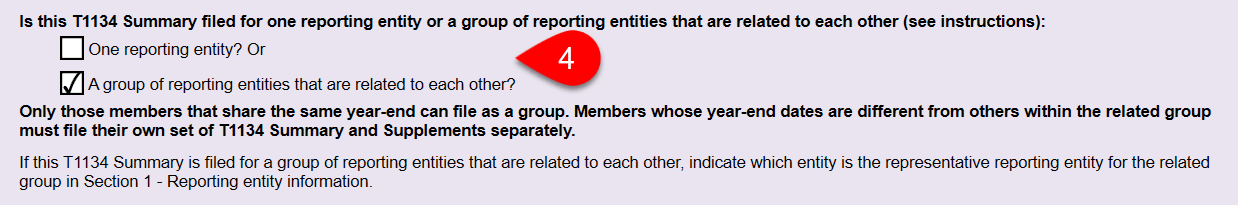

Indicate on page 1 of the T1134 Summary which filing method applies

Example: Three Related Reporting Corporations with Interest in the Same Three Foreign Affiliates

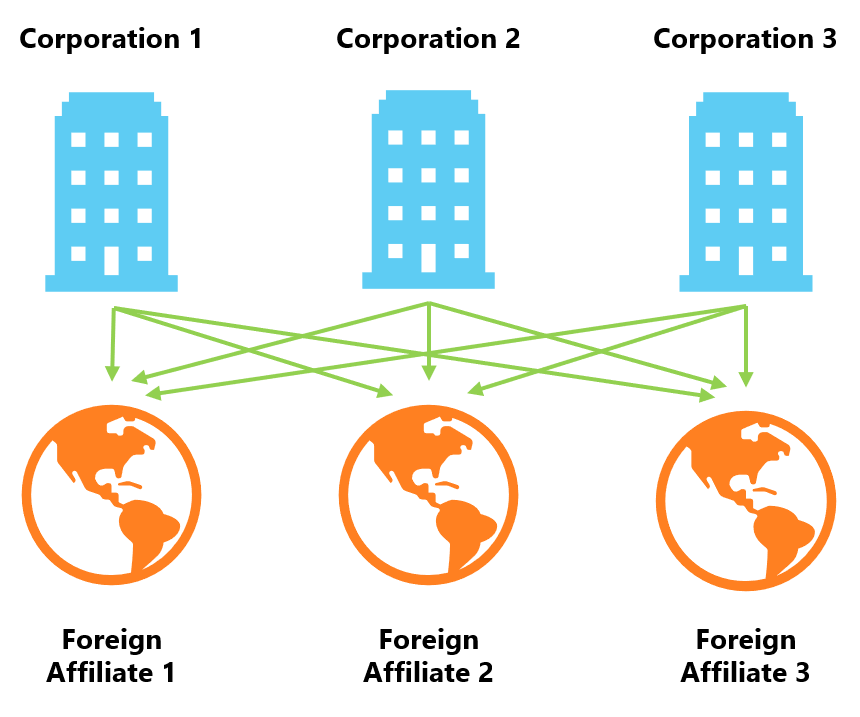

This example illustrates how to file a T1134 as a group of reporting entities.

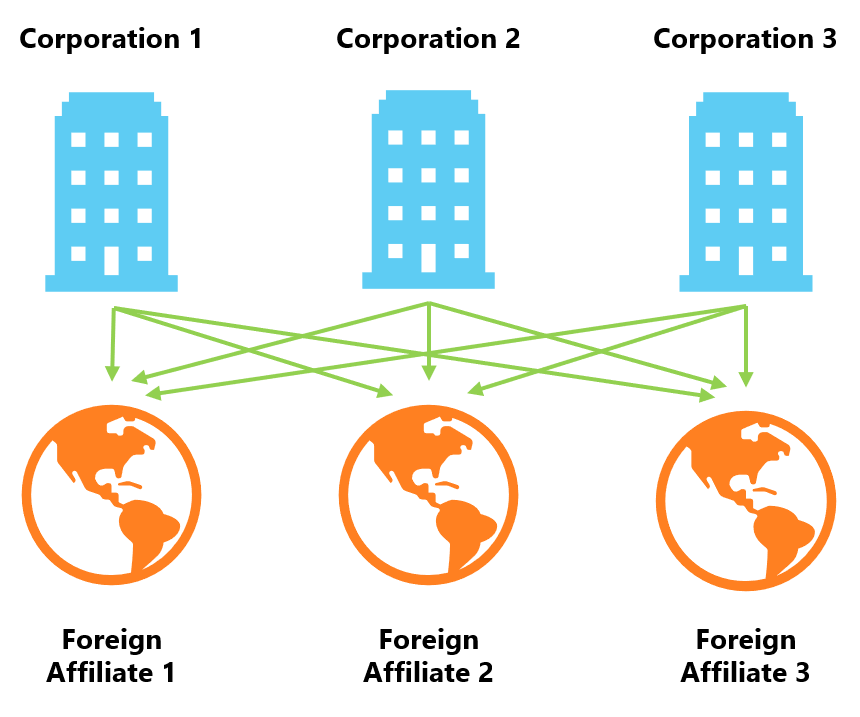

In this example, three related Canadian corporations in a group are each required to file a T1134 Summary and T1134 Supplements. Each corporation has the same taxation year-end and has interest in the same three foreign affiliates.

Figure 1: Relationships between members of the reporting corporations and foreign affiliates

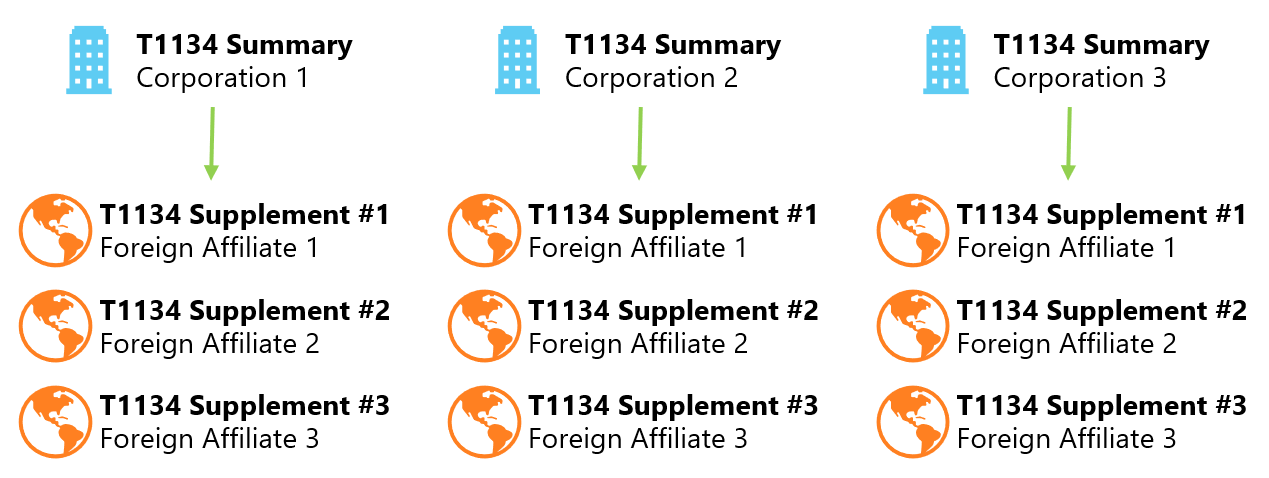

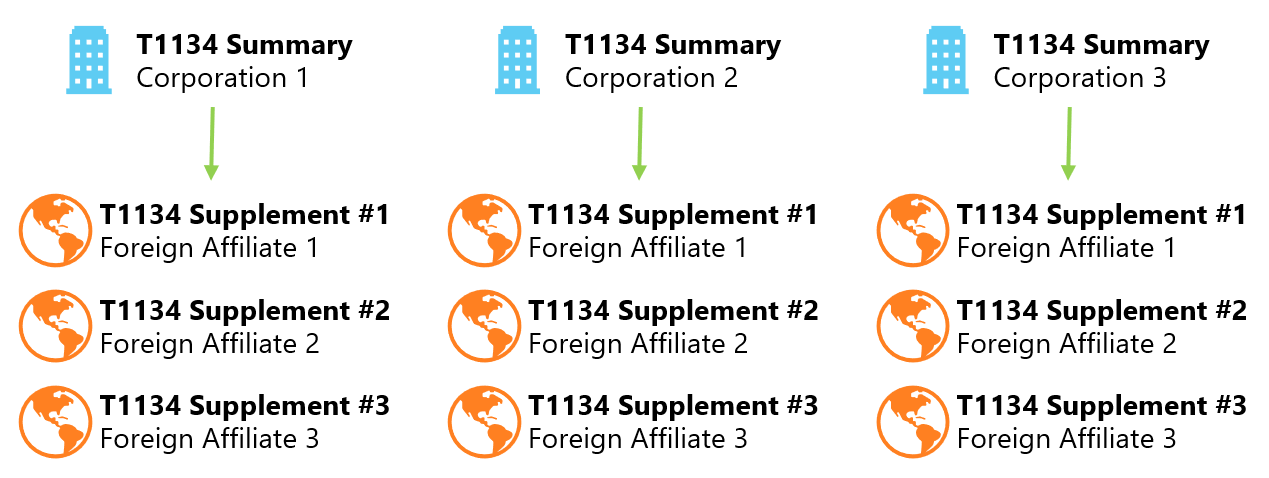

Previously, each reporting corporation was required to prepare and file three separate T1134 Summaries and T1134 Supplements, as illustrated in figure 2.

Figure 2: Duplicate filing required by the pre-2021 version of the T1134

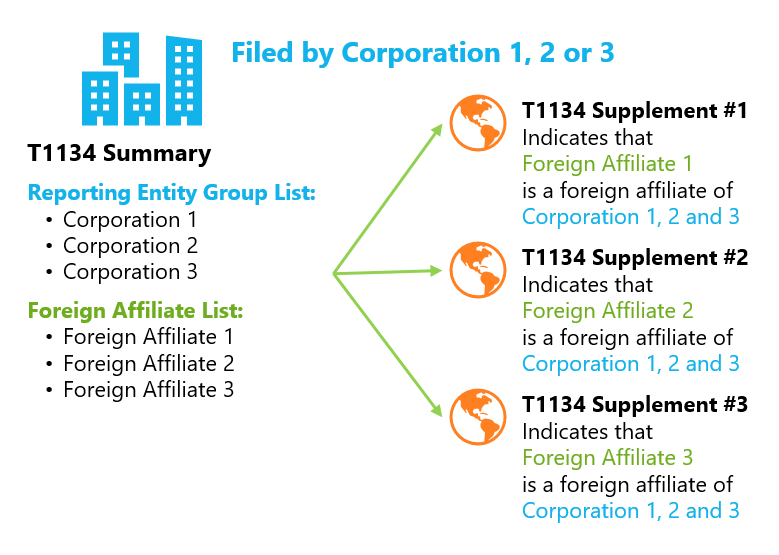

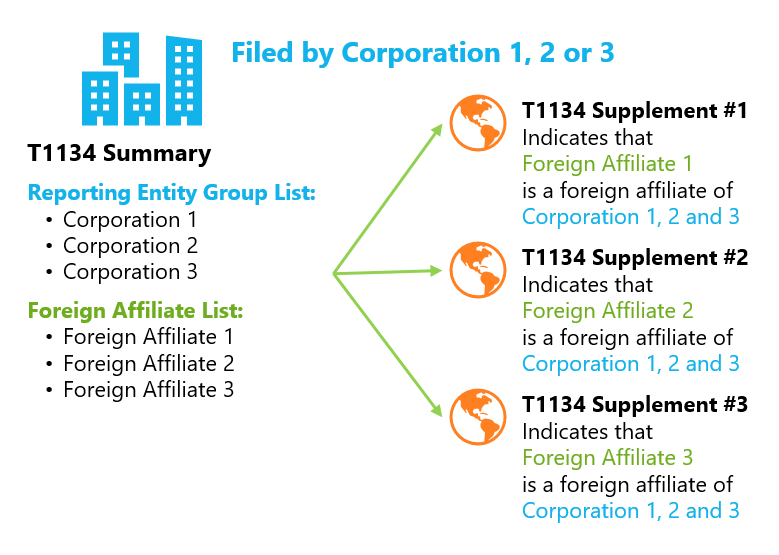

The 2021 version of the T1134 now offers two options:

- One corporation in the group files only one T1134 Summary and one set of T1134 Supplements, on behalf of the rest; or

- Each corporation in the group continues to file their own T1134 Summary and Supplements separately, as before.

Figure 3 illustrates how to file as a group from TaxCycle T2: Choose one TaxCycle T2 file from any of the related entities in the group. Then, in that file, prepare the T1134 Summary and Supplements for all members of the group.

Figure 3: T1134 Summary and Supplements prepared in one TaxCycle T2 file

How to Prepare the T1134 Summary and Related T1134 Supplements

- Create or carry forward a T2 return. If you carried forward a T2 return that contains a T1134 in the prior year, TaxCycle automatically creates the appropriate version of the T1134. If the taxation year starts in 2021 or later, it creates the 2021 version of T1134 in the new return. Otherwise, it creates the 2017 version of the forms.

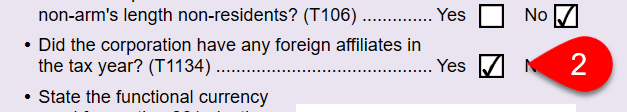

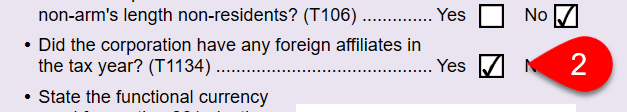

- The first time you prepare a T1134 for the corporation, answer Yes to the question in the Filing section on the Info worksheet. This activates the review messages on the T1134 Summary and T1134 Supplement (T1134Sup).

- If the tax year begins in 2021 or later, TaxCycle provides the 2021 version of the T1134 Summary and Supplement.

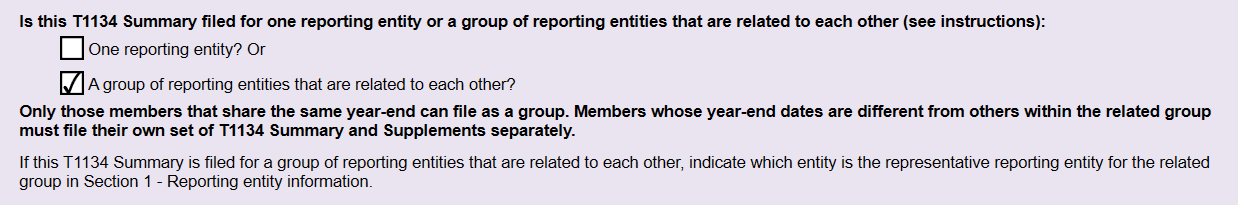

- On page 1 of the T1134 Summary, select the filing method.

- If you selected one reporting entity, skip to step 7.

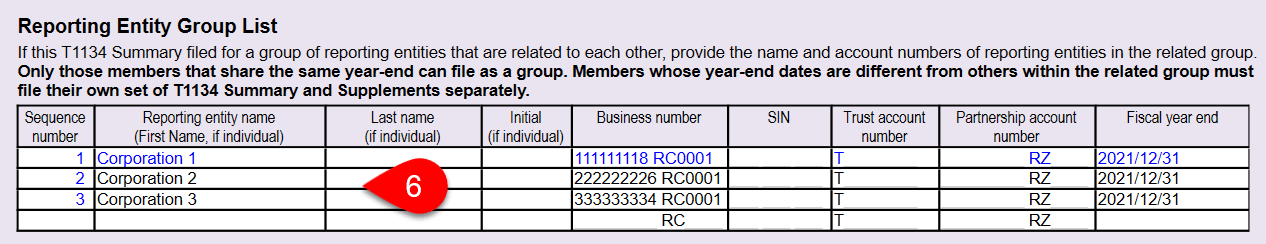

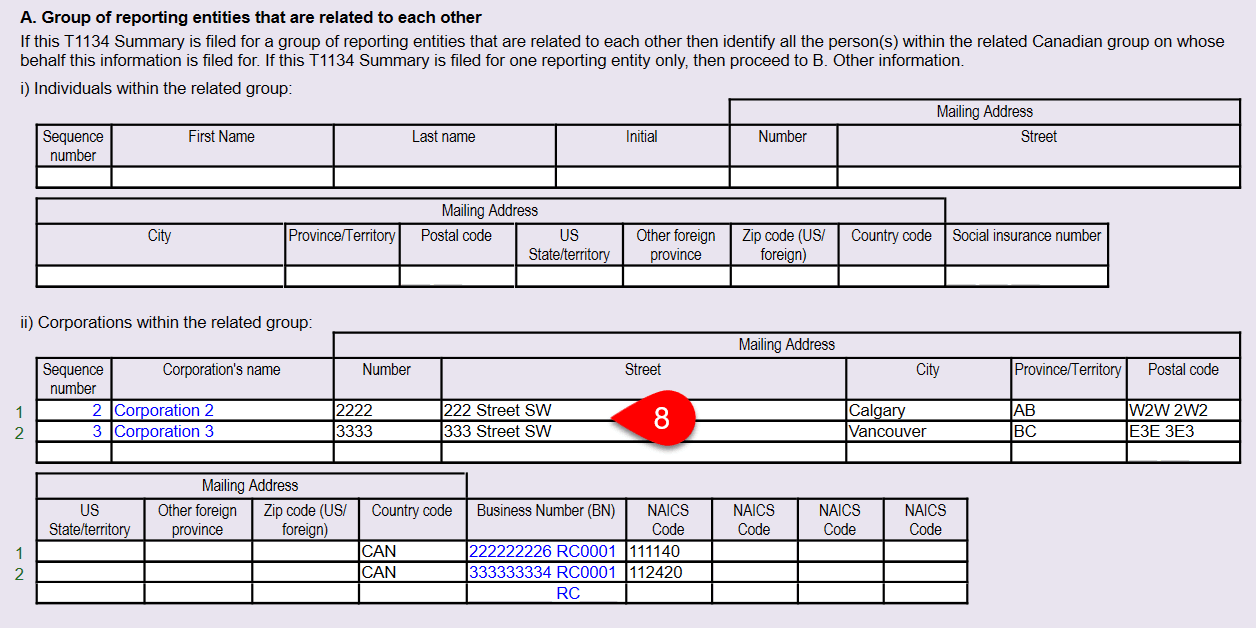

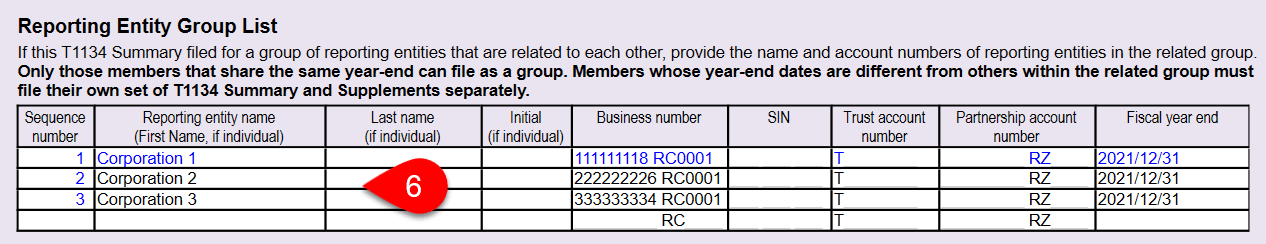

- If you selected a group of reporting entities that are related to each other, complete the Reporting Entity Group List table on page 2 of the T1134 Summary. The first row in the table flows from the Info worksheet of the T2 return in which you are preparing the T1134.

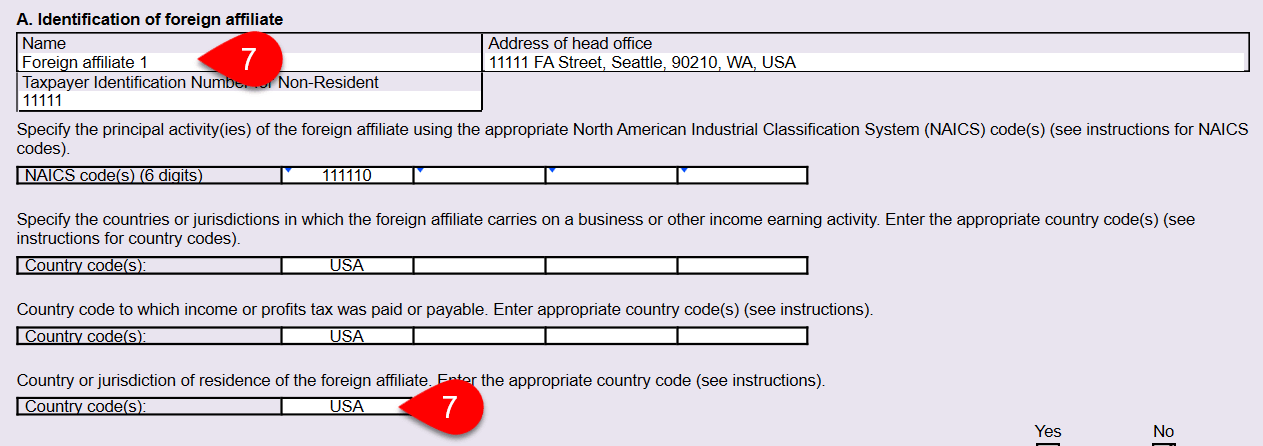

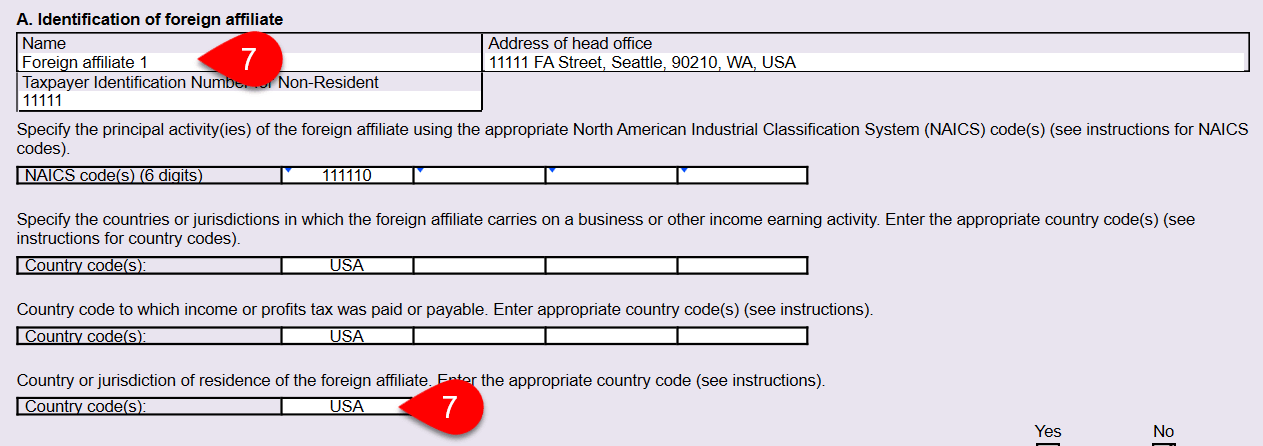

- For each foreign affiliate, create a T1134Sup. To populate the Foreign Affiliate List table on the T1134 Summary, complete Section 1, A. Identification of foreign affiliates on the T1134 Supplementary, entering at minimum the name of the foreign affiliate, taxpayer identification number and the country of residence.

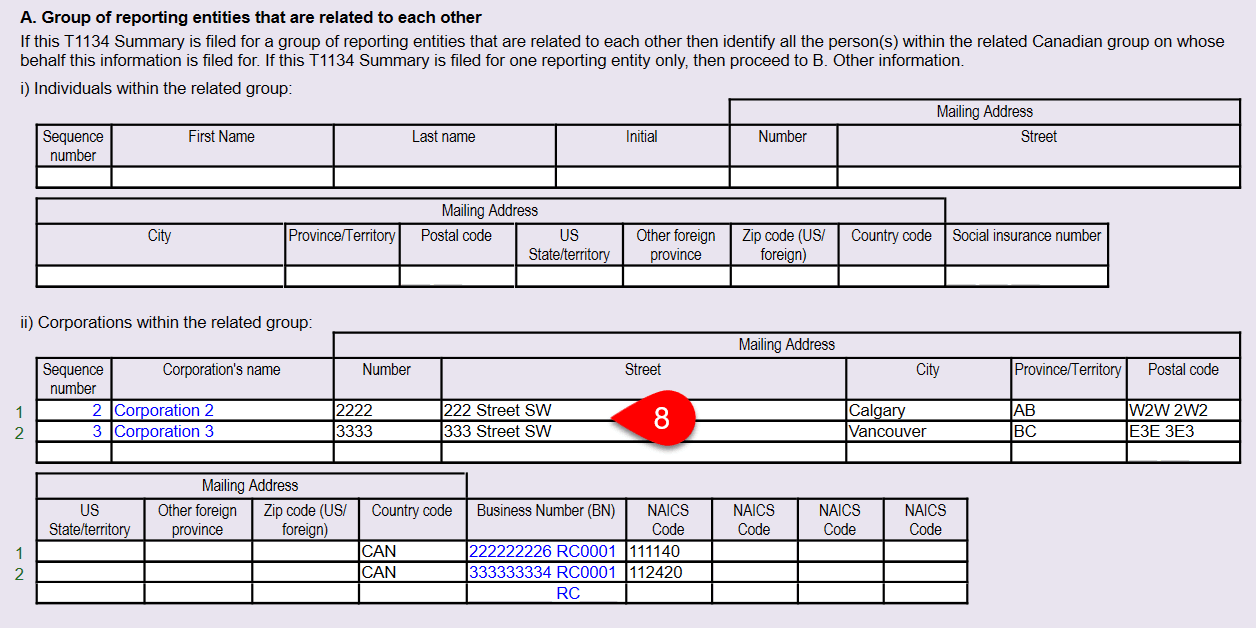

- If you are filing for a group of reporting entities that are related to each other, provide the address of each related reporting entity in the group in Section 3A of the T1134 Summary. The address of the corporation of the T2 return in which you are preparing the T1134 flows from the Info worksheet to page 1 of the T1134 Summary. Therefore, enter addresses for only the remaining entities in Section 3A.

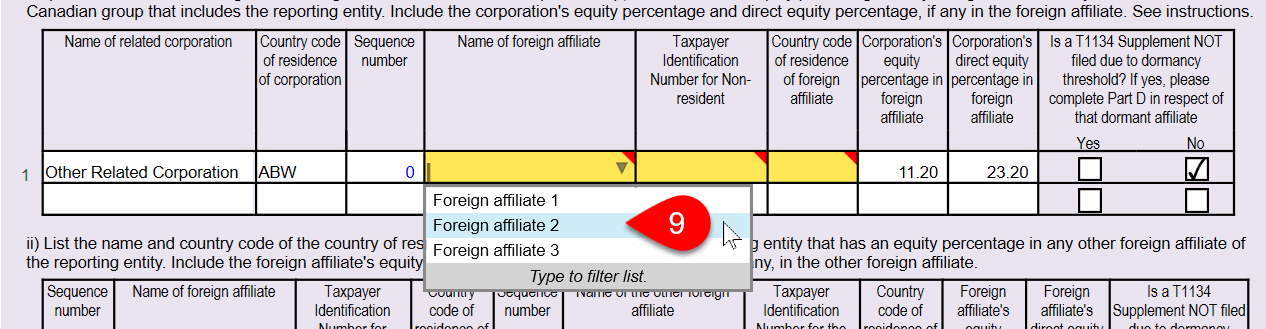

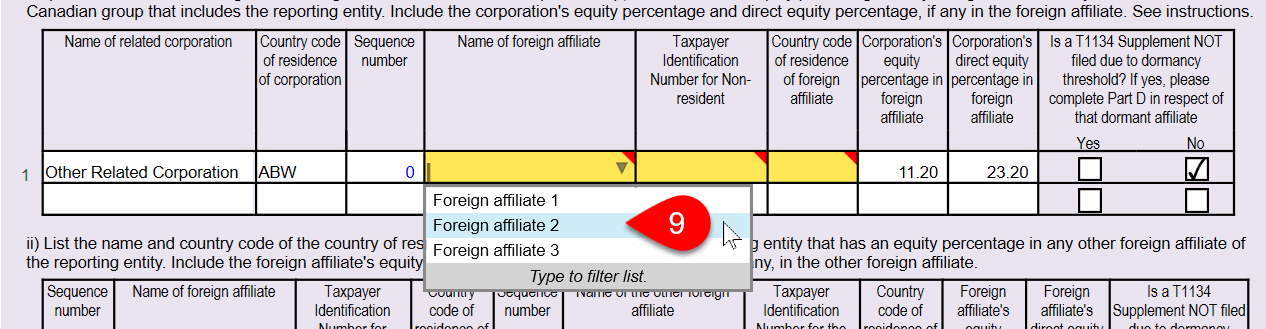

- Complete the rest of the T1134 Summary. On fields where you must enter a foreign affiliate, click the down arrow to choose from the list of foreign affiliates. TaxCycle then automatically populates the foreign affiliate information based on the details entered on each T1134Sup.

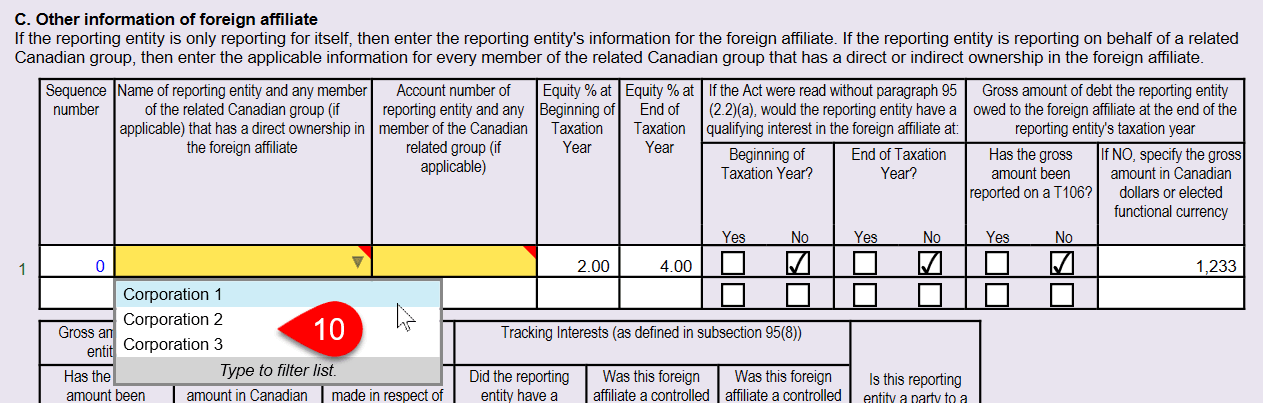

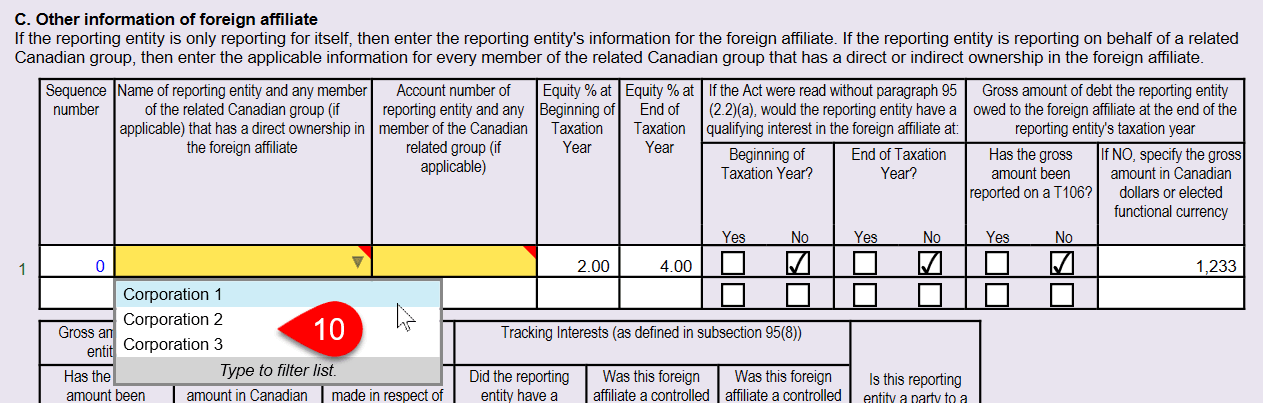

- Complete the remaining information on each T1134 Supplement. On fields where you must enter a reporting entity, click the down arrow to choose from the list of reporting entities. TaxCycle then automatically populates the identification number (Business Number, Trust Account Number, Social Insurance Number or Partnership Account Number) based on the information entered in the Reporting Entity Group List on the T1134.

Printing the T1134

To create the relationships between the data on reporting entities and related foreign affiliates, and to make it easier to understand the data flow between the forms, the on-screen version of the forms includes additional fields and sections that the filing version of the forms do not. For example, reporting entity names do not appear on the filing version of the form; they are instead identified only by account number.

To print a copy of the T1134 Summary and Supplements that includes the screen-only fields and sections, select the Print as appears on screen output option. For more information, see the Printer and PDF Output Options help topic.

T1134 EFILE

TaxCycle T2 is certified by CRA for electronically filing the T1134 Summary and Supplements. See the T1134 EFILE help topic for instructions. This help topic also contains information on filing amended T1134s.