Updated: 2023-04-18

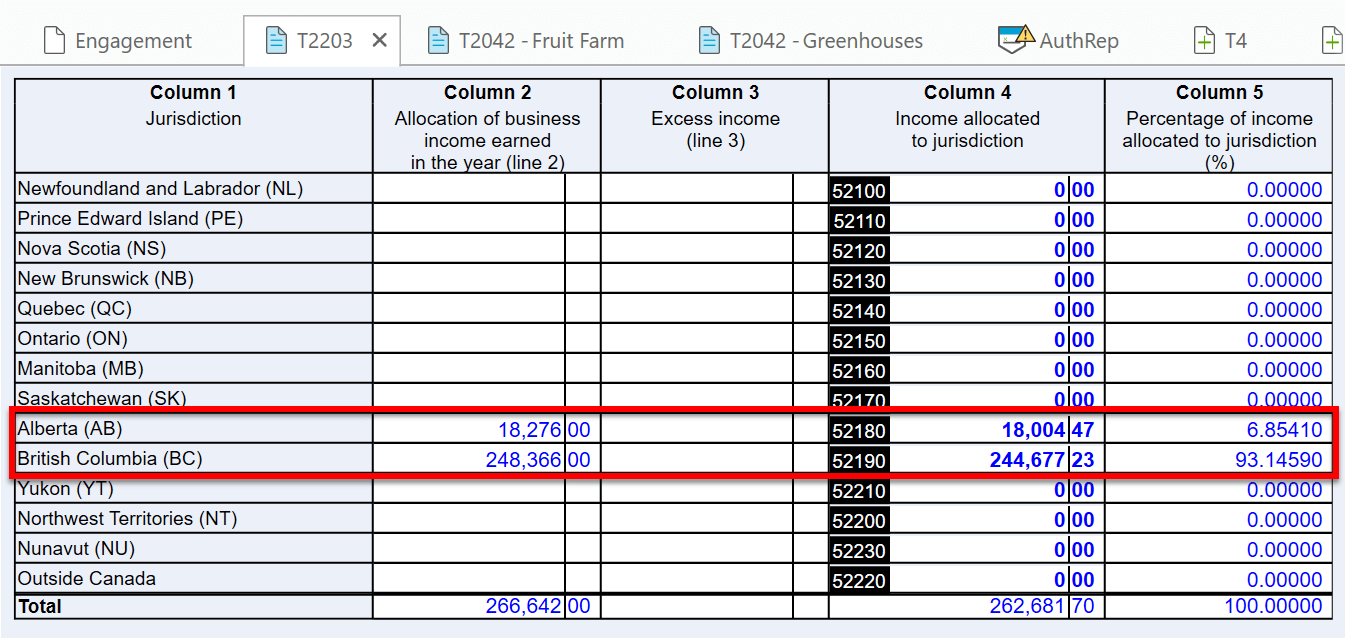

When you need to prepare a T1 or T3 return for a taxpayer who resides in one province but has income from another, use form T2203 Provincial and Territorial Taxes for Multiple Jurisdictions.

Income Statements and Form T2203

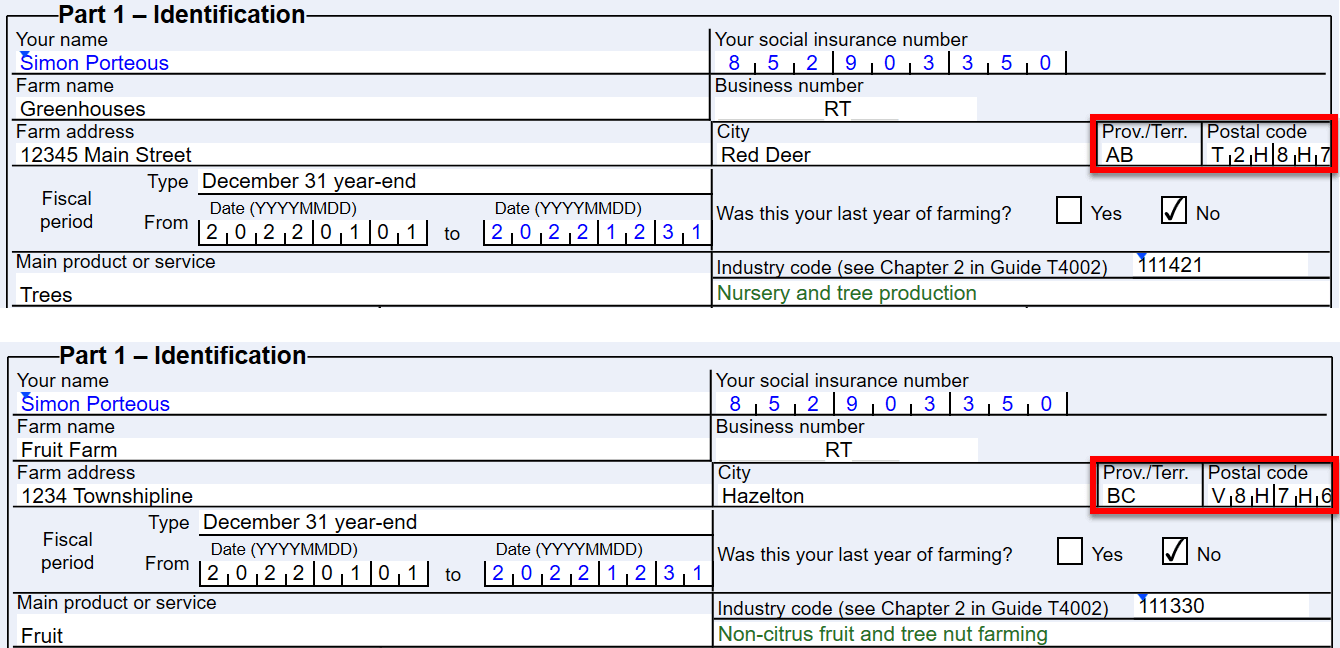

- Start a return for the taxpayer and complete the address and province of residence on the Info worksheet.

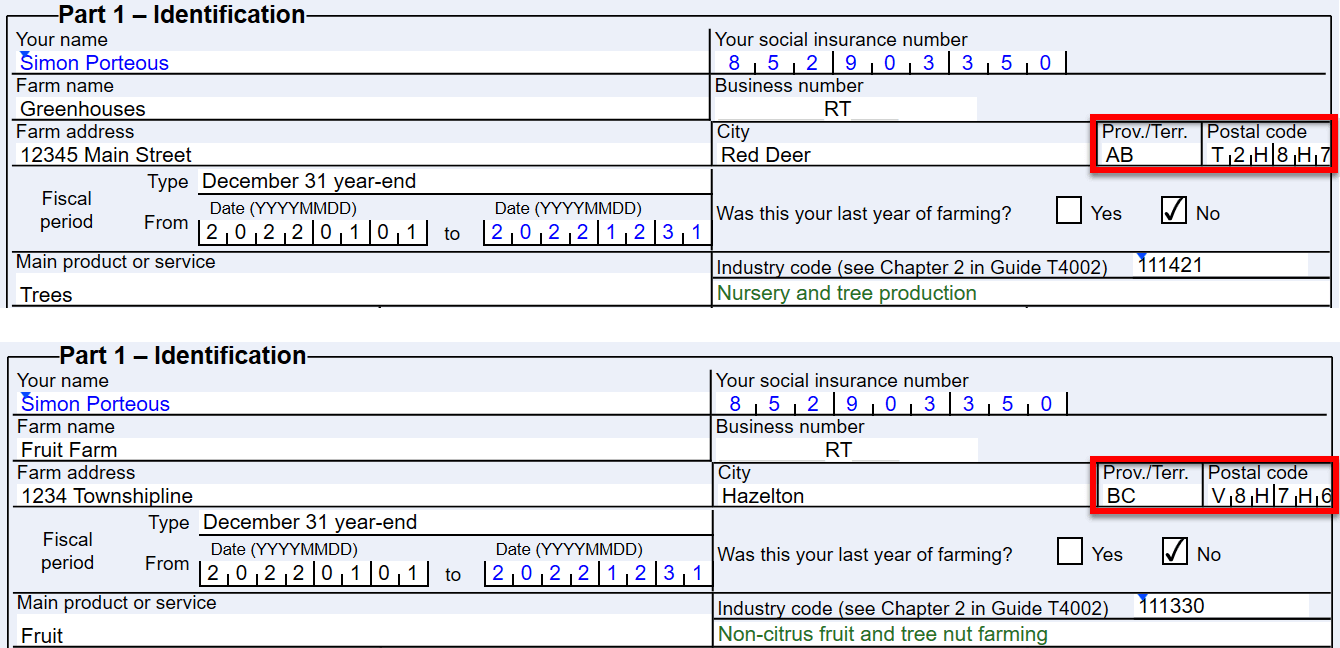

- Create an income statement, such as the T2042 Statement of Farming Activities.

- Enter the province or territory and postal code from a province other than the province of residence in the address area on the income statement.

- Enter income on the income statement.

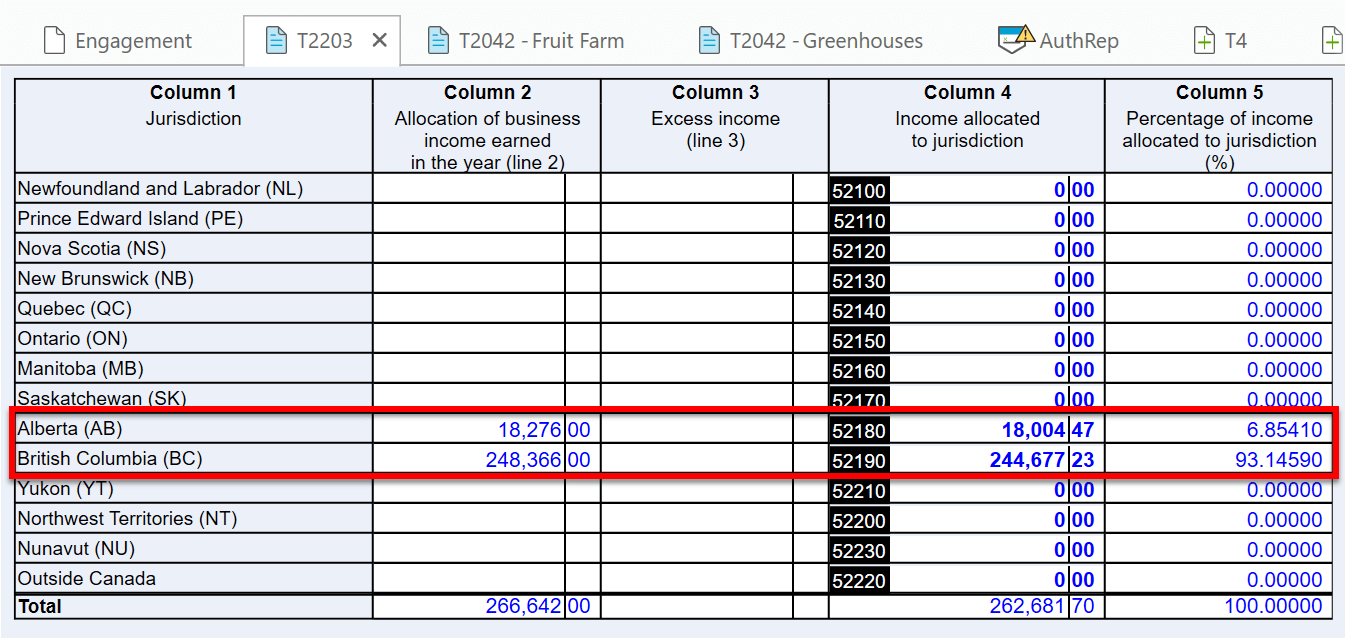

- TaxCycle determines whether multiple jurisdictions apply, then uses the T2203 to allocate income to each jurisdiction.

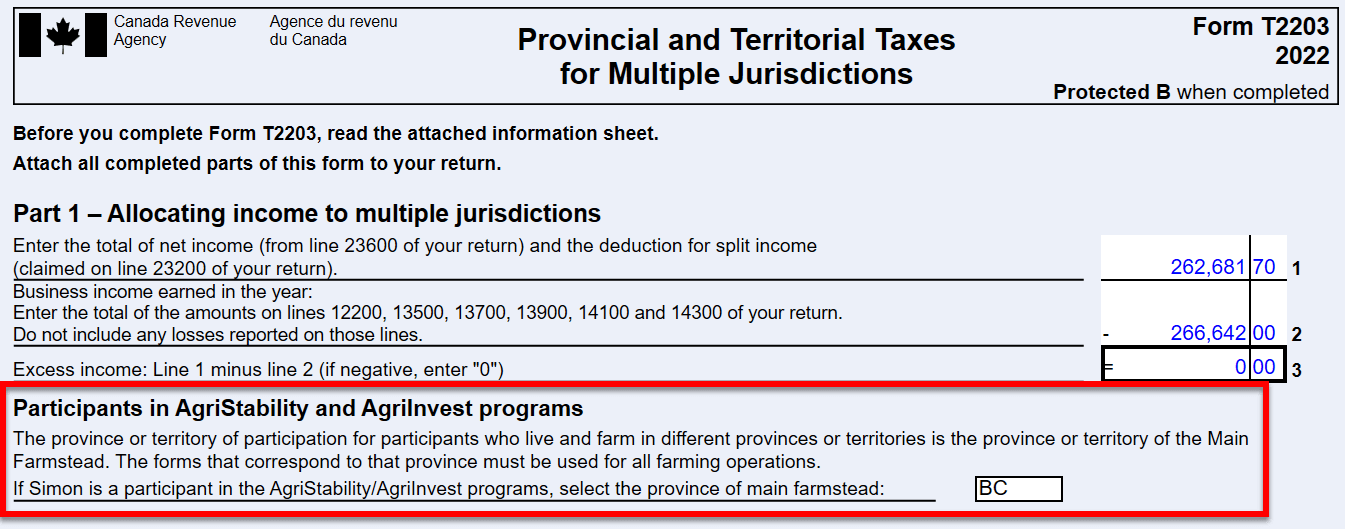

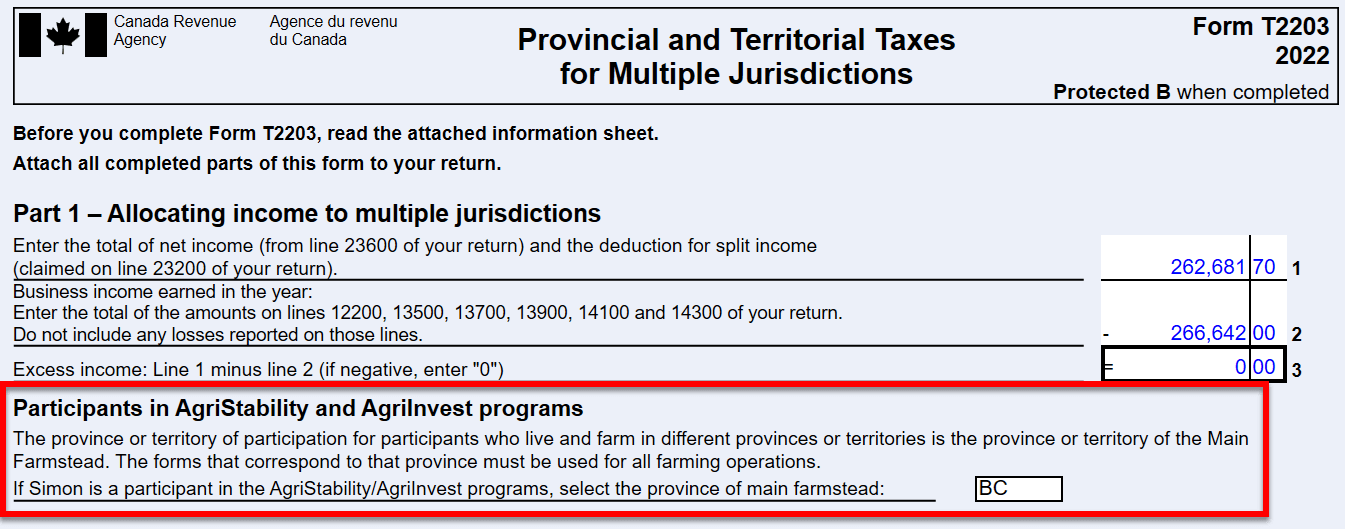

Participants in AgriStability and AgriInvest Programs

If the taxpayer is a resident of Alberta but requires a T1273 for an operation in British Columbia, where the province of main farmstead is in British Columbia, select the province of main farmstead on form T2203. This will allow you to enter date on form T1273/T1274 although the taxpayer is a resident of Alberta.

If a spouse or partner needs to report income for a farming operation where the main farmstead is in a different province than the principal taxpayer, uncouple the returns and calculate them separately.

For more information on AgriStability and AgriInvest programs in TaxCycle T1, see T1 AgriStability and AgriInvest Forms.

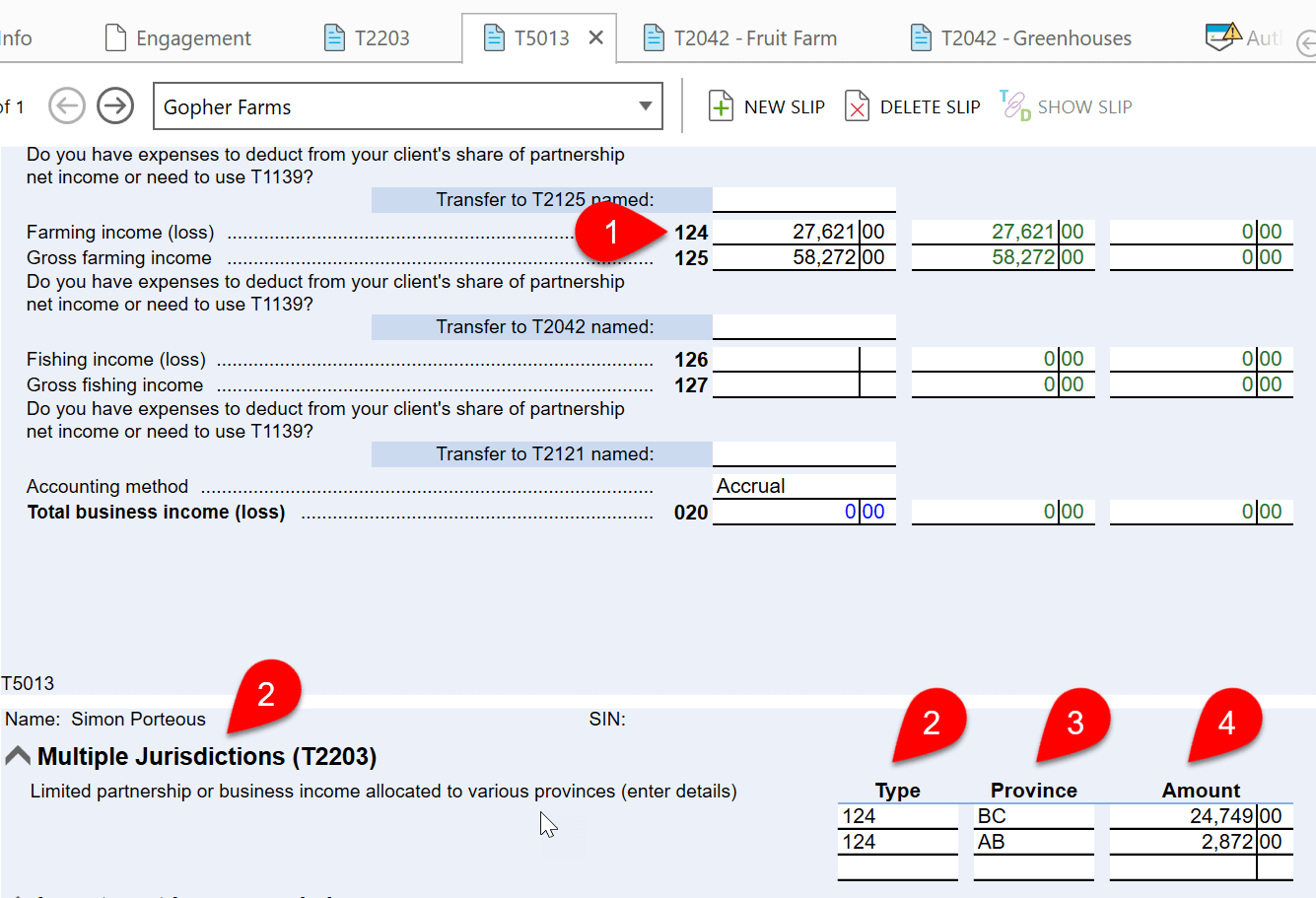

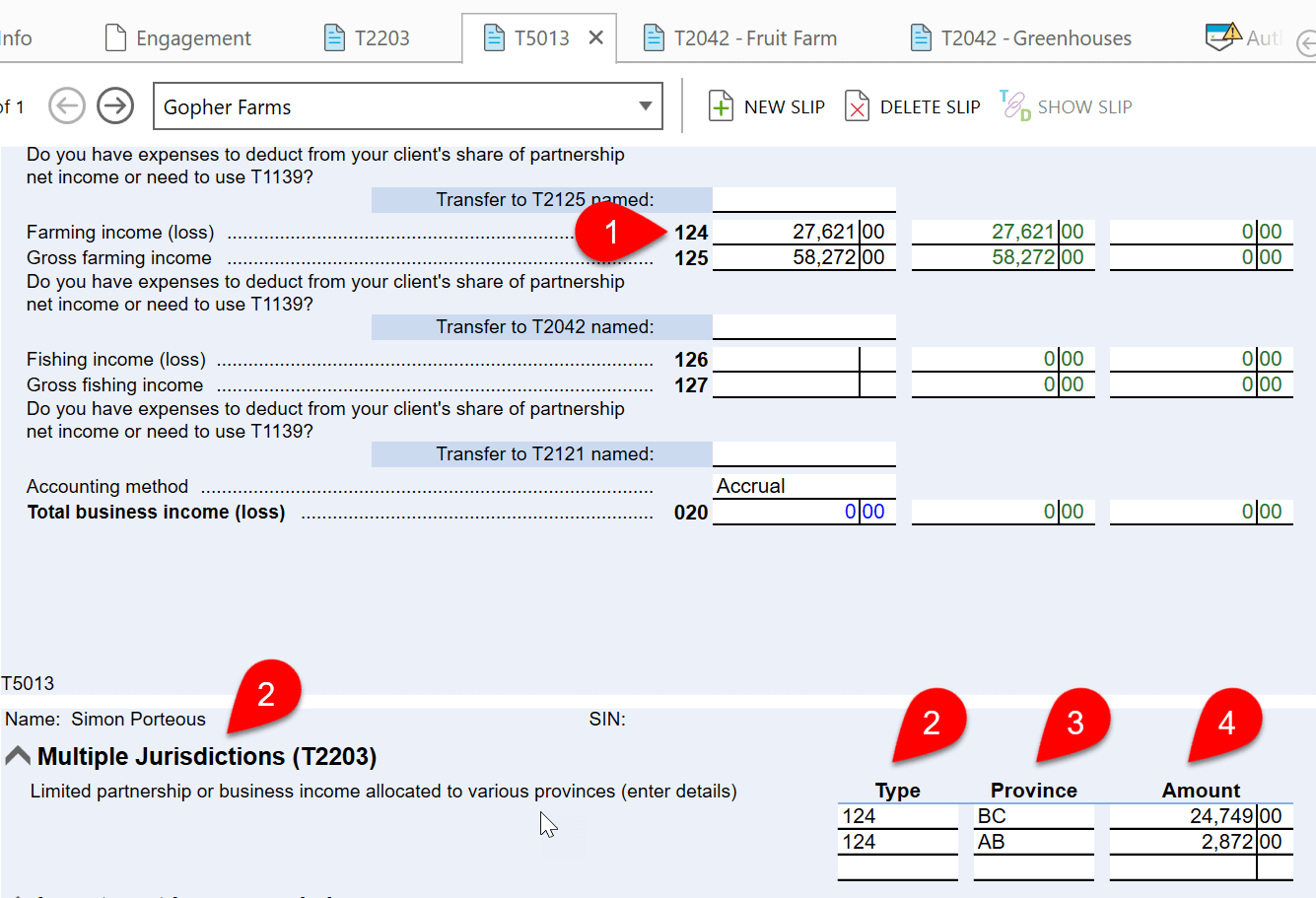

T5013 and Multiple Jurisdiction

If multiple jurisdiction income appears on a T5013 slip:

- Enter the income in the applicable box number on the T5013.

- Go to the Multiple Jurisdictions (T2203) section.

- Select the box number for the type of income.

- Select a province or territory.

- Enter the income to allocate to each province or territory. Only positive amounts flow back to the T2203.

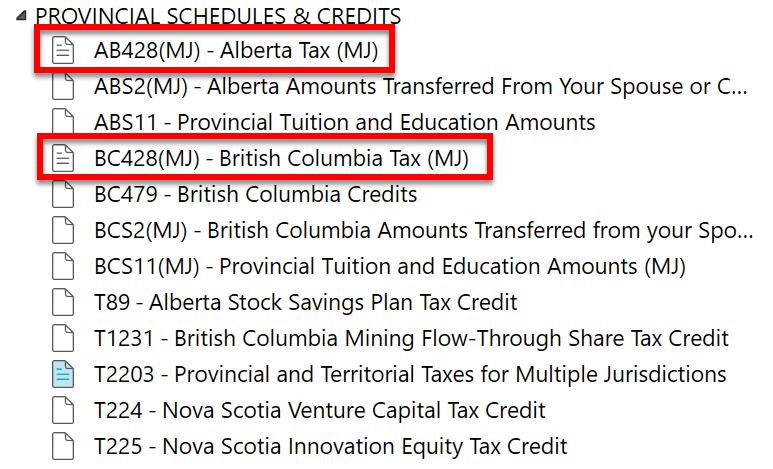

T2203, Part 3 Provincial and Territorial Non-Refundable Tax Credits

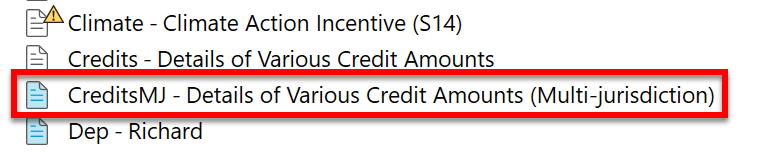

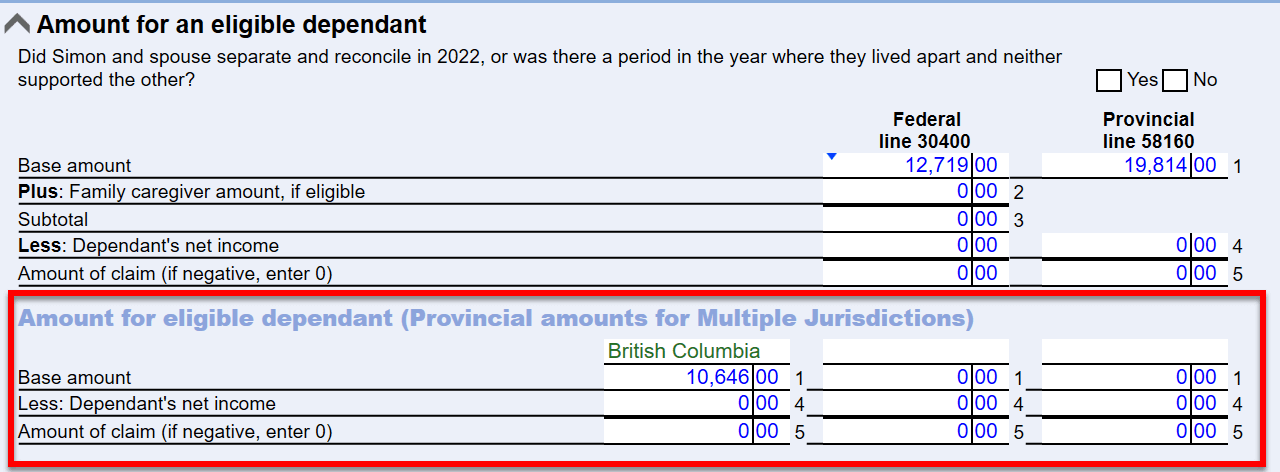

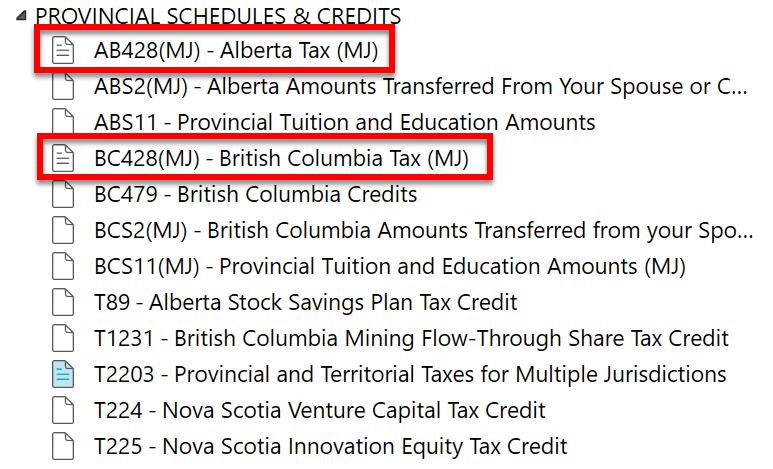

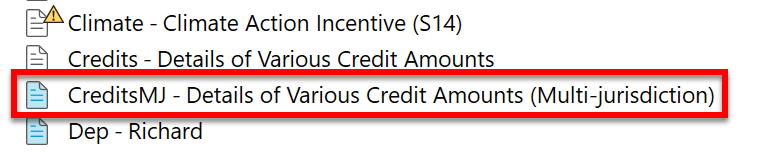

TaxCycle does not display Part 3 of the T2203 for calculating provincial and territorial non-refundable tax credits. Instead, TaxCycle contains additional worksheets and tables for those calculations:

- The provincial 428 (MJ) forms contains all the required calculations and fields for multiple jurisdictions.

- The CreditsMJ worksheet handles the calculations for multiple jurisdictions.

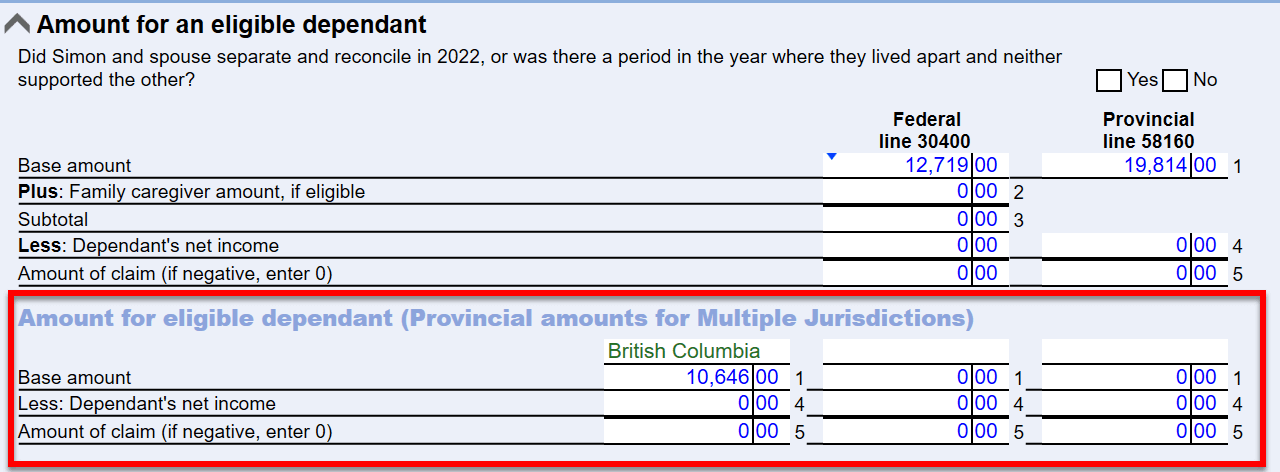

- The Dep worksheet will also have more information related to multiple jurisdictions.