Updated: 2023-01-19

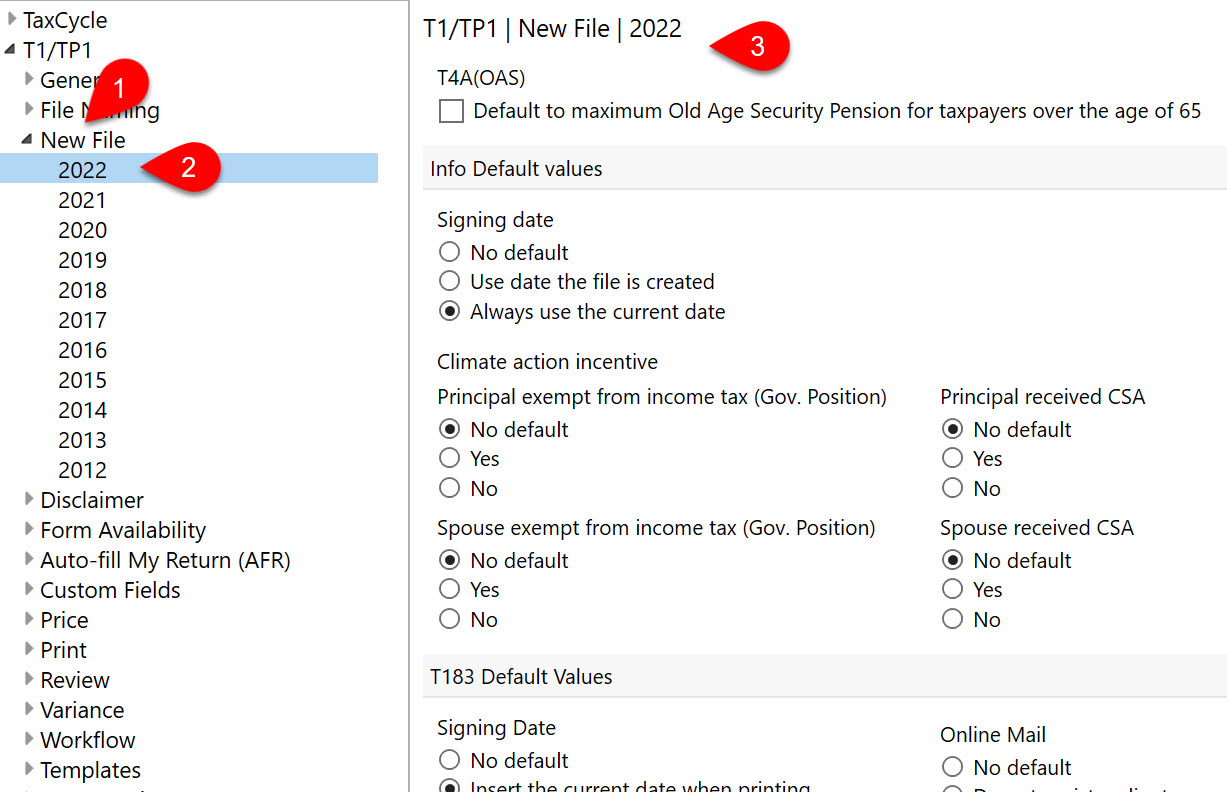

For each tax return type or module, you can set defaults to insert in fields when creating a new file or carry forward one from the prior year. It's worth reviewing these options even if you have already carried forward your files to the current year.

Set defaults for the following:

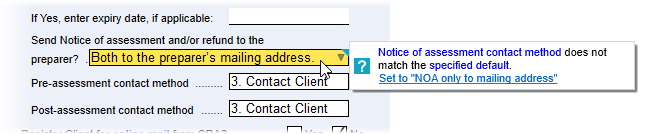

In most cases, TaxCycle also displays a Quick Fix review message if the details in the return don't match those set in Options.

If you have already carried forward your files to the current year, you can still change the default New File options. TaxCycle will display a Quick Fix review message, like the one below, letting you know when the choice in the field does not match the default you have set in Options. Click the blue link in the message to update the client file.