Updated: 2023-08-11

Use the CDA worksheets in TaxCycle T2 to calculate and track current-year, prior-year and next-year Capital Dividend Account (CDA) balances and complete the T2054 Election for a Capital Dividend Under Subsection 83(2).

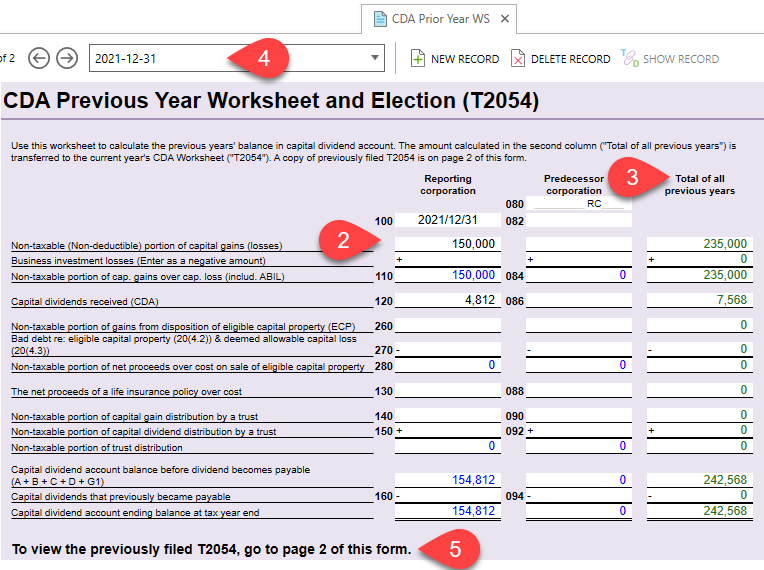

Use the CDA Prior Year worksheet to track prior-year Capital Dividend Account (CDA) details:

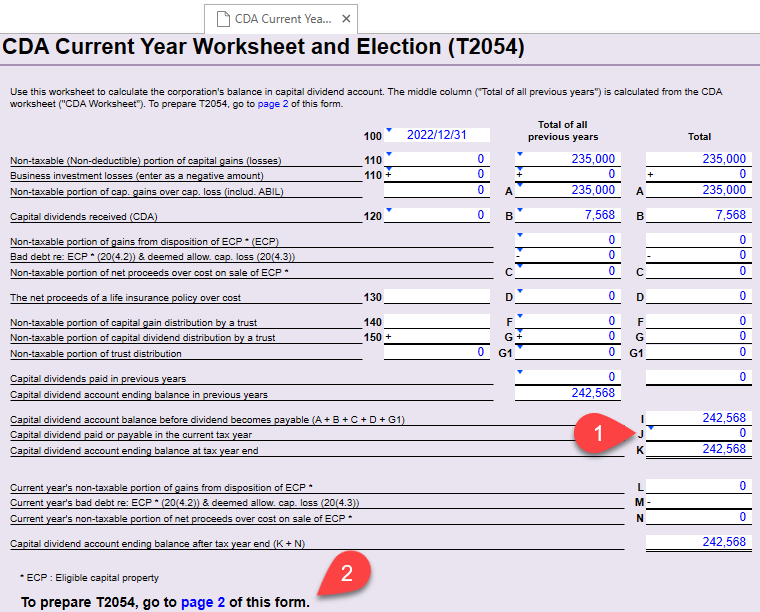

Use the CDA Current Year worksheet to calculate the CDA balance for the current year:

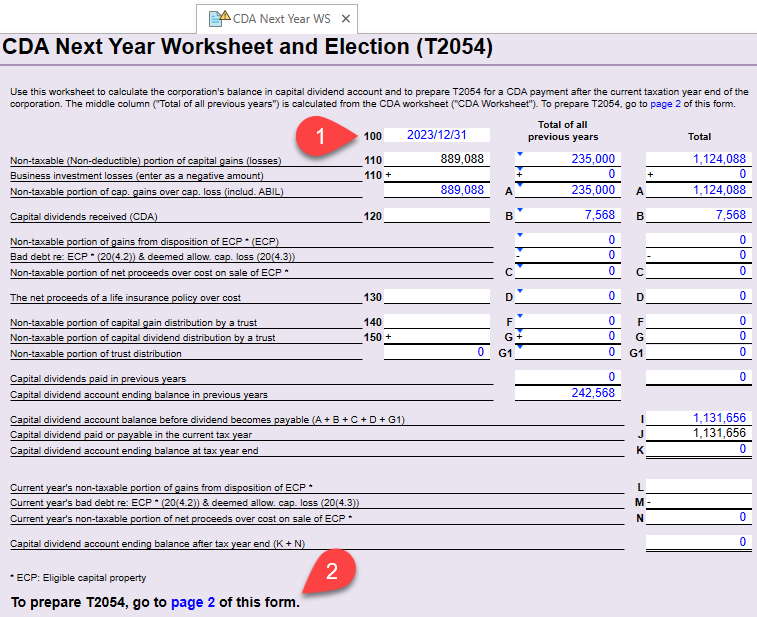

Use the CDA Next Year worksheet to prepare T2054 for the period after the tax year-end of the corporation for which you are preparing the T2 return.