Updated: 2025-07-04

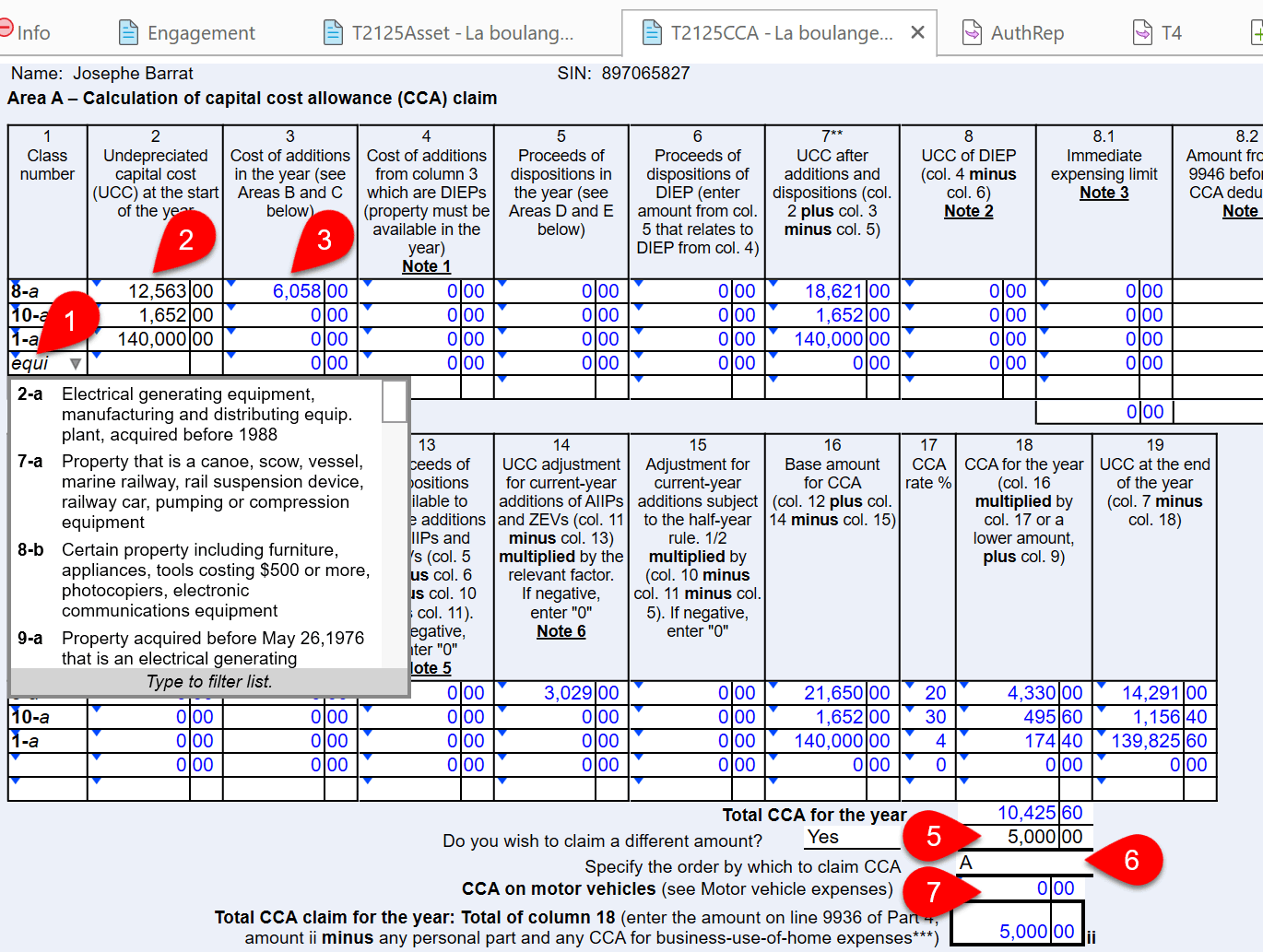

The CCA worksheet contains the standard capital cost allowance (CCA) table. The CCA worksheet appears automatically when you create a related income statement. For example, when you create a T2125, TaxCycle creates the connected T2125CCA.

Information entered in the Asset Manager flows to this worksheet. TaxCycle pools assets of the same class entered in the Asset Manager into one row on the CCA worksheet.

If you enter details on the CCA worksheet, use one row for each CCA class or pool. TaxCycle will create a separate Asset Manager record for each row in the table. As you complete a row, TaxCycle adds a new blank row to the bottom of the table.

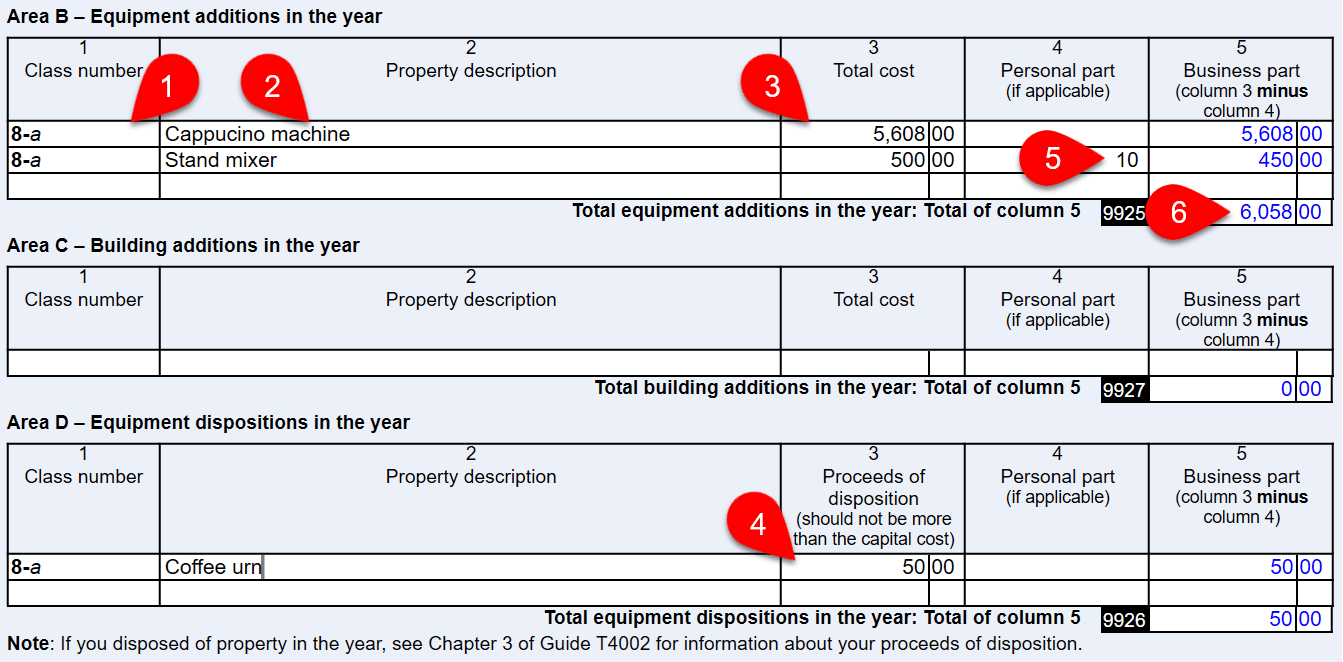

Scroll down to the bottom of the worksheet to enter details of current year addition or disposition transactions.