Updated: 2022-11-21

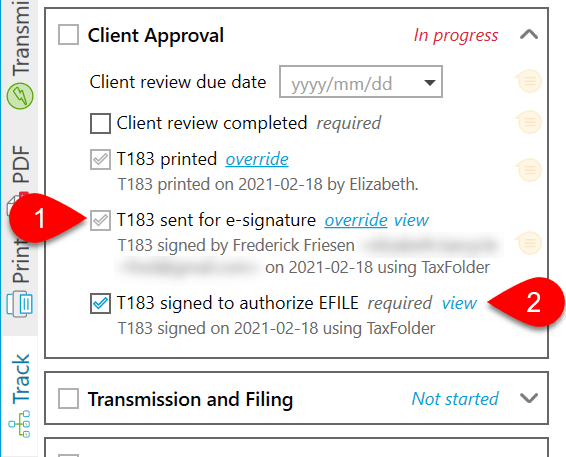

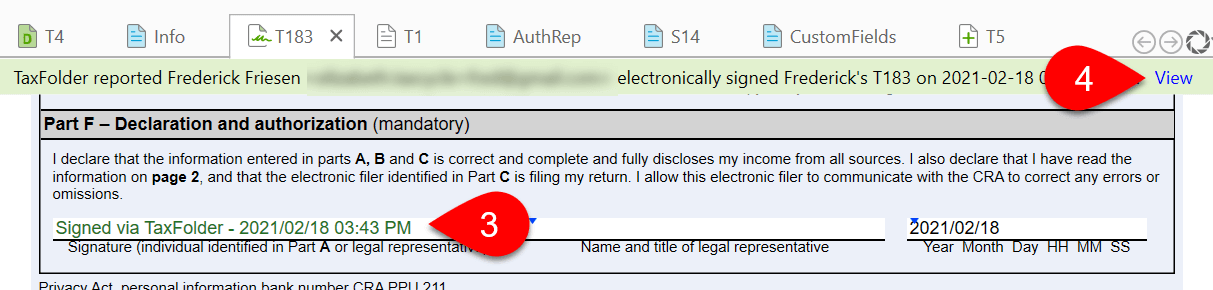

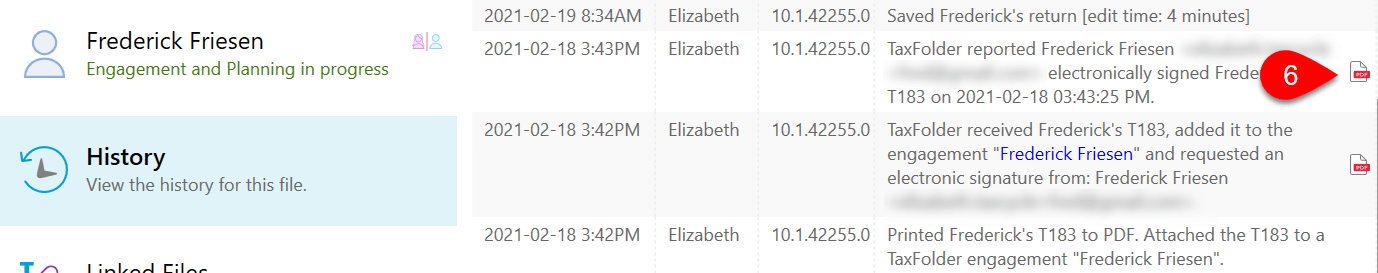

When sending a form for signature, TaxCycle tracks the tasks and status of electronic signature requests in the taxpayer's workflow.

Warning! If you send a document for e-signature via TaxFolder or DocuSign®, and then create a new, different file with the same name and SIN, the new file will not be able to receive the response message from the e-signature provider. To ensure the security of your client information, only the originating file can ever receive the response. You can, of course, log into your account and download the signed document from there.