Updated: 2023-05-10

TaxCycle T3 includes a SIFT (specified investment flow-through) worksheet specifically designed for inter-vivos SIFT trusts. Calculations on the T3SIFTWS adjust the net income and the provincial taxable income calculations throughout the T3 return.

You may not electronically file this worksheet. Please print and mail it if required.

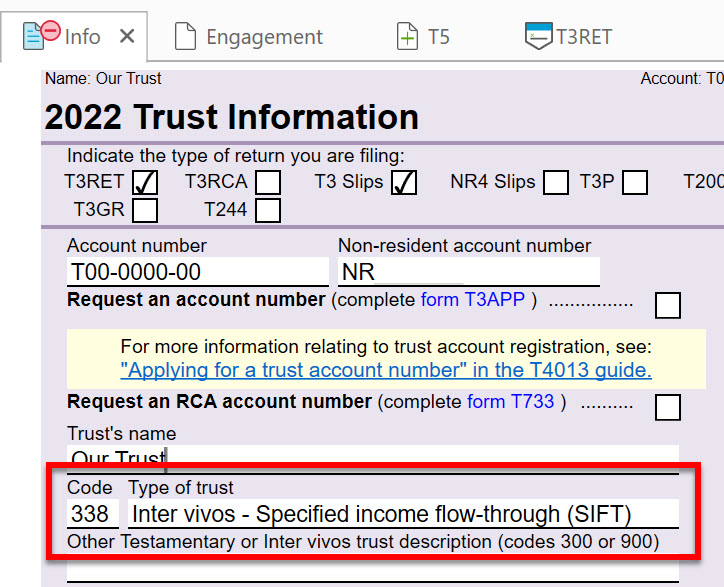

To indicate the trust type is an inter-vivos SIFT trust, enter code 338 on the Info worksheet.

Charts 1 to 5 apply to all SIFT trusts. Chart 6 calculates the refundable Québec abatement and only applies to trusts resident in Québec.

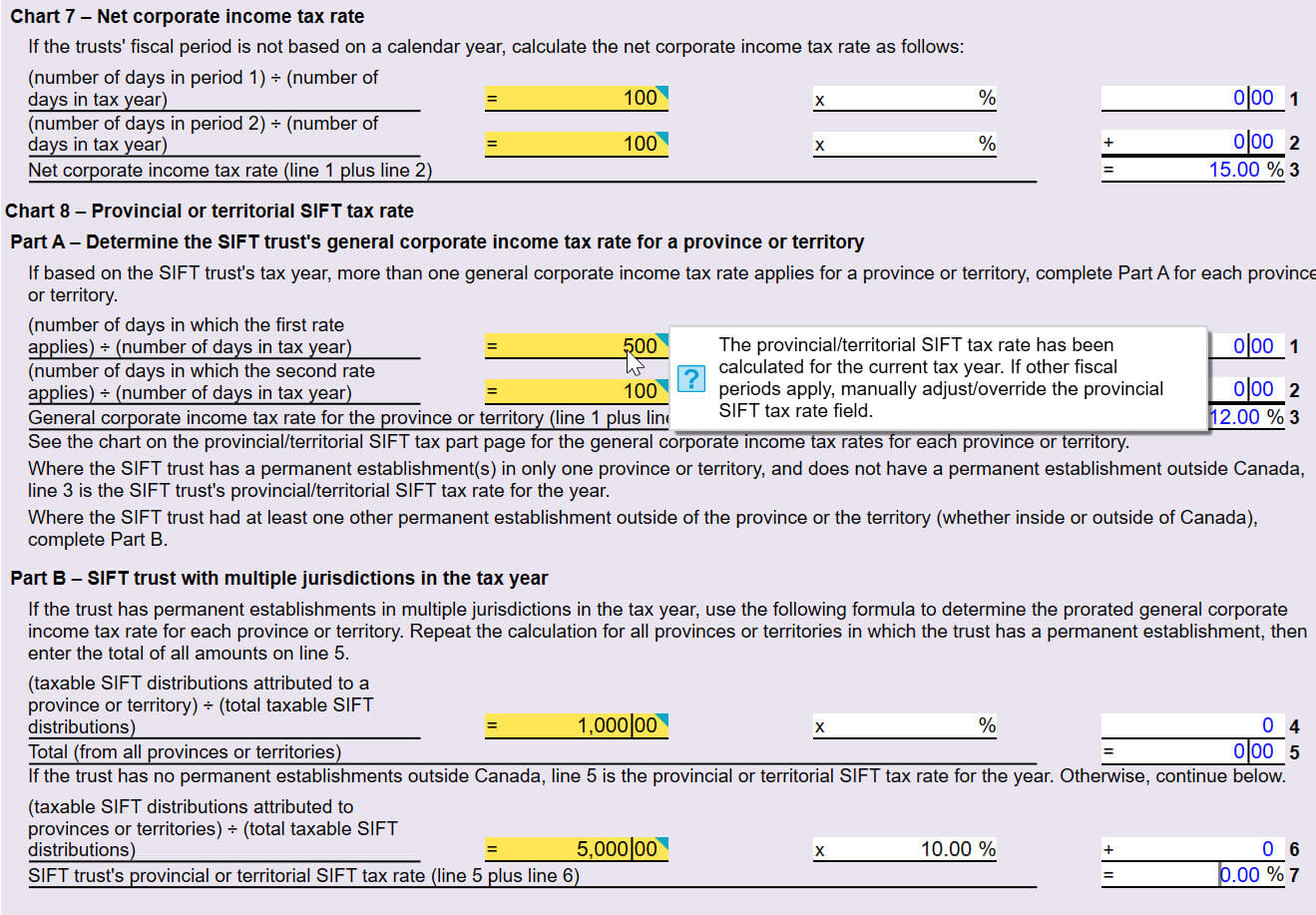

The worksheet calculates using tax rates applicable to the current tax year only.

If the trust year spans more than one year, is not based on a calendar year, or operates in multiple jurisdictions, you must:

A review message will display if the return falls into one of these situations to remind you to calculate the amounts manually.