Updated: 2020-06-23

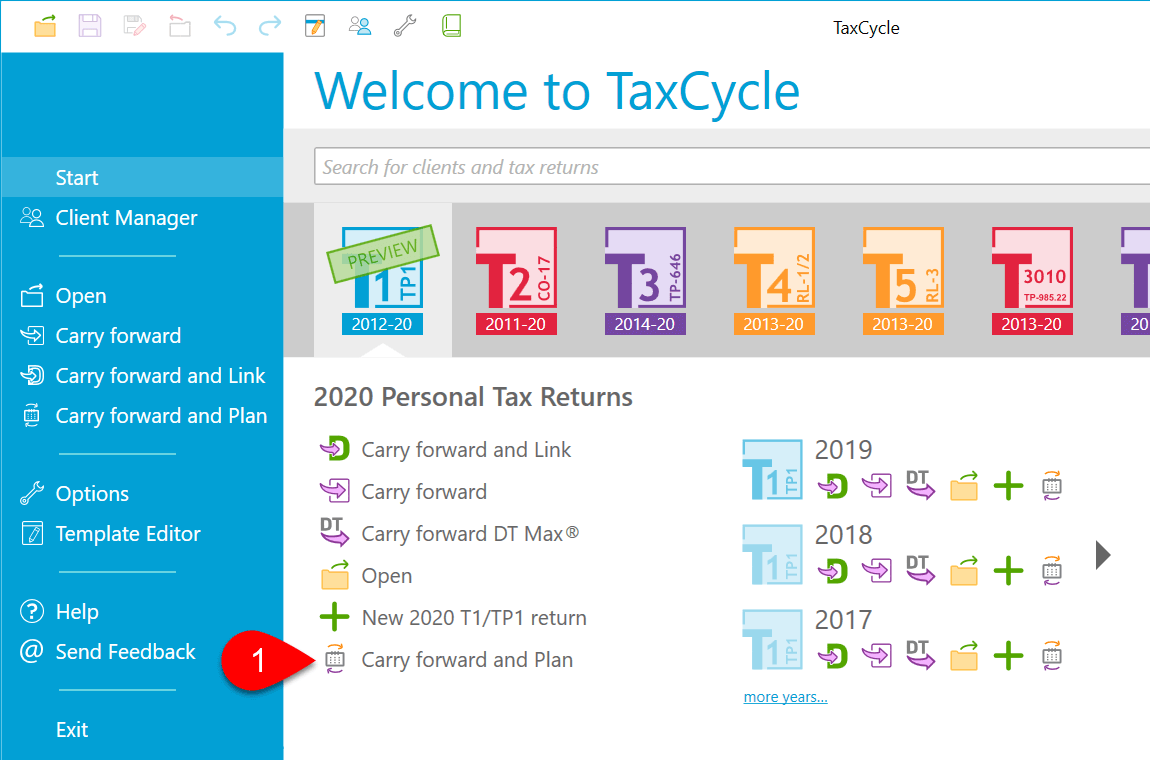

Save time when creating a planning return by using Carry forward and Plan. It combines the actions of carrying forward a return and then getting plan values from the prior year.

This is different from an ordinary carryforward in that instead of bringing forward only amounts (such as unused credits) that were eligible to carry forward from the prior year, it copies values entered on slips and forms in the prior year return, making it quick to plan for the upcoming year without re-entering data. You can then review and modify them based on projected changes for the upcoming year.

It also automatically changes the Return purpose in the Filing section on the Info worksheet to avoid filing returns with the plan values. See the T1 Planning and Training Files help topic.