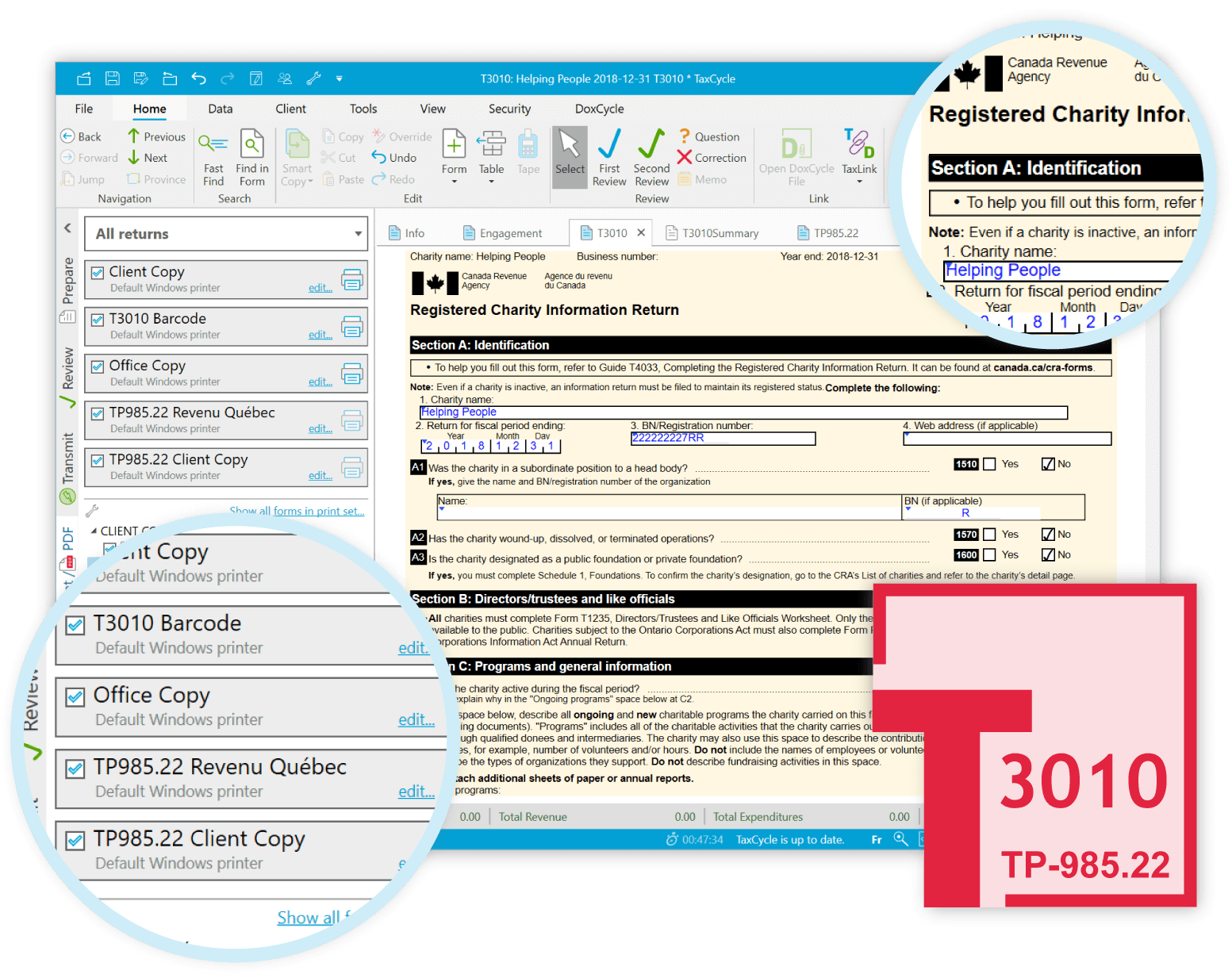

Prepare unlimited federal charity information returns for your clients, as well as Québec TP-985.22 returns.

TaxCycle T3010 is included in the Complete Paperless Tax Suite and is also available as a stand-alone module.

Find out for yourself why thousands of tax preparers have already switched. Get up and running in just 10 minutes with your free trial of the TaxCycle Suite. Seamlessly carry forward returns from DT Max®, Cantax®, Taxprep® and ProFile® software.

| RETURNS | |

|---|---|

| Number of returns | Unlimited |

| Federal T3010 | 2013 onward |

| Québec TP-985.22 | 2018 onward |

| CARRYFORWARDS | |

| TaxCycle T3010 | |

| ProFile® FX | |

| Taxprep® Forms | |

| Cantax® FormMaster | |

| ELECTRONIC FILING & SERVICES | |

| Québec MR-69 | |

| FEDERAL JACKET and SCHEDULES | |

| T3010 — Registered charity information return (2020 and later years) | |

| T3010 — Registered charity information return (2019 and earlier years) | |

| QUÉBEC JACKET and SCHEDULES | |

| TP-985.22 — Information Return for Registered Charities and Other Donees | |

| Schedule A — Disbursement Quota for the Taxation Year | |

| Schedule B — Disbursement Quota for the Taxation Year | |

| Schedule C — Summary of Gifts Made to Qualified Donees | |

| Schedule D — Directors and Other Officers | |

| MR-69 — Authorization to Communicate Information or Power of Attorney | |

| MR69Results — MR-69 Attachments and Results | |

| WORKSHEETS | |

| Info — Personal Information | |

| Engagement — Engagement Information | |

| Workflow — Workflow Summary | |

| CustomFields — Custom Fields Worksheet | |

| T1235 — Directors/Trustees and Like Officials Worksheet | |

| T1236 — Qualified Donees Worksheet/Amounts Provided to Other Organizations | |

| T2081 — Excess Corporate Holdings Worksheet for Private Foundations | |

| FILING and AUTHORIZATION | |

| DisbursementQuota — Disbursement Quota Worksheet | |

| GST66 — Application for GST/HST Public Service Bodies' Rebate and GST Self-Government Refund | |

| RC7066-SCH — Provincial Schedule - GST/HST Public Service Bodies' Rebate | |

| T1240 — Registered Charity Adjustment Request | |

| T2046 — Tax Return Where Registration of a Charity is Revoked | |

| T2046 Schedule 5 — Tax Return Where Registration of a Charity is Revoked | |

| T2094 — Registered Charities Application to Reduce Disbursement Quota | |

| T2095 — Registered Charities: Application for Re-Designation | |

| T3011 — Application for Designation as Associated Charities | |

| SUMMARIES | |

| T3010Summary — T3010 Summary (for client review) | |

| 2YearSummary — 2 Year Variance Summary | |

| 5YearSummary — 5 Year Summary | |

| Memo summary | |

| Tapes summary | |

| CORRESPONDENCE | |

| Client Letter | |

| Client MR-69 Filing Receipt | |