Updated: 2023-06-06

The TaxCycle T3010 module helps you prepare a registered charity information return. For a list of the forms included in this module, see the TaxCycle T3010 product page.

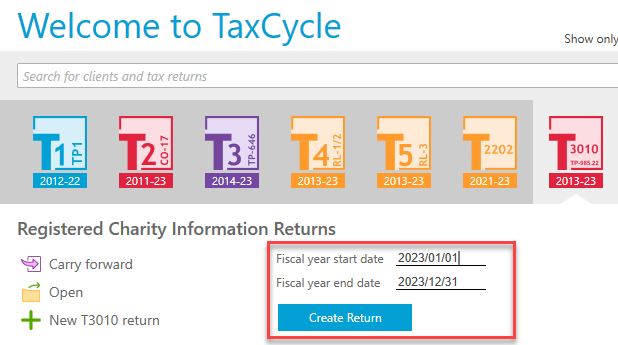

The T3010 module supports the preparation of multiple years of returns. You can carry forward returns from the prior year TaxCycle file, or from other tax software. See the Carry Forward Prior-Year Returns help topic.

If you create a new return, you’ll be asked to enter the tax year start and year end on the Start screen.

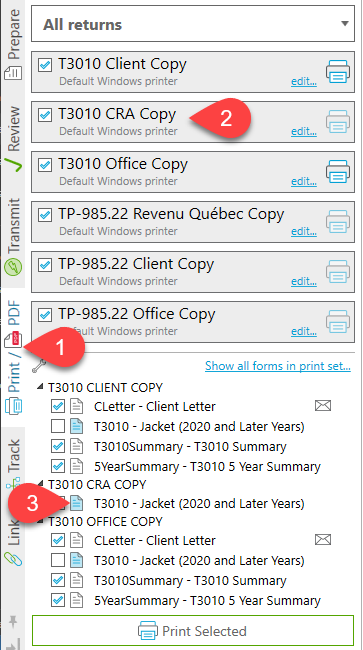

Electronic filing is not available for T3010 returns. You must print, obtain a signature and file the return by mail with the Canada Revenue Agency (CRA). You can, however, file the return online through the CRA’s My Business Account (MyBA) service. To learn more, see the CRA’s page T3010 charity return – Filing information.