Updated: 2023-04-17

This topic covers immediate expensing for personal tax returns, in TaxCycle T1. To learn how to apply the measure to corporate or partnership returns, see T2 and T5013 Immediate Expensing of CCA.

The Department of Finance has introduced a temporary tax incentive measure called “immediate expensing incentive.” This incentive allows an eligible person or partnership (EPOP) to immediately expense costs of certain depreciable capital property (known as “immediate expensing property”) in the year of acquisition up to an annual maximum limit of $1.5 million. This annual limit is called the immediate expensing limit and it must be shared with any associated EPOPs. This limit is subject to proration if a tax/fiscal year of an EPOP is less than 51 weeks.

The following abbreviations are used throughout this topic.

An EPOP is defined as:

(a) a corporation that was a Canadian-controlled private corporations (CCPC) throughout the year;

(b) an individual (other than a trust) who was resident in Canada throughout the year; or

(c) a Canadian partnership, all of the members of which were, throughout the period, persons described in paragraphs (a) or (b).

IEP refers to eligible capital asset additions and is defined as property of a prescribed class other than property included in any of Classes 1 to 6, 14.1, 17, 47, 49 and 51. If the EPOP is

In order to apply the immediate expensing incentive, an EPOP must “designate” IEP as DIEP (“designated immediate expensing property”). This designation occurs automatically through preparing a CCA schedule for any business (T2125), fishing (T2121), farming (T2042), AgriStability/AgriInvest (T1163/T1273) or rental (T776) statement.

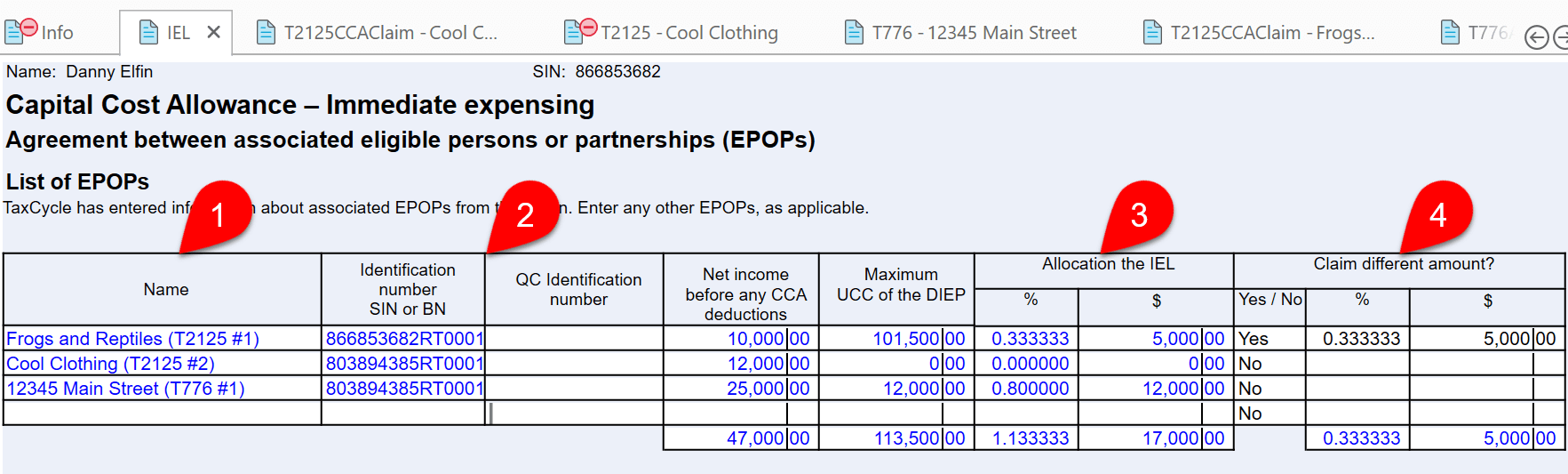

In accordance with the definition of an EPOP, above, for the purposes of sharing the immediate expensing limit among associated EPOPs, you must complete an associated table in Area G of the CCA worksheet for the statement. TaxCycle will automatically complete this table based on the data in the IEL table (discussed in more detail later).

An individual’s business, fishing, farming or rental operation with a capital cost of IEP that exceeds $1.5 million in a taxation year, and that has immediate expensing property ordinarily included in more than one CCA class, can decide which CCA class to attribute the immediate expensing incentive. Any remaining UCC may be subject to additional capital cost allowance deductions under the existing CCA rules (AIIP).

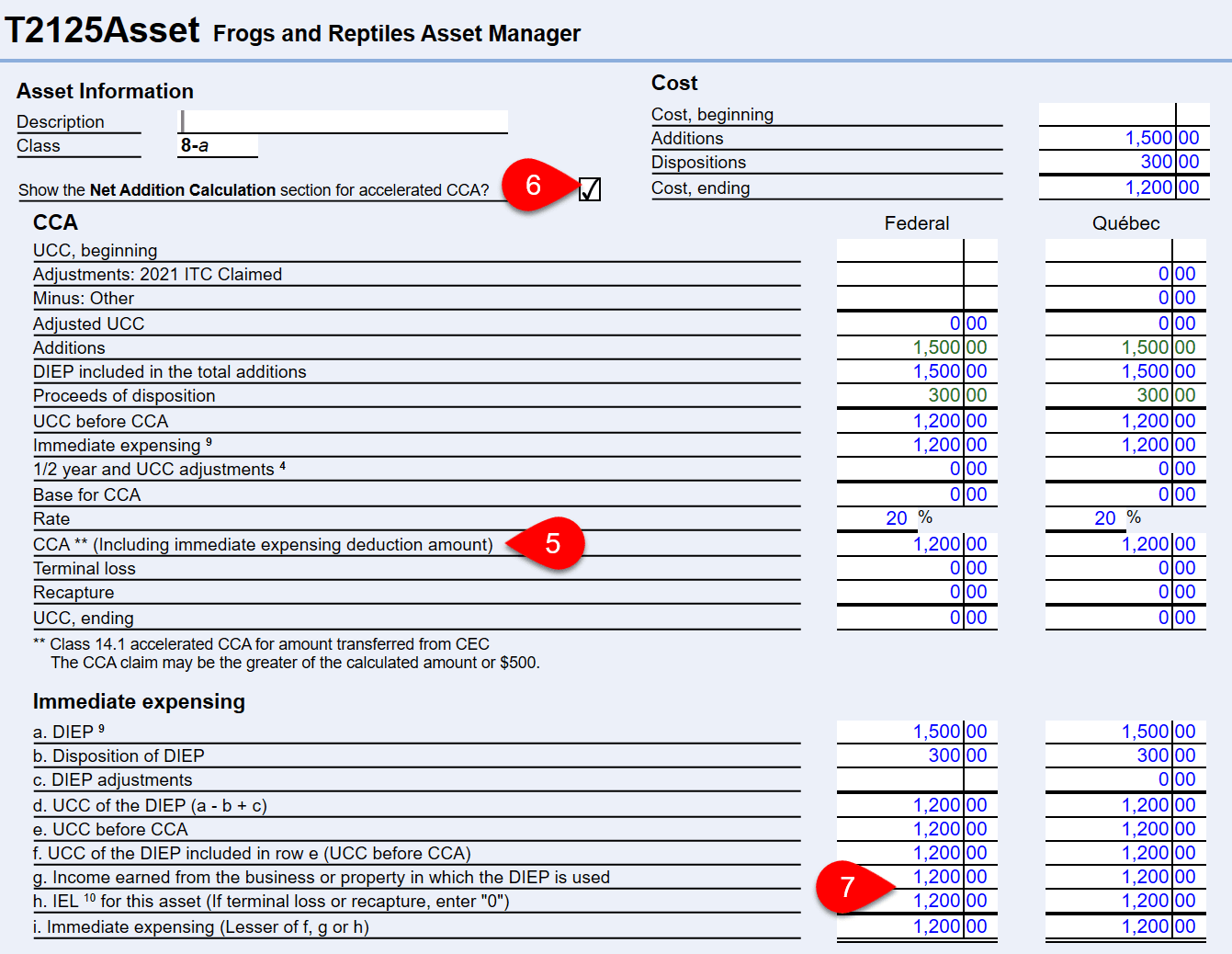

The amount of immediate expensing deduction allowed to be deducted is equal to the lesser of:

(a) the EPOP’s immediate expensing limit for the taxation year (all or portion of the $1.5 million limit);

(b) the UCC to the EPOP as of the end of the taxation year (before making immediate expensing deduction) of property that is DIEP for the taxation year, and

(c) if the EPOP is not a CCPC (that is an individual other than a trust), the amount of income, if any, earned from the source of income that is a business or property (computed without regard to paragraph 20(1)(a) of the Act) in which the relevant DIEP is used for the eligible person or partnership’s taxation year.

VERY IMPORTANT! Point (c), above, applies only to individuals (T1) and partnerships (T5013). Eligible individuals and partnerships cannot claim immediate expensing deduction to create or increase a loss before claiming any other CCA (see example below).

For example, if an individual carries on a self-employment business which has $10,000 of net income before CCA, recapture and terminal loss, the maximum amount of immediate expensing amount cannot exceed $10,000.

For example, an EPOP (individual taxpayer) invests $3,000,000 in equal amounts to acquire the following three properties:

Although the taxpayer could designate any of the three properties as DIEP, it is expected that it would generally designate, for purposes of the immediate expensing incentive, starting with property that falls under CCA classes that would otherwise offer the lowest CCA deduction. By doing so, the EPOP would be able to maximize its CCA claim. Simply put, the CCA claim is maximized if the immediate expensing incentive is applied to class 7, class 10, and then class 50—in this order—as illustrated below.

| CCA Class (rate) | Cost of Acquisitions |

Immediate Expensing |

1st year Allowance on Remainder of Class |

Total First-Year Allowance |

|---|---|---|---|---|

| Class 7 (15%) | $1,000,000 | $1,000,000 | $0 | $1,000,000 |

| Class 10 (30%) | $1,000,000 | $500,000 | $225,000 | $725,000 |

| Class 50 (55%) | $1,000,000 | $0 | $825,000 | $825,000 |

| Total | $3,000,000 | $1,500,000 | $1,050,000 | $2,550,000 |

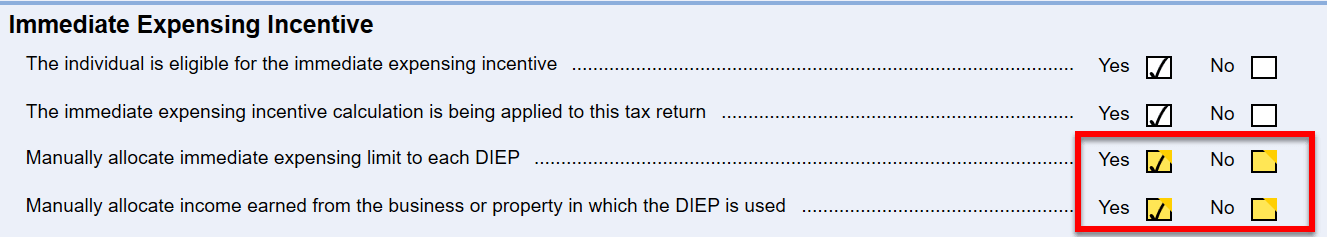

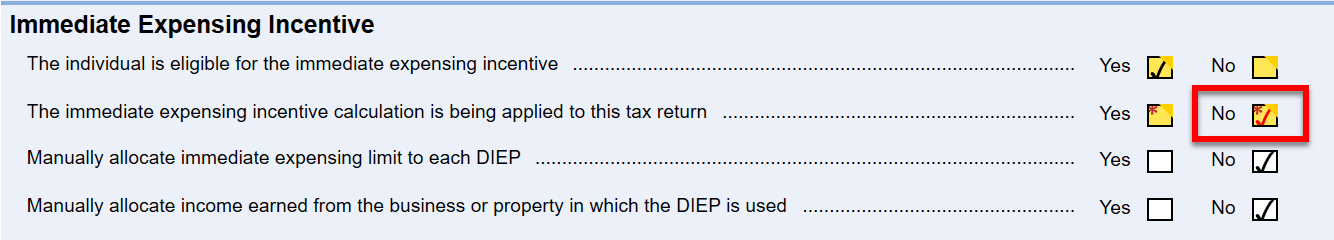

TaxCycle offers two ways of calculating the immediate expensing incentive, depending on how you answer the following questions on the CCAClaim worksheet. You can choose to:

The default for both questions in TaxCycle T1 2022 is Yes, manually allocate the immediate expensing limit and the income earned whether you create a new file or open an existing file. This protects the calculations and CCA claims during the middle of personal tax filing season.

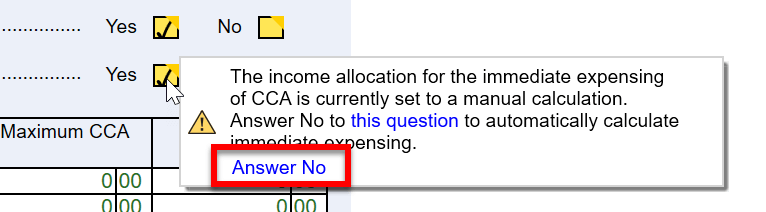

To activate the automatic calculation, answer No to these two questions. You must do this on each income statement in the file. TaxCycle will automatically calculate the immediate expensing claim as you enter capital asset additions on the Asset Manager or the CCA worksheet. TaxCycle will remind you to do this in a review message and you can use the Quick Fix solution to automate the claim.

In the 2023 T1 module, we will set the default to No for these questions, similar to the implementation in T2/T5013.

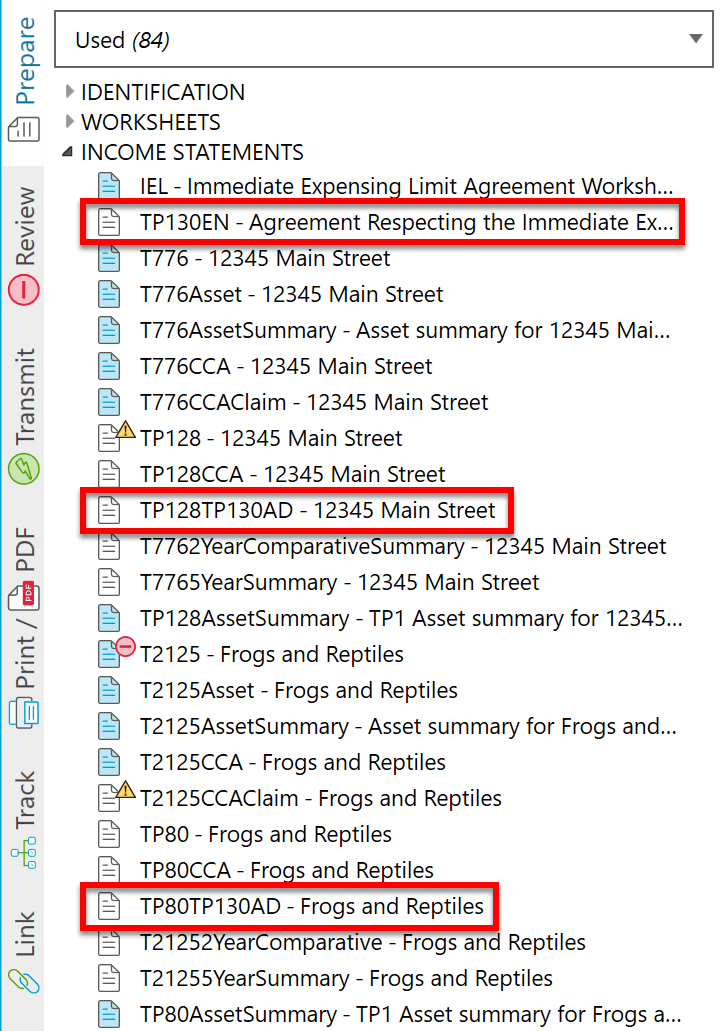

Individual taxpayers must share the $1.5 million immediate expensing limit between EPOPs. To support the allocation of this limit, TaxCycle T1 contains the Immediate Expensing Limit (IEL) worksheet.

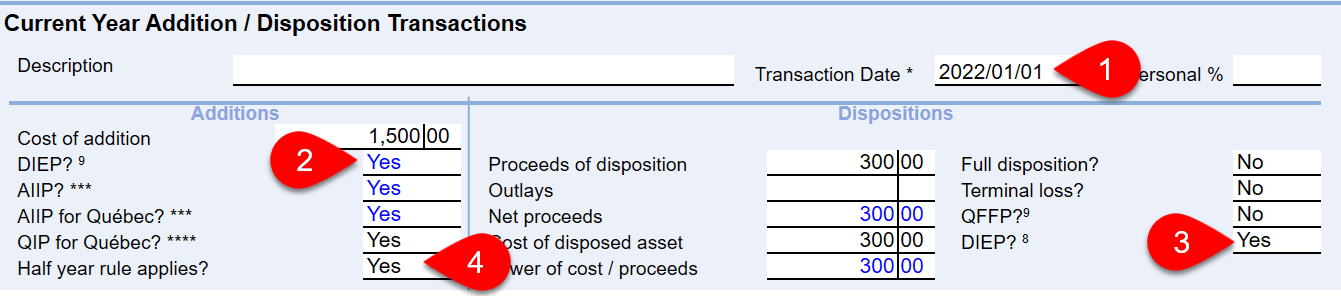

The Asset Manager contains a section to calculate the immediate expensing deduction:

Québec has separate forms to calculate, allocate and claim immediate expensing. They are forms TP-130.AD and TP-130.EN.

If you do not wish to apply immediate expensing to an income statement, go to the CCAClaim worksheet and override the answer to the question about applying the calculations.

You must do this separately for each income statement.

Once you override this question, additions entered on the Asset Manager will no longer show as eligible for immediate expensing.

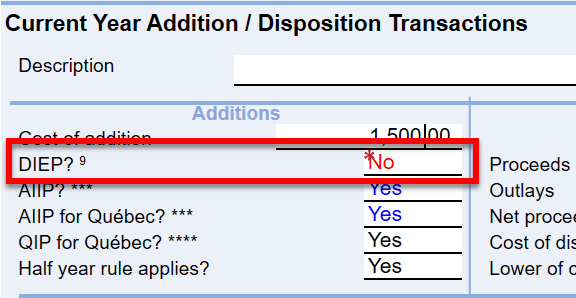

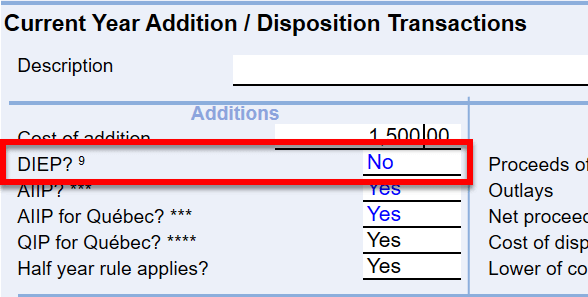

To exclude a specific addition from immediate expensing, do not override the question on the CCAClaim worksheet. Instead, override the answer to the DIEP question on the Asset Manager to No. The addition will still qualify for Accelerated CCA (AIIP).