Updated: 2023-04-14

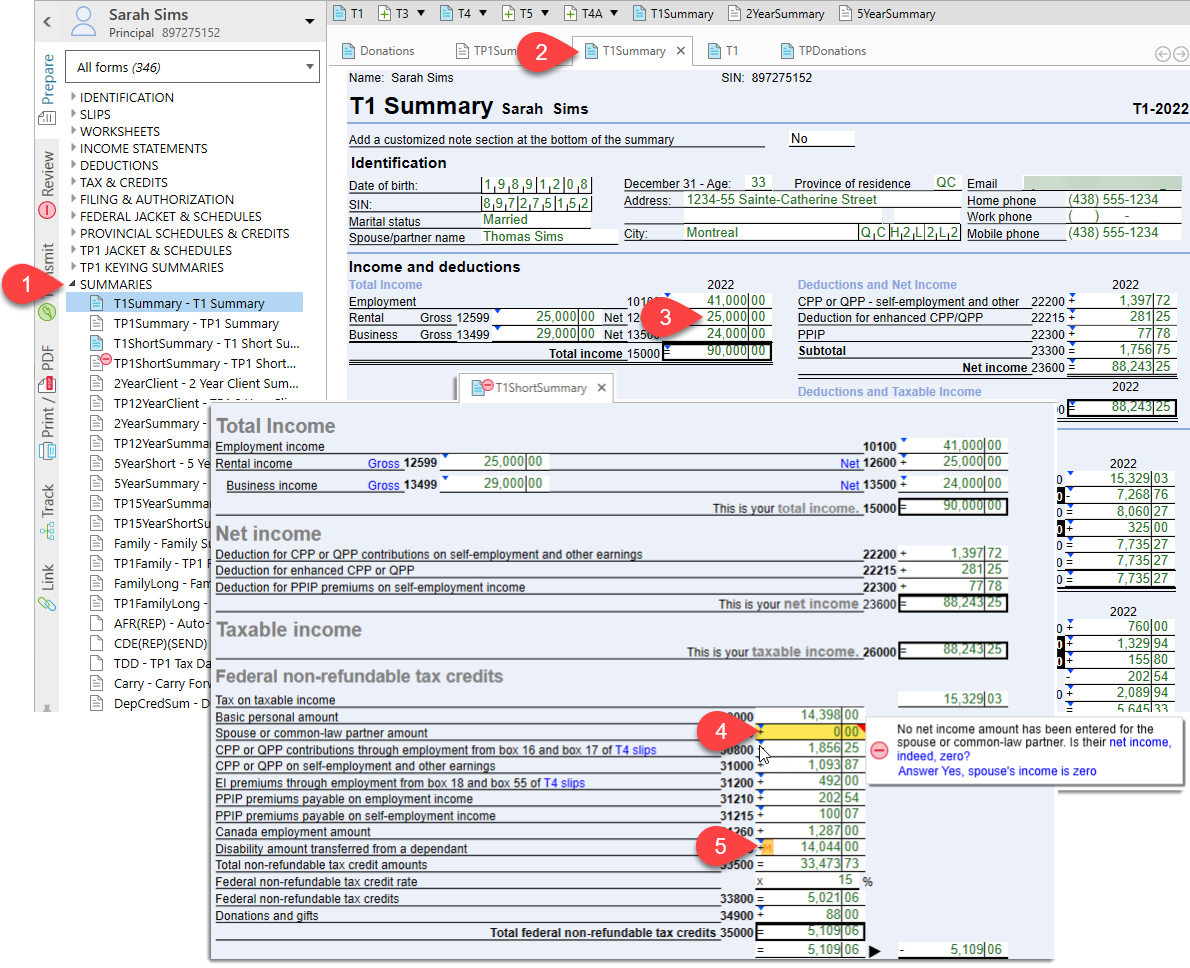

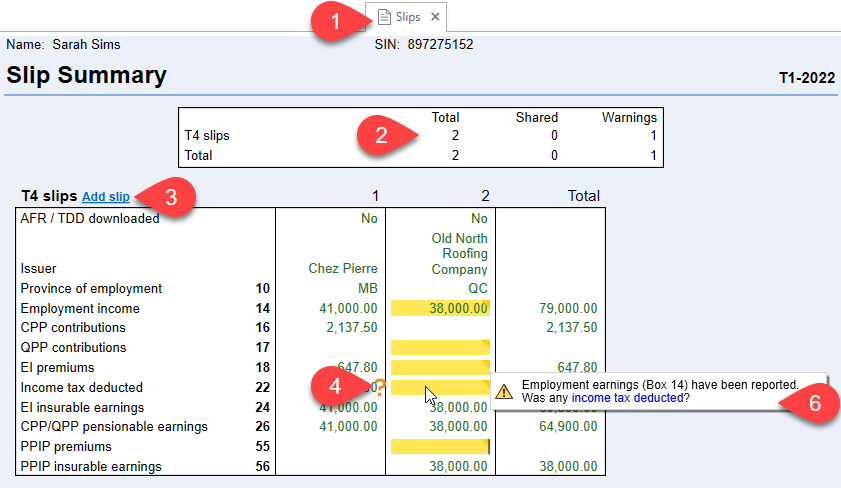

TaxCycle contains summaries to assist in reviewing returns and communicating with clients.

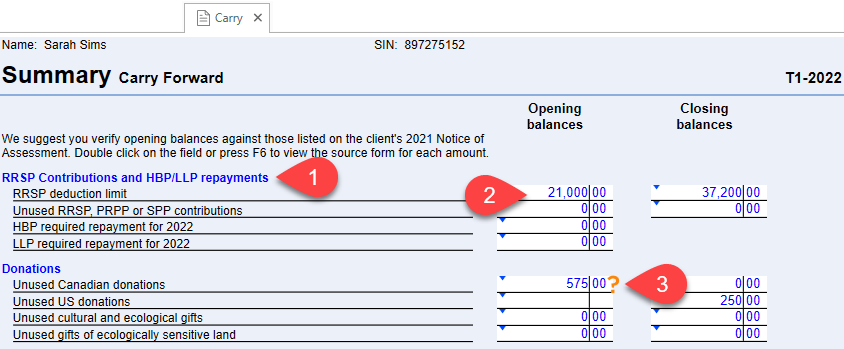

The T1 Carry Forward Summary (Carry) lists amounts carried forward from the prior year, such as RRSP deduction limit, unused donations and other deductions.

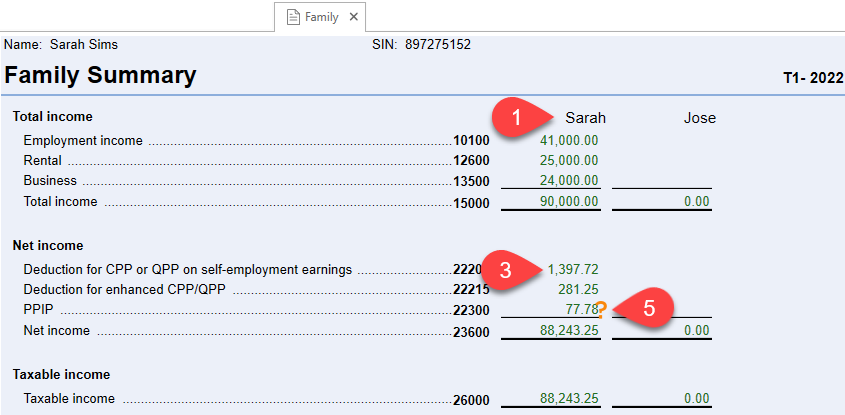

The Family summary in TaxCycle T1/TP1 provides a comparative summary of all family members in the return. Dependants are only included if they are full returns, not if they are only listed on the Dep worksheet.

Five-year income statement summaries—T776Summary, T2121Summary, T2042Summary, and T2125Summary—appear in the forms list as part of the set of forms for each income statement you create.

For example, for each T2125 form you create, you will see a T2125Summary.