Updated: 2024-12-11

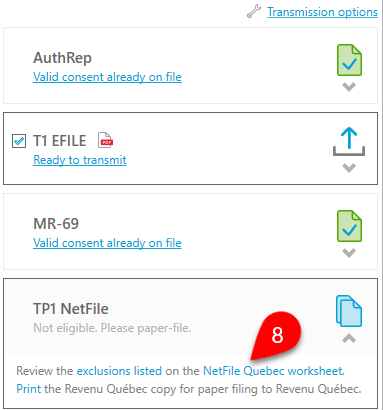

In TaxCycle T1, you can prepare three types of bankruptcy returns for individuals:

To set up trustee’s information:

Once you change these settings, they will automatically be inserted into the Engagement worksheet when you create a new return. They then flow to the DC905 from there.

If you are the Trustee for someone filing for bankruptcy, you must complete the DC905 as soon as you receive the taxpayer’s estate number.

Do not include this form in any of the T1 tax returns.

TaxCycle includes the DC905 to make it easy for you to fill out. It auto-completes the taxpayer’s information from the Info worksheet and the trustee’s information from the Engagement worksheet.

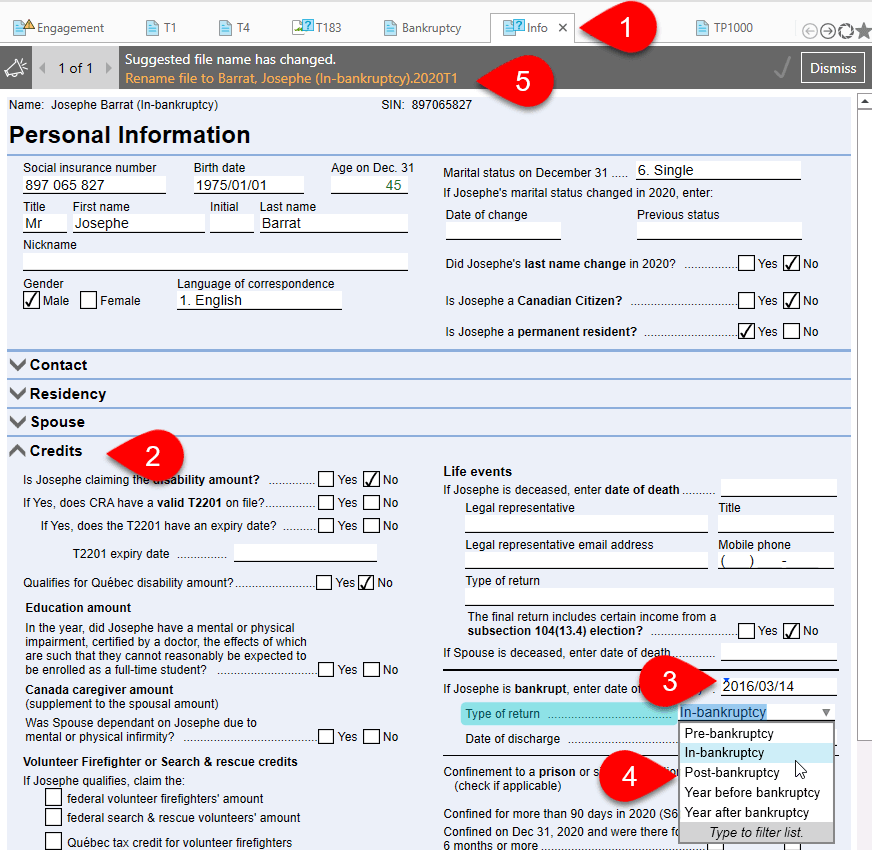

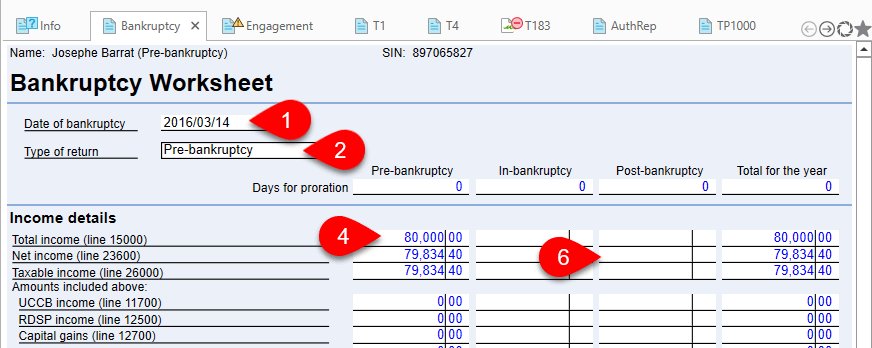

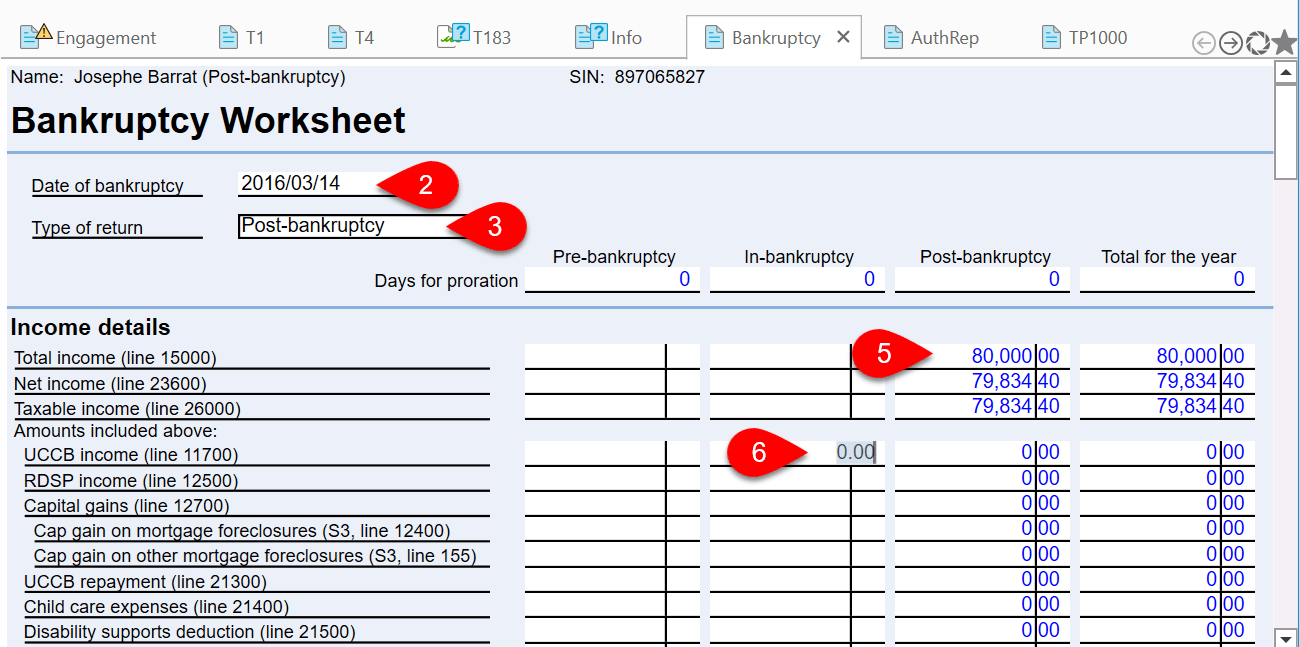

TaxCycle uses the date and type of bankruptcy entered on the Info worksheet to calculate the number of days in the period for the return type, so as to pro-rate relevant amounts on the Bankruptcy worksheet.