Updated: 2022-08-12

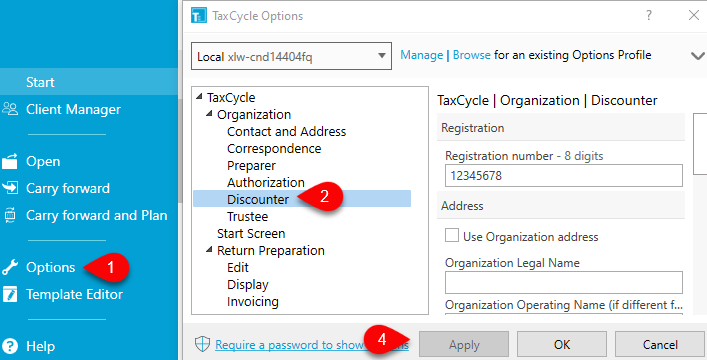

If you prepare discounted tax returns for your clients (see Information for discounters—Canada.ca), enter your information on the Discounter page so TaxCycle can automatically insert this information on the T1 Engagement Worksheet when you create or carry forward a return.

You can import and export your Options to your colleagues or to another computer. See the Options Profiles help topic for instructions.

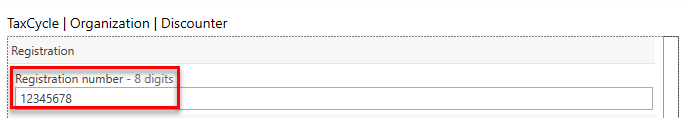

Enter your Discounter Code obtained from the Canada Revenue Agency in the Registration number field.

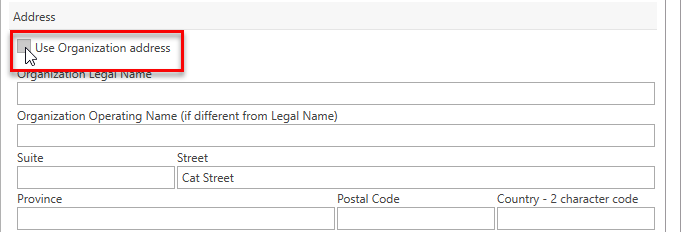

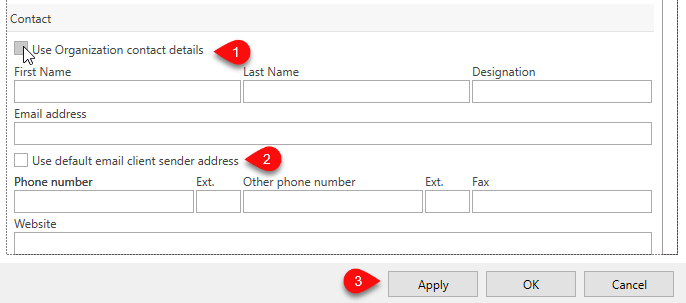

Check the Use Organization address box to use your organization’s name and address, as entered in Contact and Address Options. If you use different information when discounting returns, leave the check box blank and complete the fields with the discounter information.