Updated: 2020-07-22

The rules surrounding Tax on Split Income (TOSI) on T1 personal tax returns changed as of the 2018 tax year.

Previously, the T1206 form was applicable to children under 18. Those rules:

As of 2018:

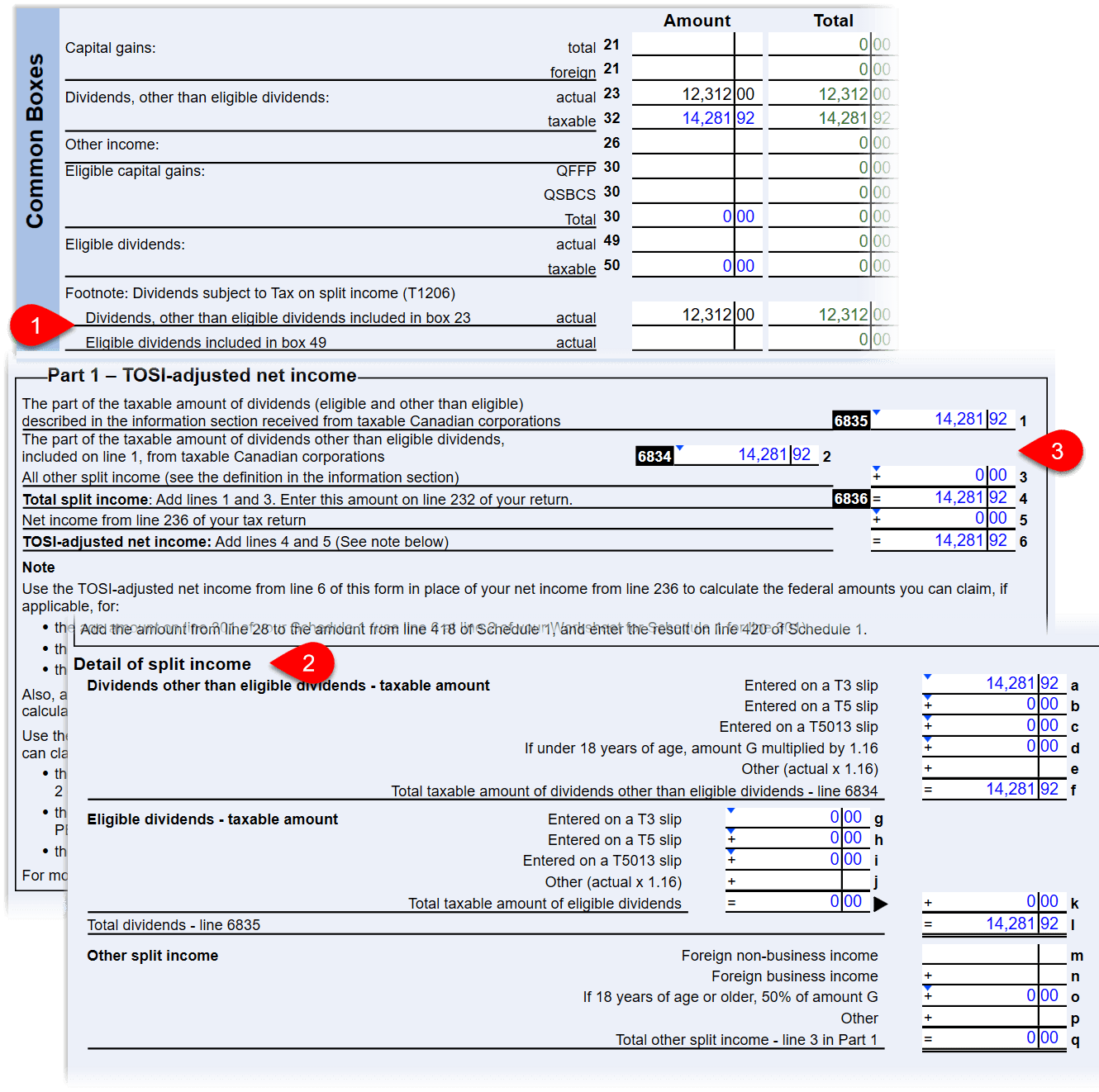

The T1206 form includes several pages of detailed instructions to help you determine whether TOSI applies to your clients. To better understand how the TOSI calculations affect your client(s), please review the instructions pages on the T1206 which include extensive definitions of “split income” and several of the terms used in its definition.

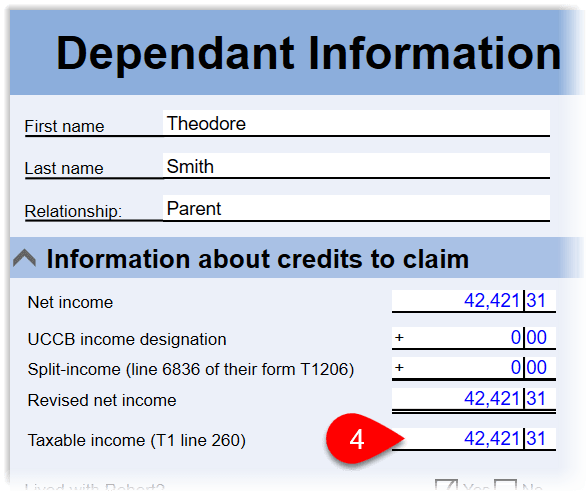

The following sections help you understand how split income affects the calculation of various amounts and credits: