Updated: 2024-01-05

ESign field codes appear in email cover letter templates used to request electronic signatures from your clients.

For example, in the T1 ClientCopyEmail, it is used to show one segment of text when requesting an electronic signature and another when requiring the client to print and sign the attached forms. This allows preparers to use a secure electronic signature service or send the PDF document as an email attachment. The template handles both scenarios.

This email contains two sections that show or hide if the return was electronically filed:

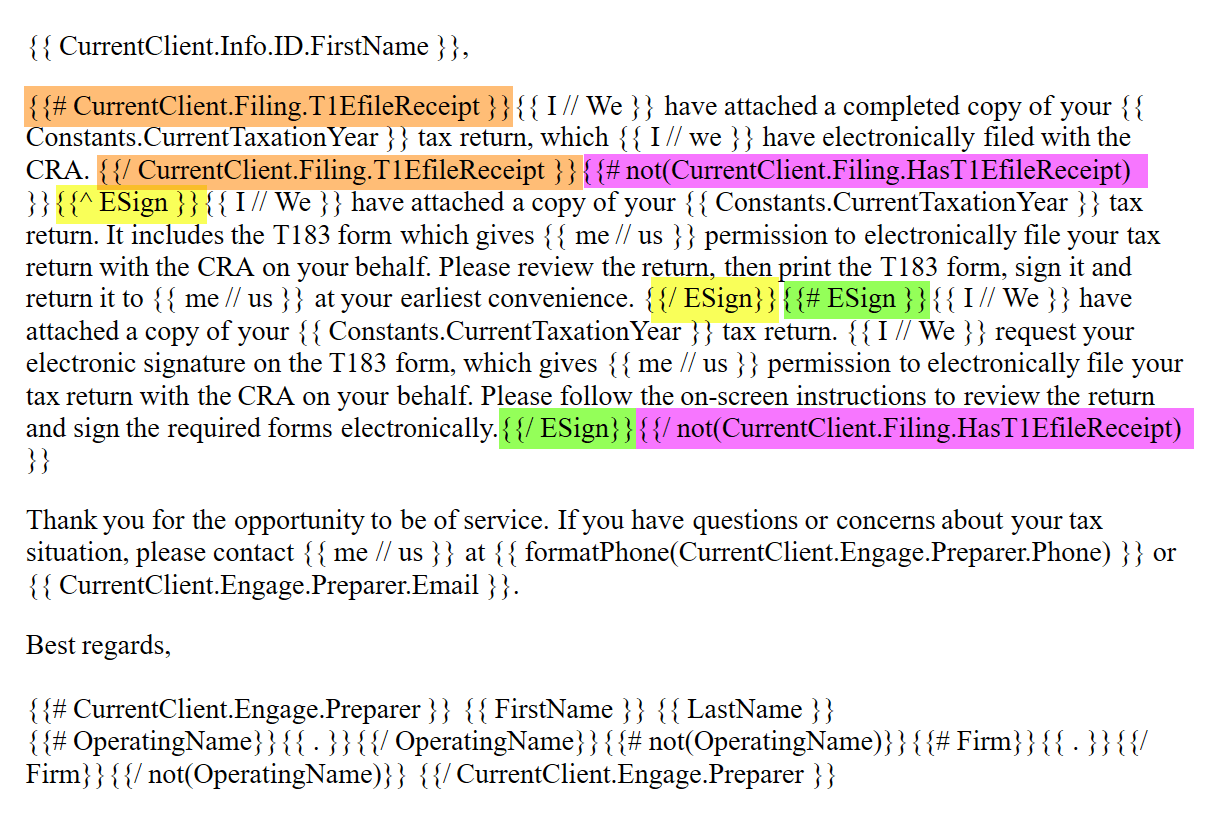

{{# CurrentClient.Filing.T1EfileReceipt }} and {{/ CurrentClient.Filing.T1EfileReceipt }} will show if the return HAS been transmitted. These tags appear in orange in the screen capture above.{{# not(CurrentClient.Filing.T1EfileReceipt) }} and{{/ not(CurrentClient.Filing.T1EfileReceipt) }} will show if the return HAS NOT been transmitted. These tags appear in purple in the screen capture above. The segment that displays if the return has not been filed contains ESign tags to control whether text requesting an electronic signature shows for the client:

{{^ ESign}} and {{/ ESign}} shows when you are sending a PDF by email and requesting the client print and sign the form. The ^ checks that an electronic signature is NOT requested in printer/output options. The / closes the condition. These tags appear in yellow in the screen capture above.{{# ESign}} and {{/ ESign}} shows when you are requesting an electronic signature. The # checks that an electronic signature is requested in printer/output options. The / closes the condition. These tags appear in green in the screen capture above.