Updated: 2024-03-12

TaxCycle T1, T2 and T5013 are certified by the CRA for electronic filing of the T1134 Information Return Relating to Controlled and Not-Controlled Foreign Affiliates. Here’s what you need to know to get set up and transmitting T1134 forms.

To electronically file the T1134 with the CRA, you must have an EFILE number and password.

If you are transmitting the T1134 in TaxCycle T2, you can also use a Web Access Code (WAC) issued by the CRA. To learn how to request a WAC in TaxCycle T2, read the Request a T2 WAC help topic.

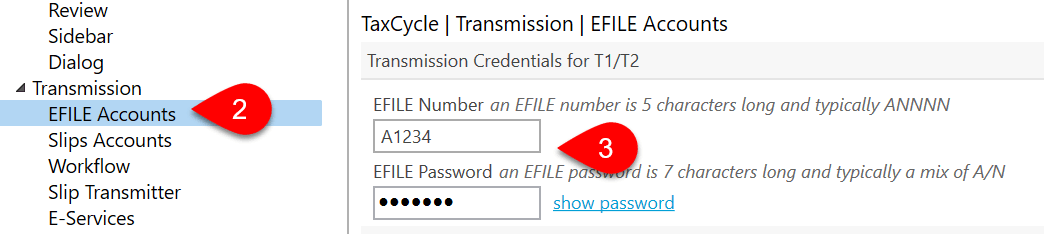

EFILE Number and Password

To file electronically with the CRA, you must have an EFILE number and password:

- To register for EFILE and receive these credentials, go to the CRA’s EFILE for electronic filers page.

- If you already have an EFILE number, you must complete a yearly renewal to receive a new password for the latest T1 tax season. Always use the latest password given to you.

The registration or renewal process includes a suitability screening. This process may take up to 30 days. To allow enough time for the review of your application before the filing season starts, we encourage you to renew your application as soon as possible.

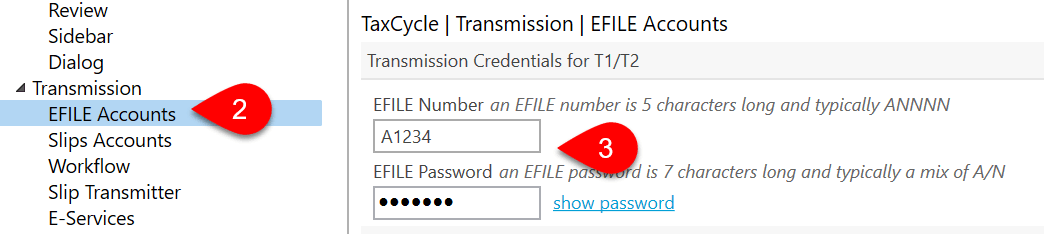

Enter the CRA EFILE number and password in TaxCycle options:

- If you have a file open, go to the File menu, then click Options. To open Options from the Start screen, click Options in the blue bar on the left side. (You can also access these EFILE options any time by clicking on the wrench icon in the Transmit sidebar.)

- On the left side of the screen, expand Transmission, then click on EFILE Accounts.

- Enter your CRA EFILE Number and EFILE Password.

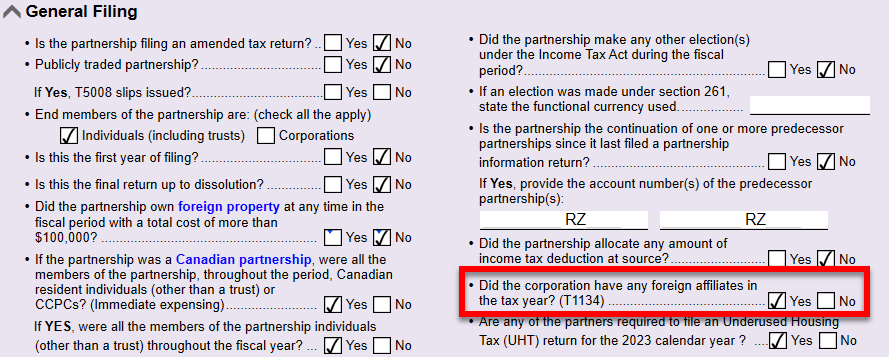

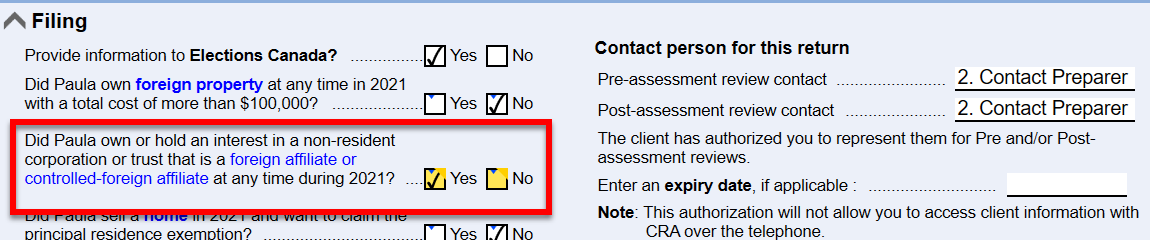

Answer the T1134 Question

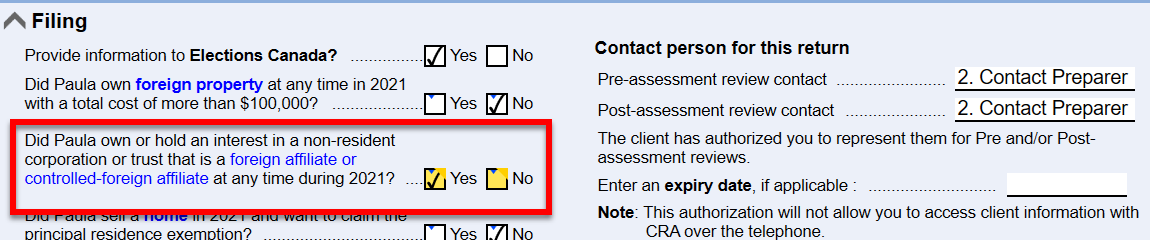

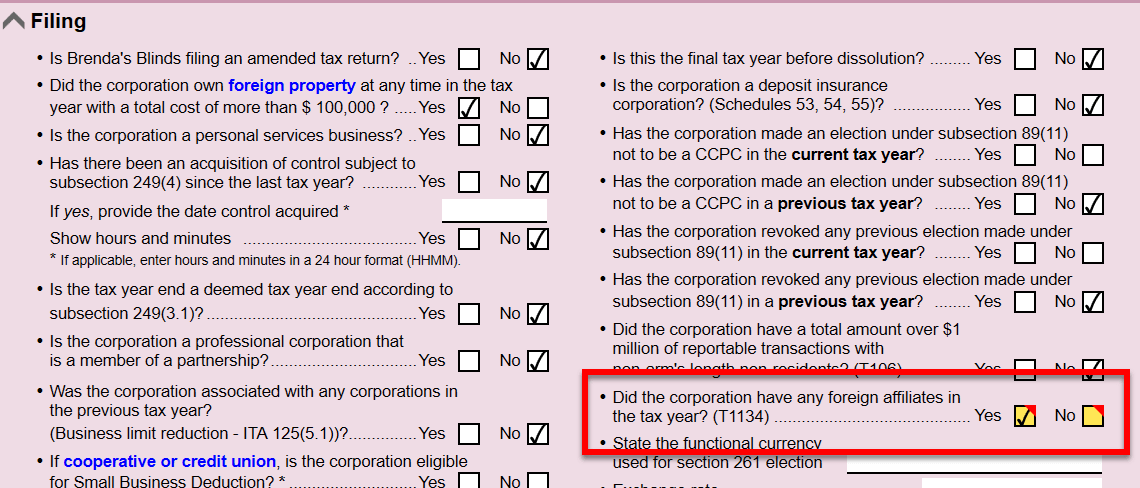

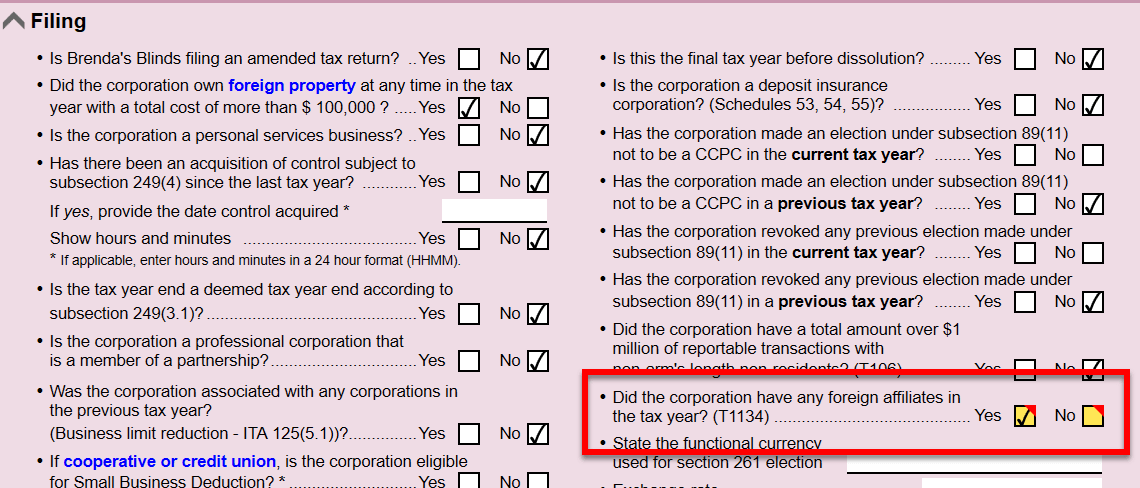

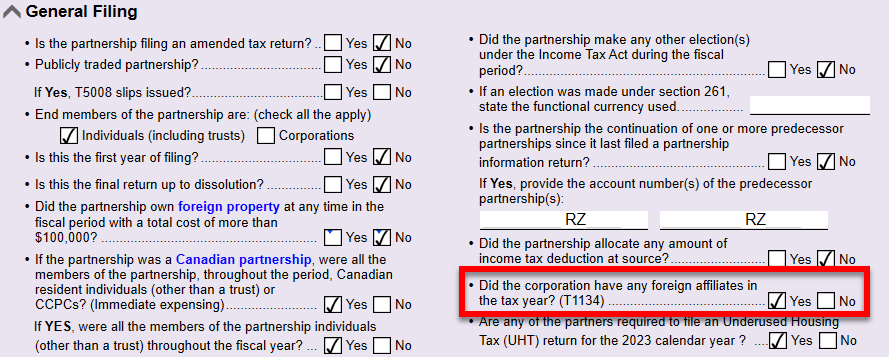

Review messages and transmission functions for the T1134 form only appear once you answer Yes to a question in the Filing section on the Info worksheet.

In TaxCycle T1:

In TaxCycle T2:

In TaxCycle T5013:

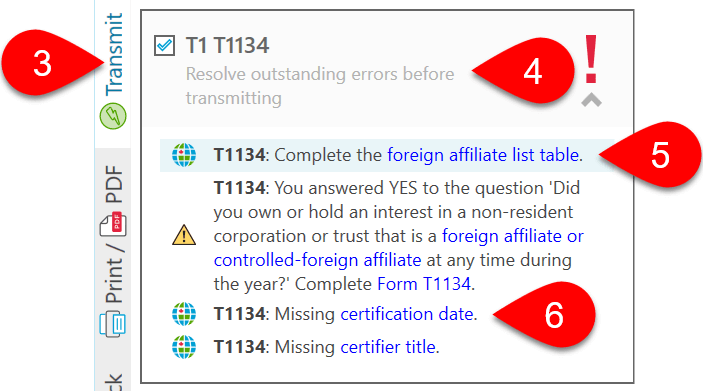

Step 1: Complete the T1134 and T1134Sup

Once you answer the question on the Info worksheet, a T1 T1134, T2 T1134 or T5013 T1134 box appears in the Transmit sidebar. It shows any outstanding errors preventing filing of the T1134.

- Complete the T1134.

- Complete one T1134Sup for each foreign affiliate or controlled foreign affiliate.

- Click Transmit in the sidebar or press F12.

- Click once on the T1 T1134, T2 T1134 or T5013 T1134 box to expand it and see a list of all outstanding errors preventing filing of the T1134.

- Double click a message or click a blue link to jump to the applicable field.

- A review message will prompt you to enter a certification date on the T1134. The T1134 uses the same date set for the T2 return. This information flows from the Filing section on the Info worksheet.

To file amended, cancelled, or additional slips or summaries, select the correct check box at the top of the forms. For more details, see the section on Filing an Amended T1134 and T1134Sup, below.

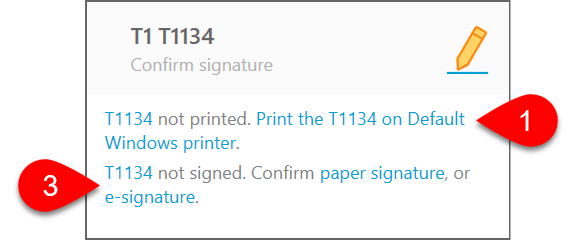

Step 2: Confirm Signature of Form T1134

The CRA requires that the taxpayer sign a paper copy of the T1134 before the tax preparer can electronically file it on his/her behalf. It is also important that you keep this signed form in your files should the CRA ask for it. They regularly check with tax preparers.

By default, TaxCycle requires you to confirm the taxpayer has signed the form before you can transmit. You can do this from the Transmit sidebar:

- Click Print the T1134 link to print the form or to send it for electronic signature. TaxCycle records the date and the name of the person who printed the form.

- If you send the form for electronic signature through TaxFolder or DocuSign®, TaxCycle automatically records the signing date and time when the document was signed.

- If you collect a signature by any other method (such as collecting a scanned copy or using Adobe® Reader), TaxCycle does not record the date and time the document was signed. Instead, you must click the paper signature or e-signature link to confirm receipt of the signature.

If required, you can disable the signature confirmation step (not recommended). See the “Disable signature confirmation” section in the Transmission Options help topic.

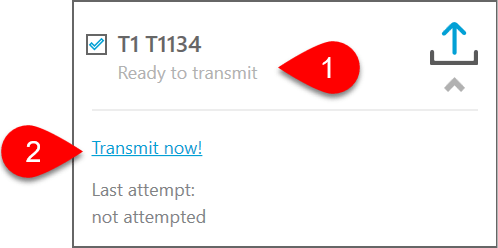

Step 3: Transmit the T1134

- Once you confirm the signature, the return is Ready to transmit.

- Click the Transmit Now! link to begin the transmission.

You can also transmit other returns and requests (like T2 CIF or T1 EFILE) at the same time by using Transmit multiple. Learn how in the Transmit Multiple help topic.

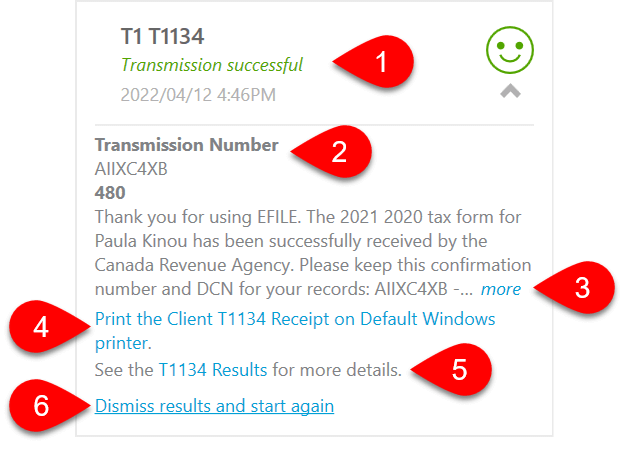

Transmission Results

- When a transmission succeeds, you will see the words Transmission successful in green text and a green happy face. This symbol also appears in the Client Manager for T1134s that are successfully filed, and in the blue bar at the bottom of the window of any open tax return.

- The box also shows the Transmission Number for future reference.

- Any messages returned from the CRA appear in this box. Click the more link to see the full message.

- Click the Print the Client T1134 Receipt link to give a copy of this information to your client.

- Click the T1134 Results link to view the worksheet that contains a full list of the results from all transmission attempts.

- If you need to retransmit the return, click Dismiss results and start again.

Rejected or Failed Transmission

If the CRA rejects a transmission due to errors, you will see the words Transmission rejected and a red sad face.

Any error messages received from the CRA also appear in this box, starting with the error number. This number may be useful if you need to contact the CRA regarding an error. The longer error description usually contains information outlining what went wrong with the transmission, so you can work to correct it.

If a transmission fails due to an issue with your Internet connection, you will see the words Transmission failed and two computers with red dots between them. This means that TaxCycle could not connect with the CRA system, and did not attempt to file the return. Click the Diagnose Internet connectivity link to see whether your Internet connection is working.

When you resolve the issue, click Dismiss results and start again to retransmit. This rechecks the return for outstanding errors before returning to the transmission step.

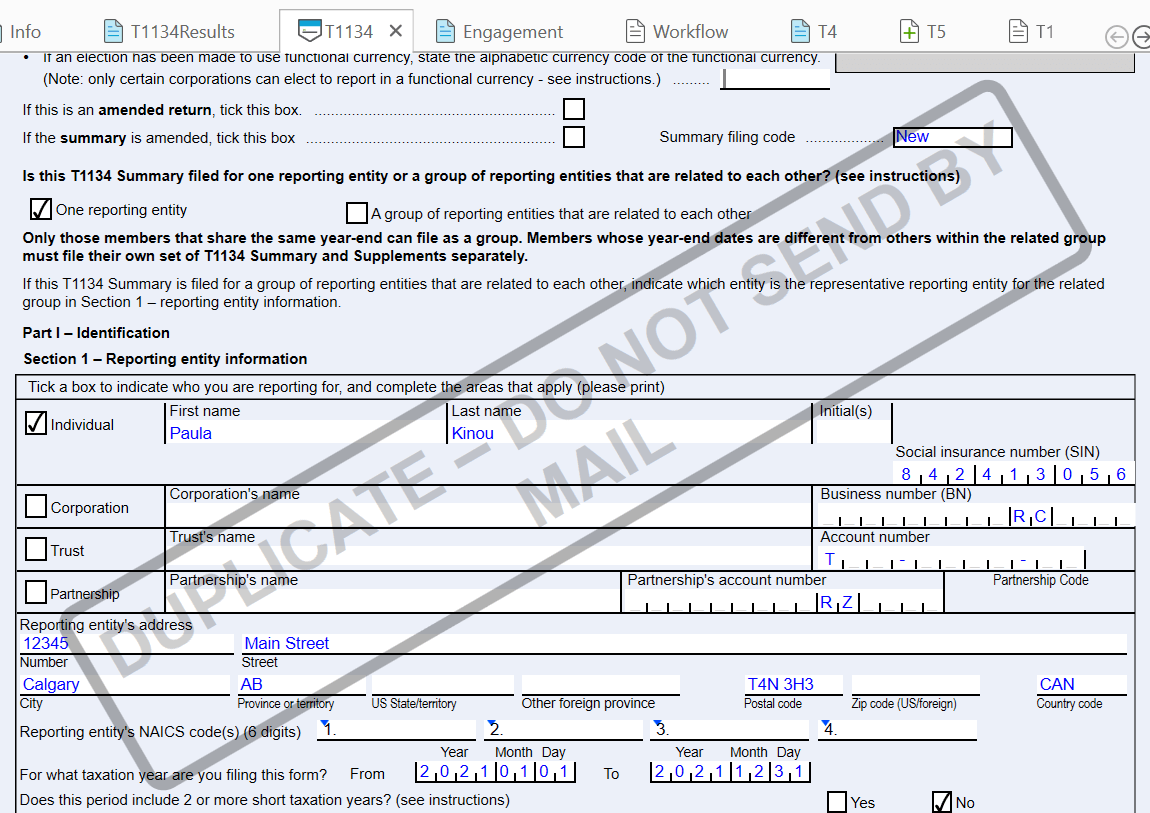

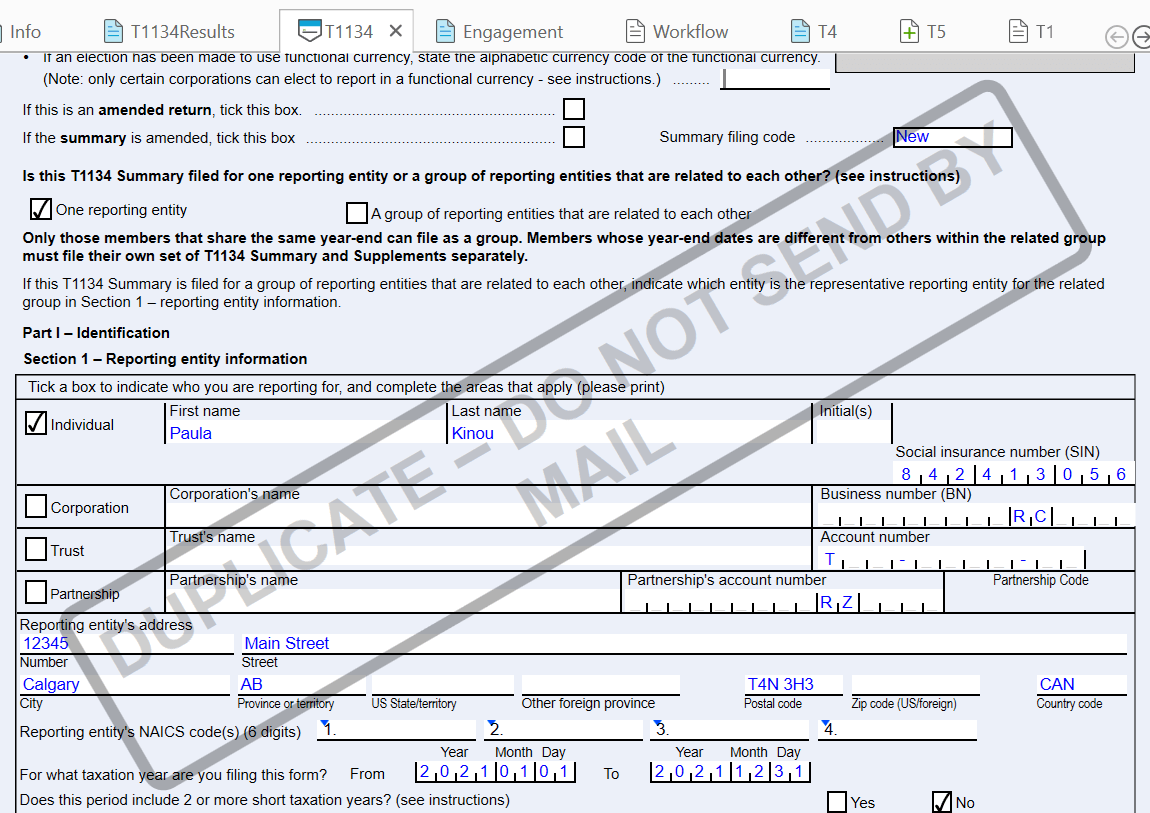

Watermark: DUPLICATE—DO NOT SEND BY MAIL

After a successful transmission, the T1134 form includes a watermark—on screen and when printed—to remind you and your client that the statement was already submitted to the CRA and that they should not send the form by mail.

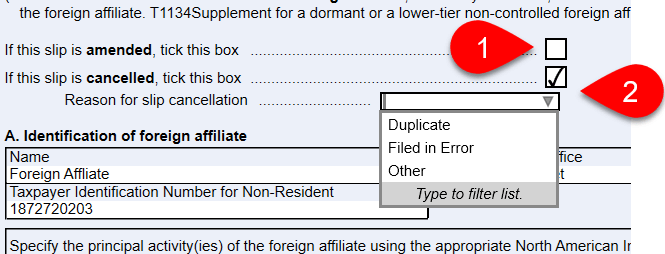

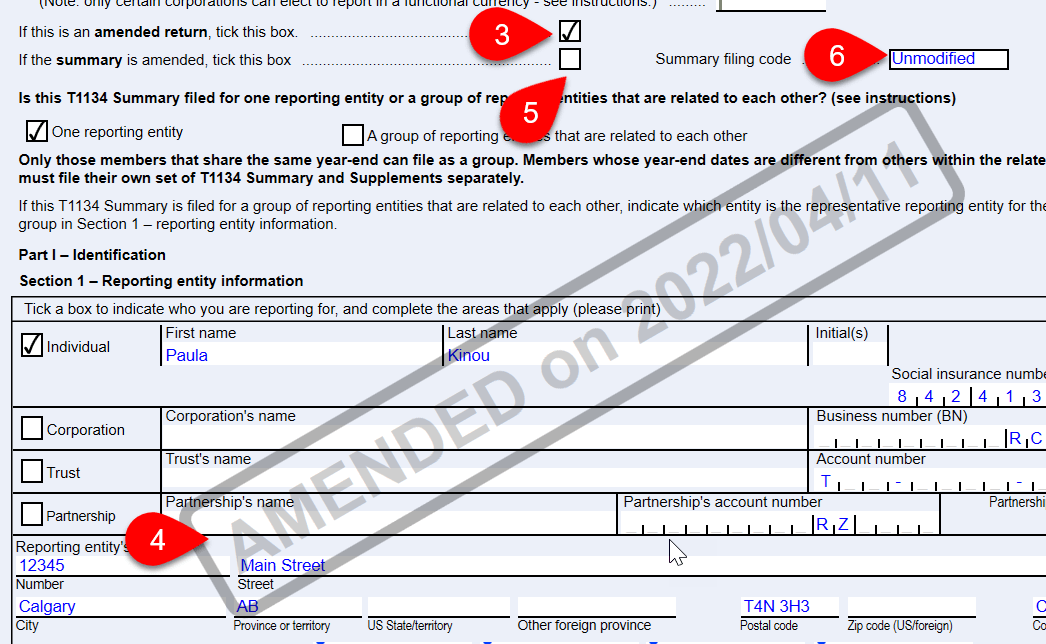

Filing an Amended T1134 and T1134Sup

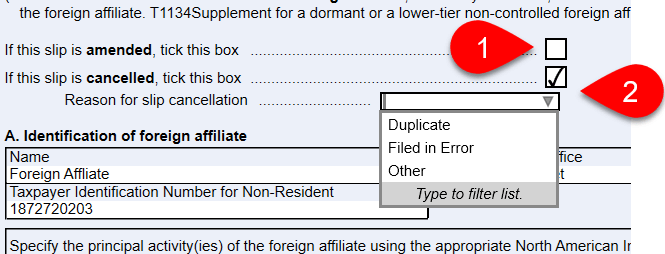

- To file an amended T1134Sup, check the appropriate box at the top of the affected T1134Sup.

- To cancel a T1134Sup, check the appropriate box at the top of the affected T1134Sup and select a reason for its cancellation.

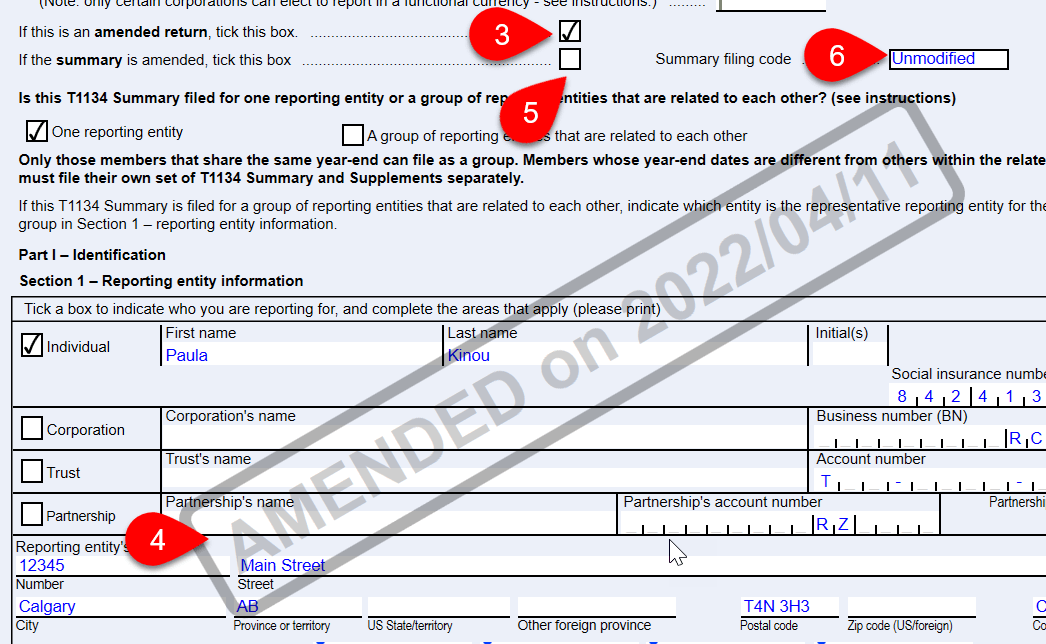

- Check the first box at the top of the T1134 summary to indicate you are filing an amended T1134Sup.

- This marks the form as amended and puts a watermark on the form.

- If the T1134 summary is amended in addition to the slips, check the second box.

- The field with the summary filing code will automatically change based on this selection.

- In the Transmit sidebar, click the link to Dismiss results and start again, then follow the same steps as above to the file return.

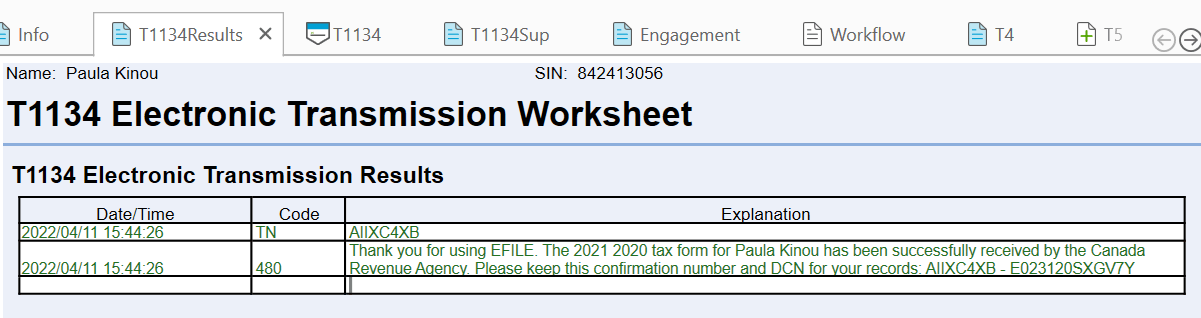

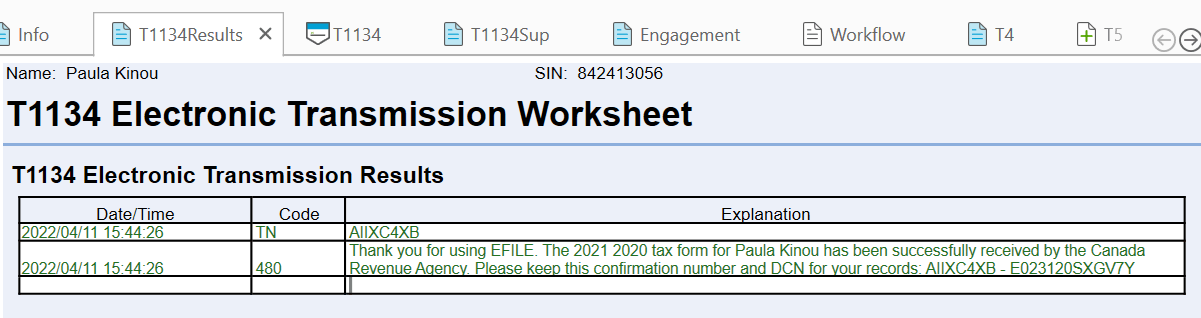

T1134 Results Worksheet

The T1134 Results worksheet lists the results of transmission attempts.

Regardless of a successful or failed transmission, TaxCycle records the time and the result of the transmission, so you always have a complete record of transmission attempts and returned messages, even if you have to retransmit the return.

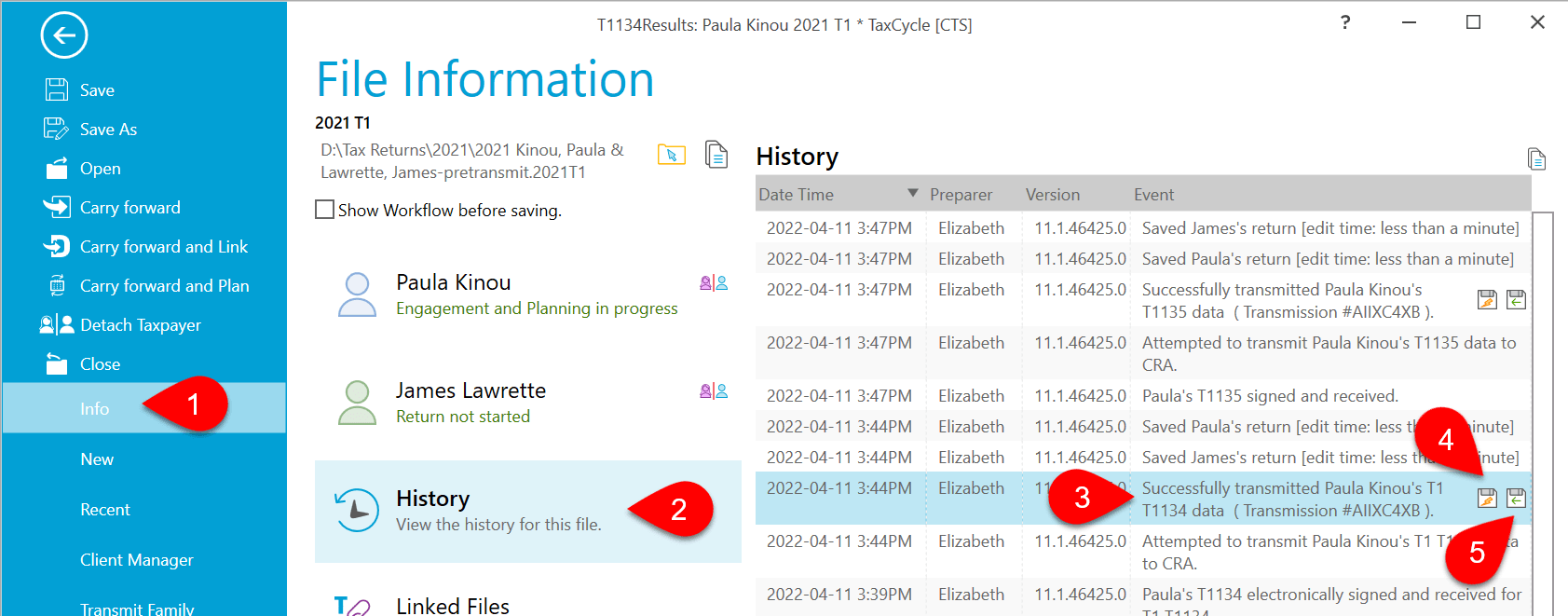

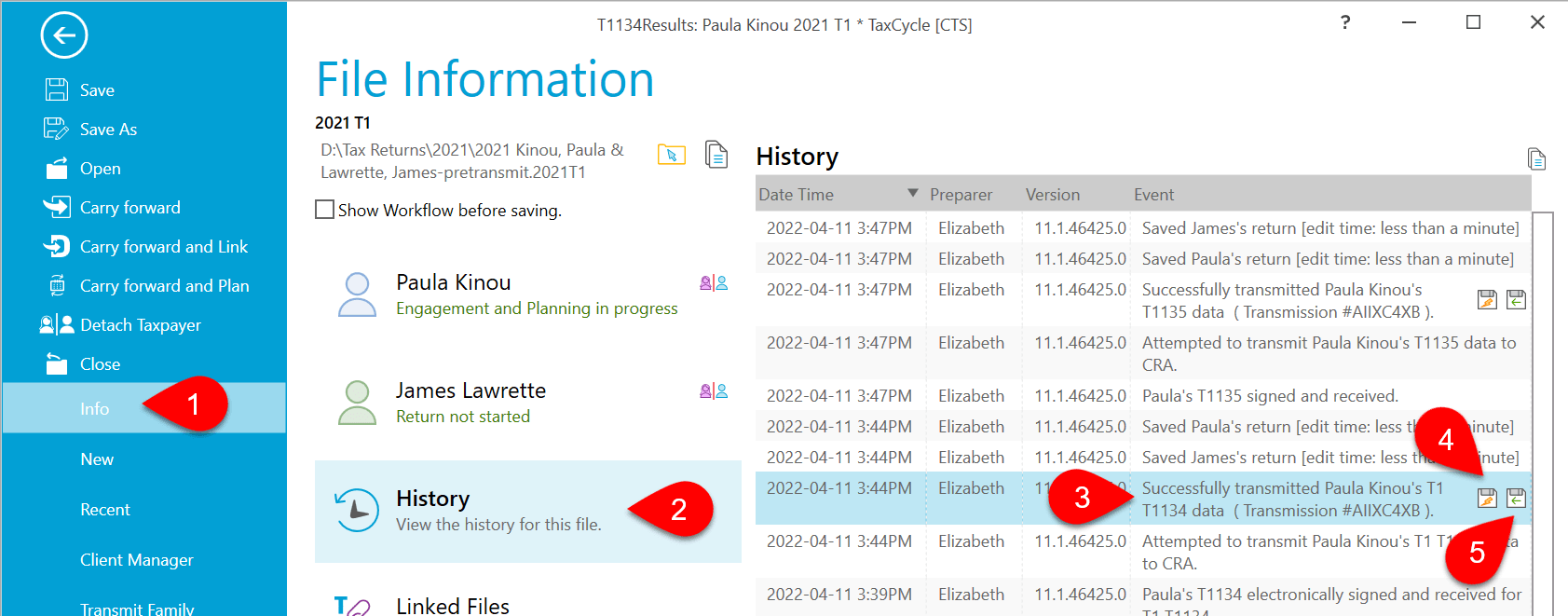

Transmission History

TaxCycle saves each transmission attempt in the file history:

- Go to the File menu, then click on Info.

- Click on History.

- Find the record of the transmission in the list.

- Click the first save button (the one with the lightning bolt) to save a copy of the XML file that was transmitted to the CRA.

- Click the second save button (the one with the green arrow) to save a copy of the response sent back from the CRA.

- TaxCycle also updates the workflow information for the taxpayer. (See the Workflow Groups and Tasks help topic.)