Updated: 2023-04-20

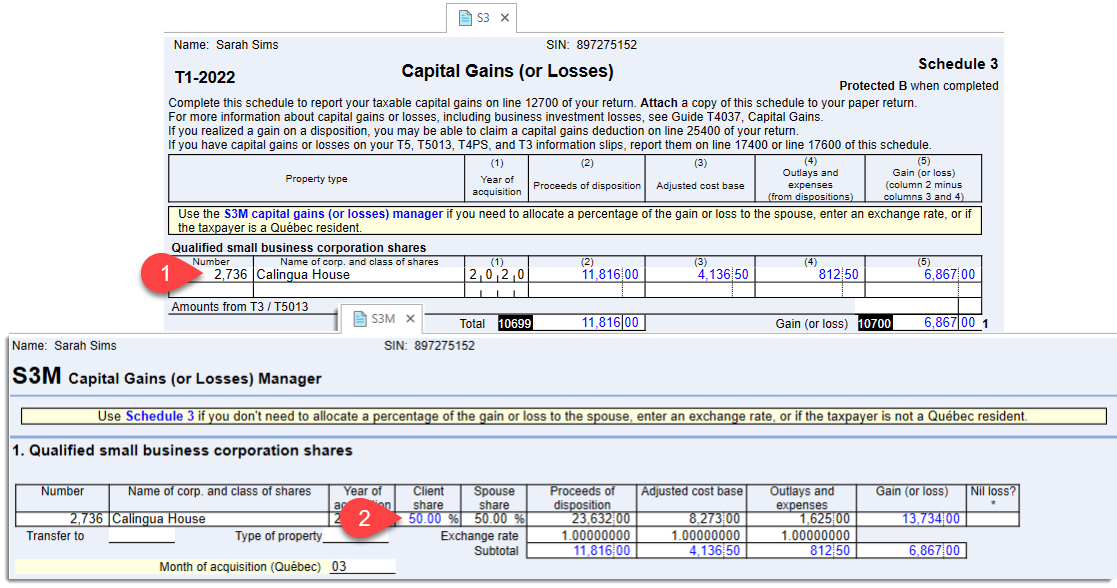

To facilitate data entry and management for certain schedules and tax situations, Schedule 3 (S3) has a flexible companion worksheet called the Schedule 3 Manager (S3M).

You can enter or modify data on either the S3 form or the S3M worksheet and it instantly flows back and forth. Use whichever method is right for you.

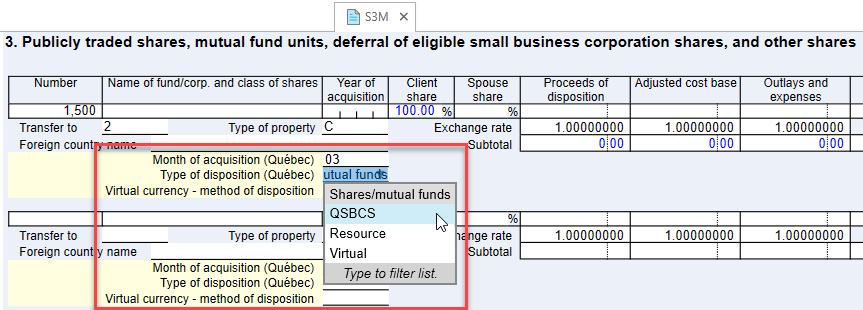

If you are preparing a Québec TP1 return where you need to report capital transactions, you need to make additional entries on the S3M. The Month of acquisition as well as the Type of disposition are required before the information flows through to the TPG and TPGSum:

Information flows from the S3 and S3M to the TPGSum and the TPG (Québec Schedule G). However, if there is only one transaction for a particular section on the TPG, the information does not appear on the TPGSum at all. TPGSum is only required when there are multiple transactions for a section to consolidate the totals of the transaction into the required single line on the TPG.

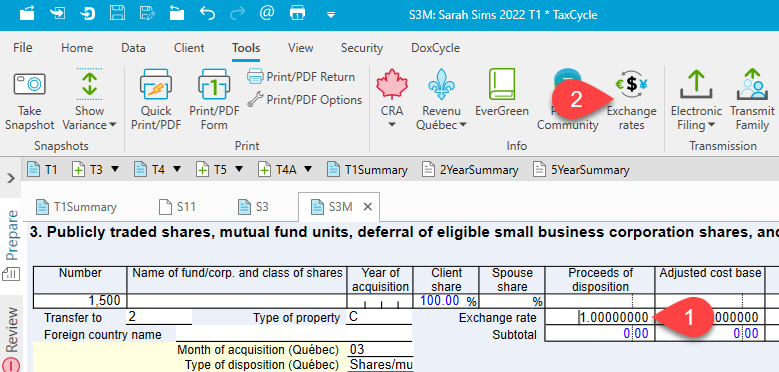

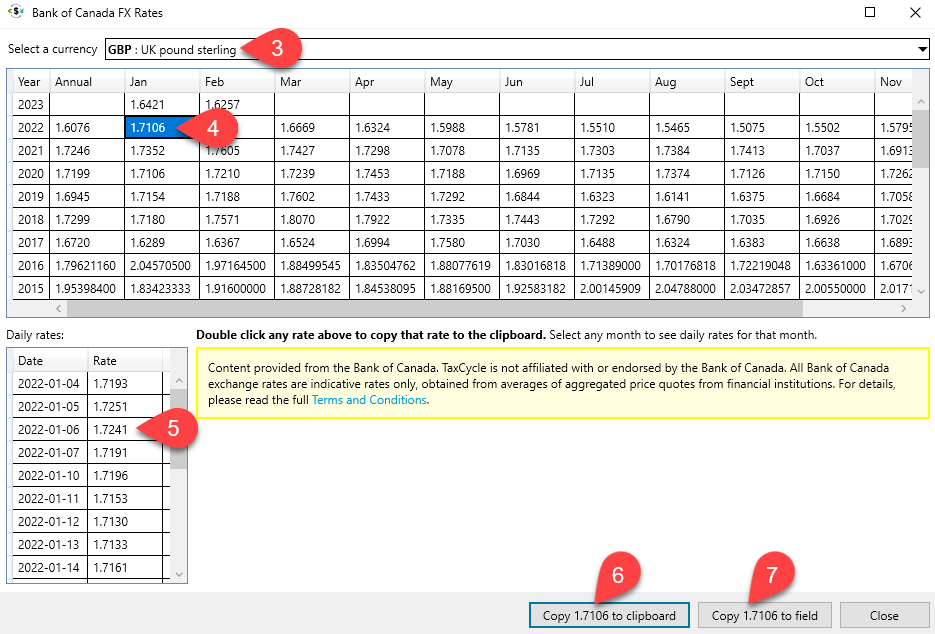

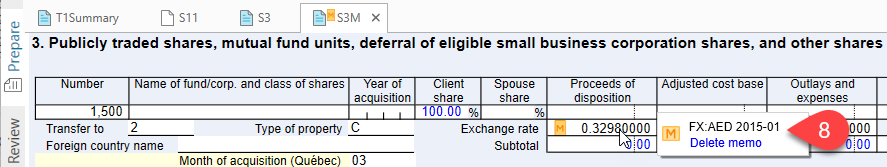

Easily select a foreign exchange rate for forms and worksheets like the S3M.