Updated: 2023-01-13

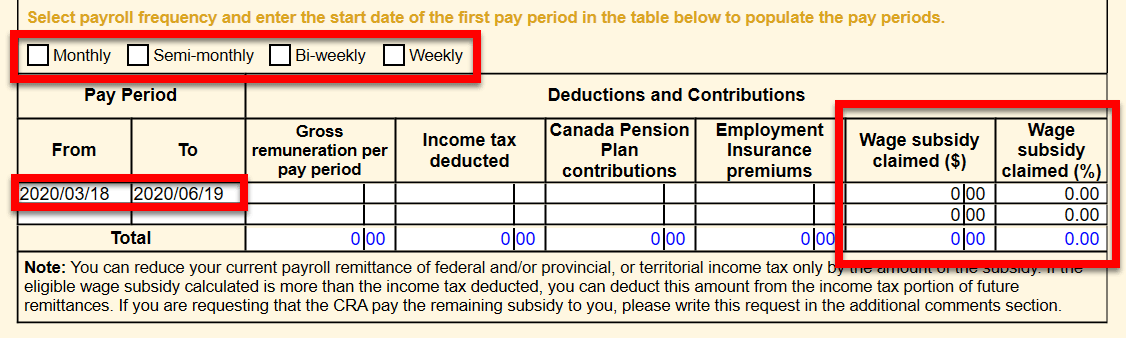

Every eligible employer who claimed or intends to claim the Temporary Wage Subsidy (TWS) and/or the Canada Emergency Wage Subsidy (CEWS) must complete and file a PD27 10% Temporary Wage Subsidy Self-identification Form for Employers.

Please review the following information carefully to help you correctly complete this form:

Refer to the CRA’s 10% Temporary Wage Subsidy for Employers page for full details, along with definitions of eligible income and examples.

Yes. If an employer claimed the 10% Temporary Wage Subsidy (TWS) in 2020 and reduced their remittance amounts as per the program guidelines, the T4 Summary will show a balance owing in the amount of the subsidy. This is how the Canada Revenue Agency (CRA) expects you to report this amount for 2020 T4 slips. You must also complete and file a PD27. The CRA will use the PD27 information to reconcile the payroll account.