Updated: 2023-05-02

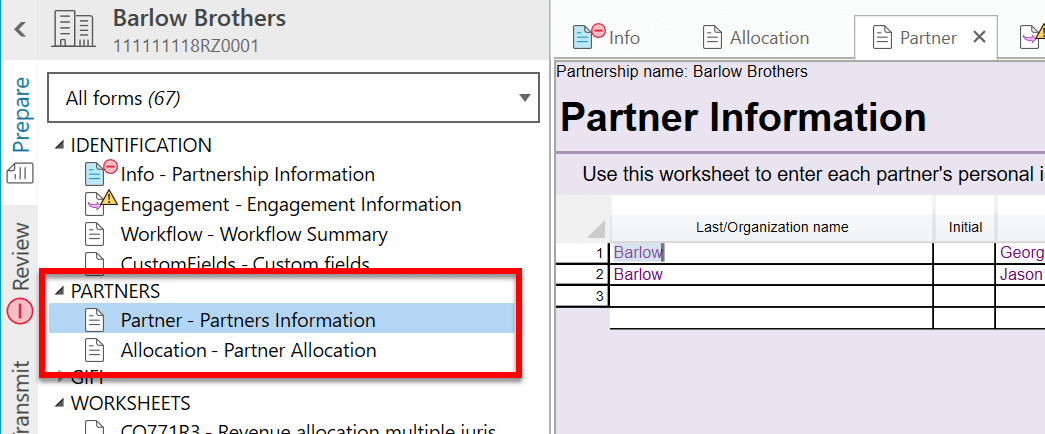

Enter the personal information for each partner on the Partner worksheet:

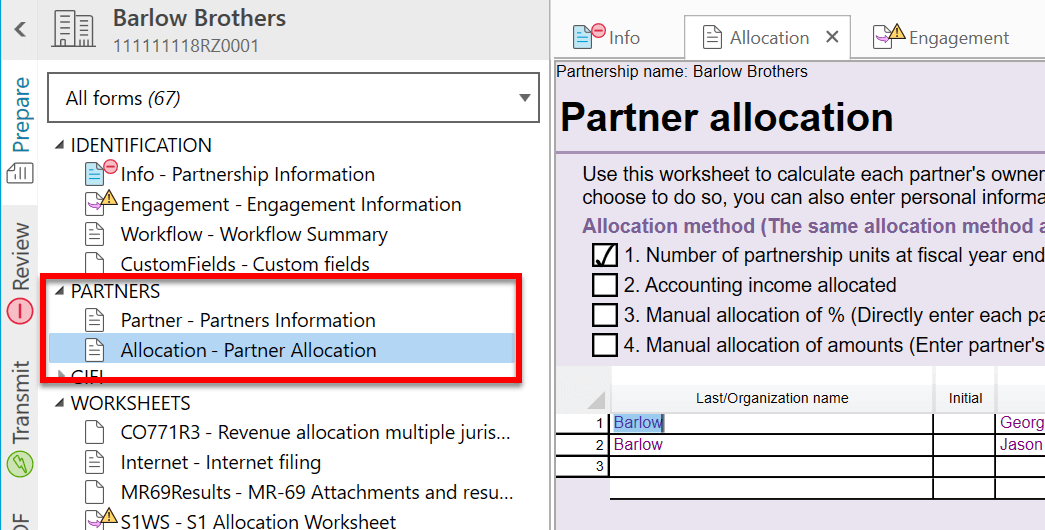

Select an allocation method on the Allocation worksheet. The method you select here will apply to both T5013 and RL-15 slips.

Depending on the allocation method you choose, complete the related column(s) or worksheet(s):

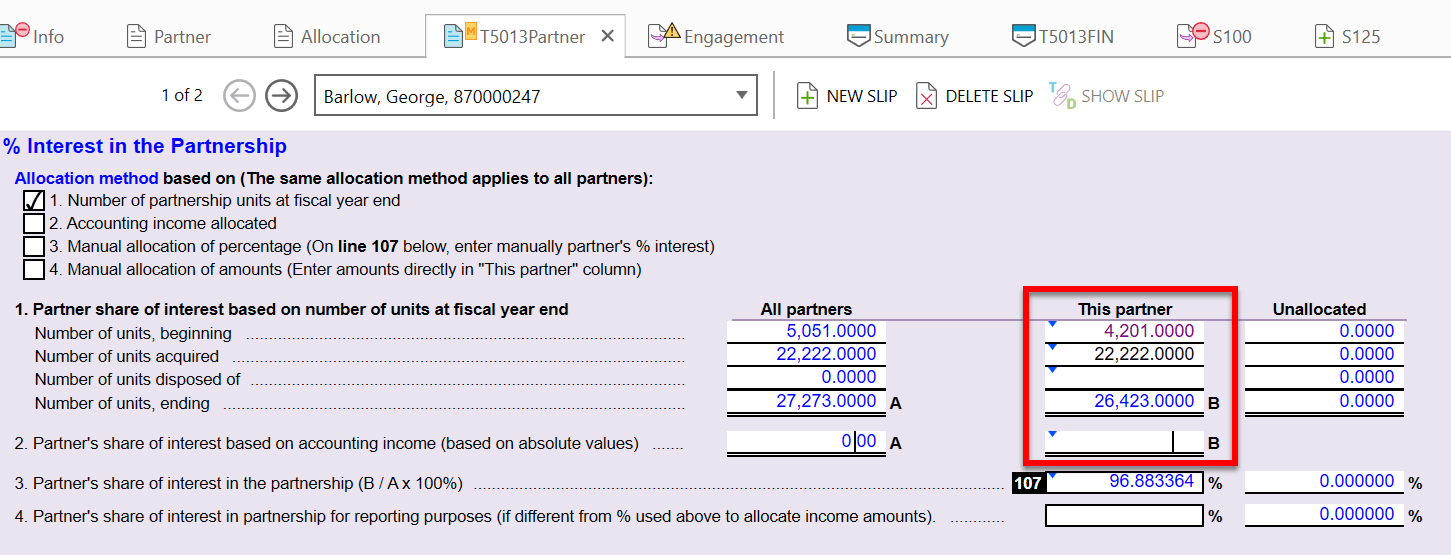

You can also complete or modify these fields on each partner's T5013Partner worksheet. Amounts automatically flow between the T5013Partner data entry slip and the Allocation worksheets.