Updated: 2025-07-02

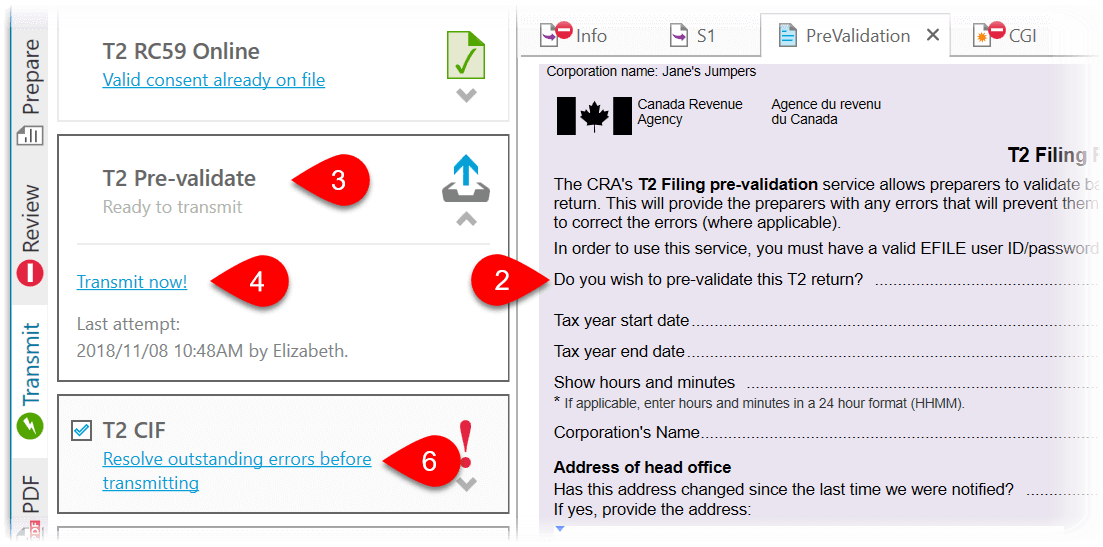

The Canada Revenue Agency’s (CRA) T2 Pre-Validation service allows you to validate basic filing information ahead of transmitting the completed return.

The service returns any errors that will prevent filing the T2 return once complete. It also provides some basic instructions on how to correct the errors. For example, if a corporation’s name is incorrect, this service will indicate that the name does not match the CRA’s records. You may use this service more than once for a particular T2 file.

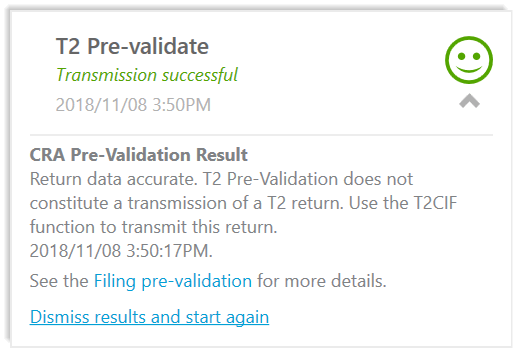

Transmission using the T2 Pre-Validation service does not constitute filing a T2 return. After using this service, you must still file the return through T2 Corporation Internet Filing (CIF).

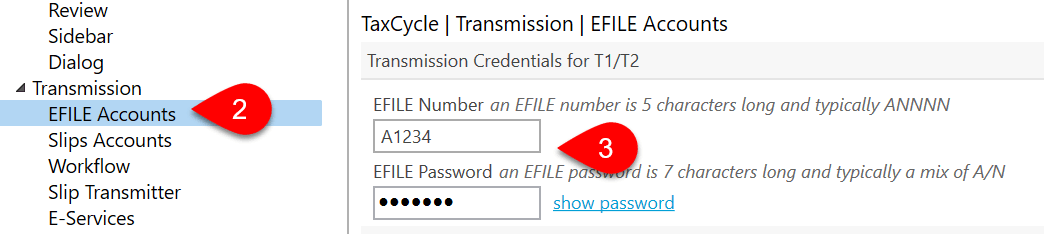

You can pre-validate a T2 tax return using your EFILE number and password, or using the corporation’s Web Access Code (WAC).

If you recently renewed your EFILE number, you will immediately receive a new EFILE password for the year. However, the suitability screening may not complete immediately. Until it has, you cannot file T2 returns using your EFILE number and password. You can, however, use a Web Access Code (WAC) to file the T2 return. See the Request a T2 WAC help topic to learn more.

Enter the CRA EFILE number and password in TaxCycle options:

If the pre-validation service returns no errors, you will see a green happy face and a message reminding you to use T2 Corporation Internet Filing (T2CIF) function to transmit the return:

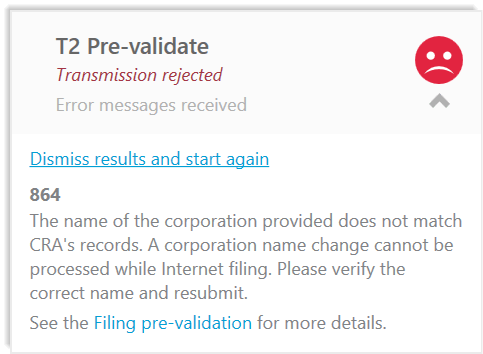

If the pre-validation service returns errors, you will see a red sad face and a message explaining the error.

The service returns any errors that will prevent filing the T2 return once complete. It also provides some basic instructions on how to correct the errors. For example, if a corporation’s name is incorrect, this service will indicate that the name does not match the CRA’s records.

After correcting the issue in the file, you can run the pre-validation service again.