RESOLVED: Immediate Expensing of CCA No Longer Prorates (T2 Schedule 8)

For short taxation years, the Income Tax Regulations 1100(3) required that immediate expensing be prorated by the proportion of the number of days in the short taxation year over 365 days.

However, as per the Canada Gazette Vol. 158, No. 25 issued on December 4, 2024, this proration rule no longer applies to the calculation of immediate expensing of Capital Cost Allowance (CCA).

This amendment applies retroactively to taxation years that end on or after April 19, 2021.

Workaround

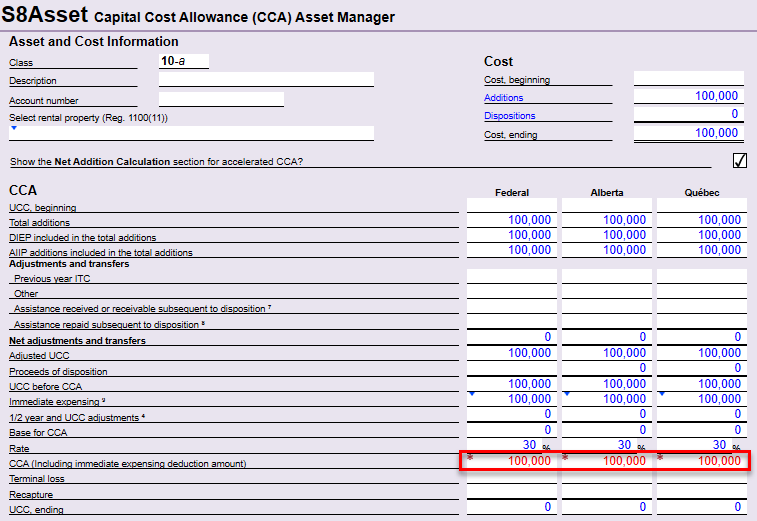

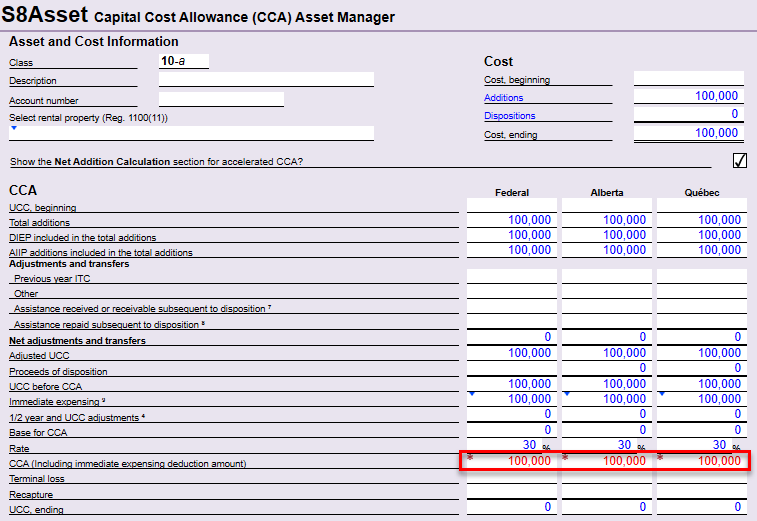

If a Canadian-controlled private corporation (CCPC) has a short taxation year, manually calculate the amount of immediate expensing without a short taxation year proration and override the CCA amount in the S8Asset.

For example, a CCPC with a short taxation year (January 1, 2023-June 30, 2023) has a class 8 addition of $100,000. Under the old rule, the amount of immediate expensing is $49,589 ($100,000 × 181 days / 365 days). With the revised rule, the immediate expensing amount is the full $100,000.

Resolution

We resolved this issue in the latest TaxCycle update.