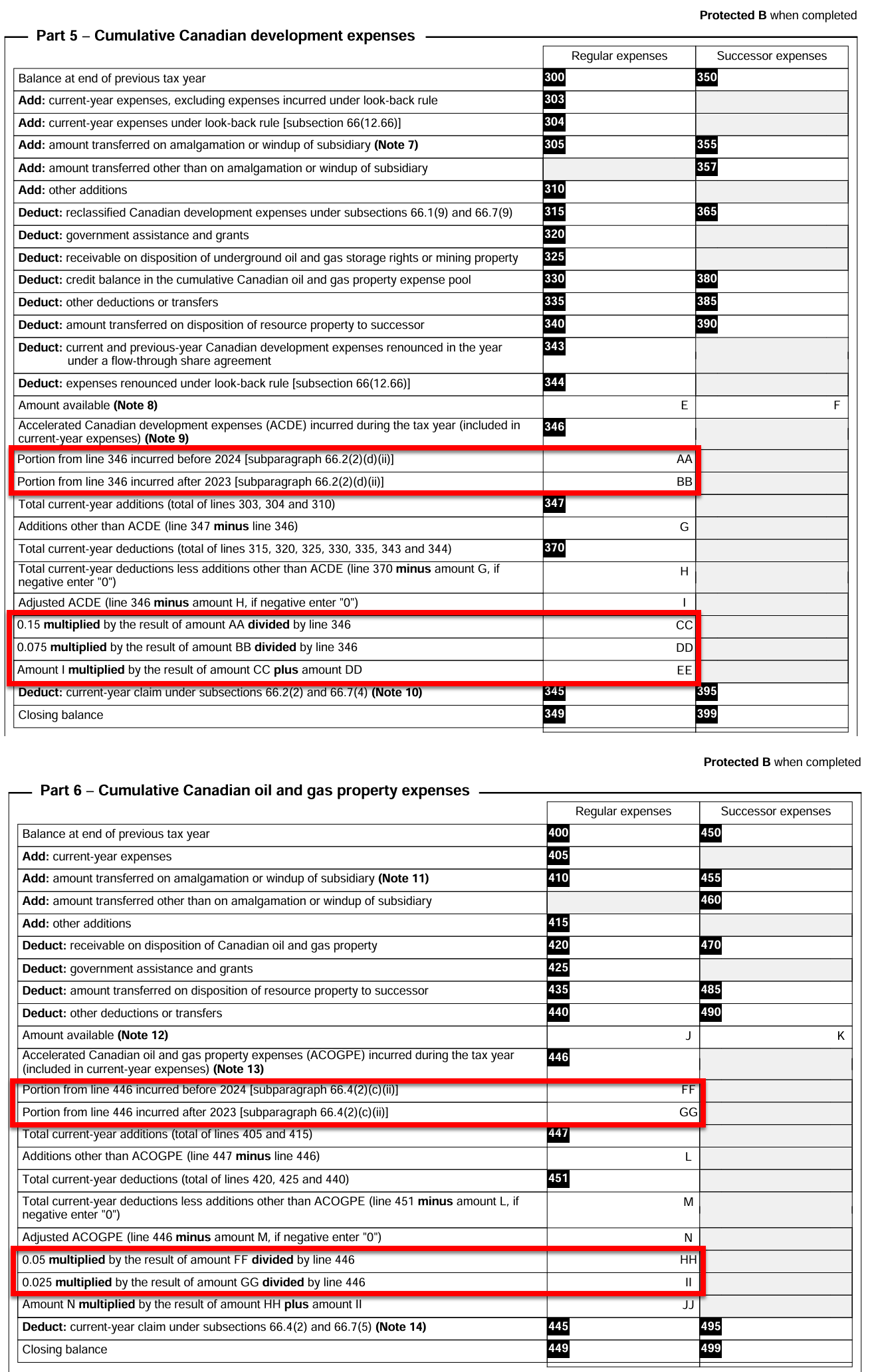

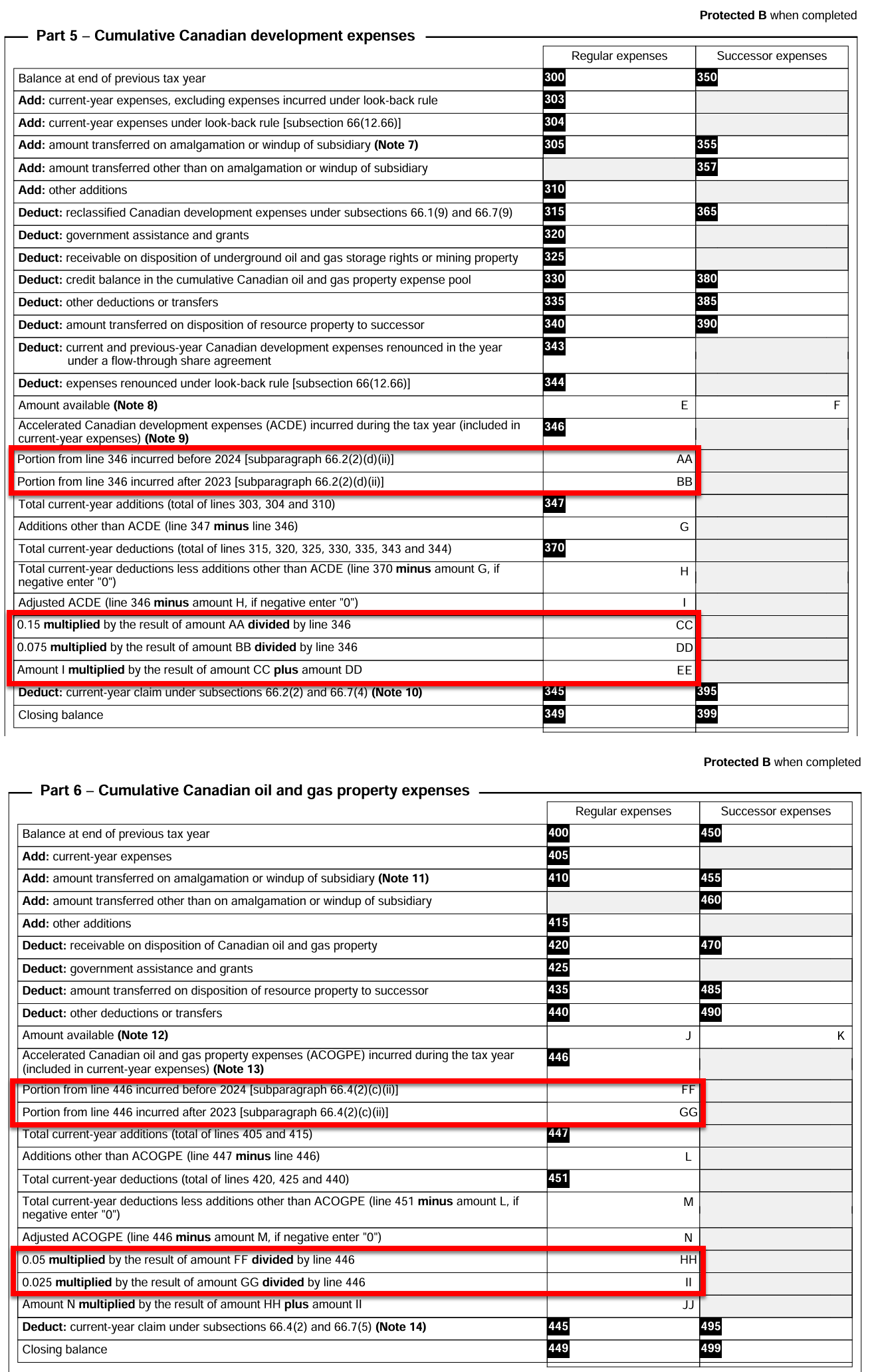

RESOLVED: Incorrect ACDE and ACOGPE Rates on AT1 Schedule 15

We are aware of an issue where TaxCycle T2 is applying the incorrect rates for the Accelerated Canadian development expense (ACDE) and the Accelerated Canadian oil and gas property expense (ACOGPE) on the AT1 Schedule 15.

For expenditures incurred after 2023, a rate of 7.5% should be used to calculate the additional deduction related to ACDE. Similarly, for expenditures incurred after 2023, a rate of 2.5% should be used for ACOGPE.

However, TaxCycle is incorrectly applying the pre-2024 rates of 15% for ACDE and 5% for ACOGPE. This affects the calculation of the additional deductions that flow to lines 115 and 169 of the AT1 Schedule 15.

Workaround

Refer to Part 5 and Part 6 of the T2 Schedule 12 to calculate the correct additional deduction.

Use the amounts from lines AA, BB, CC, DD and EE from Part 5 and lines FF, GG, HH and II from Part 6 to override lines 115 and 169 of the AT1 Schedule 15.

Resolution

We resolved this issue in the latest TaxCycle update.