| RETURNS |

| Number of returns |

Unlimited |

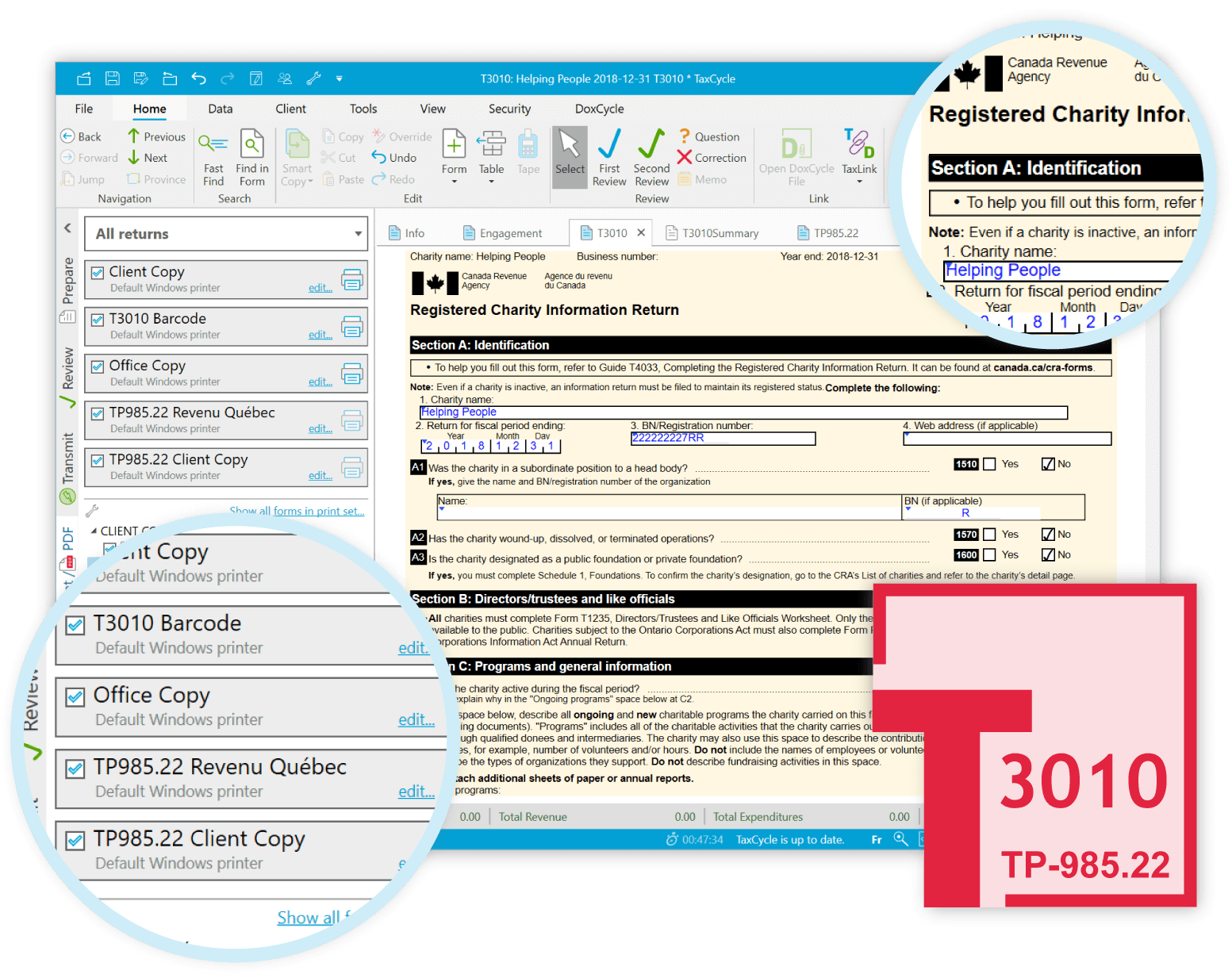

| Federal T3010 |

2013 onward |

| Québec TP-985.22 |

2018 onward |

| CARRYFORWARDS |

| TaxCycle T3010 |

|

| ProFile® FX |

|

| Taxprep® Forms |

|

| Cantax® FormMaster |

|

| ELECTRONIC FILING & SERVICES |

| Québec MR-69 |

|

| FEDERAL JACKET and SCHEDULES |

| T3010 — Registered charity information return (2020 and later years) |

|

| T3010 — Registered charity information return (2019 and earlier years) |

|

| QUÉBEC JACKET and SCHEDULES |

| TP-985.22 — Information Return for Registered Charities and Other Donees |

|

| Schedule A — Disbursement Quota for the Taxation Year |

|

| Schedule B — Disbursement Quota for the Taxation Year |

|

| Schedule C — Summary of Gifts Made to Qualified Donees |

|

| Schedule D — Directors and Other Officers |

|

| MR-69 — Authorization to Communicate Information or Power of Attorney |

|

| MR69Results — MR-69 Attachments and Results |

|

| WORKSHEETS |

| Info — Personal Information |

|

| Engagement — Engagement Information |

|

| Workflow — Workflow Summary |

|

| CustomFields — Custom Fields Worksheet |

|

| T1235 — Directors/Trustees and Like Officials Worksheet |

|

| T1236 — Qualified Donees Worksheet/Amounts Provided to Other Organizations |

|

| T2081 — Excess Corporate Holdings Worksheet for Private Foundations |

|

| FILING and AUTHORIZATION |

| DisbursementQuota — Disbursement Quota Worksheet |

|

| GST66 — Application for GST/HST Public Service Bodies' Rebate and GST Self-Government Refund |

|

| RC7066-SCH — Provincial Schedule - GST/HST Public Service Bodies' Rebate |

|

| T1240 — Registered Charity Adjustment Request |

|

| T2046 — Tax Return Where Registration of a Charity is Revoked |

|

| T2046 Schedule 5 — Tax Return Where Registration of a Charity is Revoked |

|

| T2094 — Registered Charities Application to Reduce Disbursement Quota |

|

| T2095 — Registered Charities: Application for Re-Designation |

|

| T3011 — Application for Designation as Associated Charities |

|

| SUMMARIES |

| T3010Summary — T3010 Summary (for client review) |

|

| 2YearSummary — 2 Year Variance Summary |

|

| 5YearSummary — 5 Year Summary |

|

| Memo summary |

|

| Tapes summary |

|

| CORRESPONDENCE |

| Client Letter |

|

| Client MR-69 Filing Receipt |

|