| RETURNS |

| Number of returns |

Unlimited |

| CARRYFORWARD |

| TaxCycle T4/T4A |

|

| ProFile® FX |

|

| Cantax® FormMaster |

|

| Taxprep® Forms |

|

| ELECTRONIC FILING |

| CRA Internet File Transfer (XML) for T4, T4A, T4 Reduced EI (original, amended or cancelled slips) |

|

| Revenu Québec RL-1 and RL-2 (original, amended or cancelled relevés) |

|

| WORKSHEETS |

| Info — Return Information |

|

| Engagement — Engagement Information |

|

| Workflow — Workflow Summary |

|

| CustomFields — Custom Fields Worksheet |

|

| T4 Adjustment Options |

|

| LE-39.0.2 — Calculation of the Contribution Related to Labour Standards |

|

| RC-18 — Calculating Automobile Benefits |

|

| RL1Appendix — Work Chart: Lines 28, 30 and 50 of the RL-1 Summary |

|

| Internet — Internet Filing Results |

|

| SLIPS and RELEVÉS |

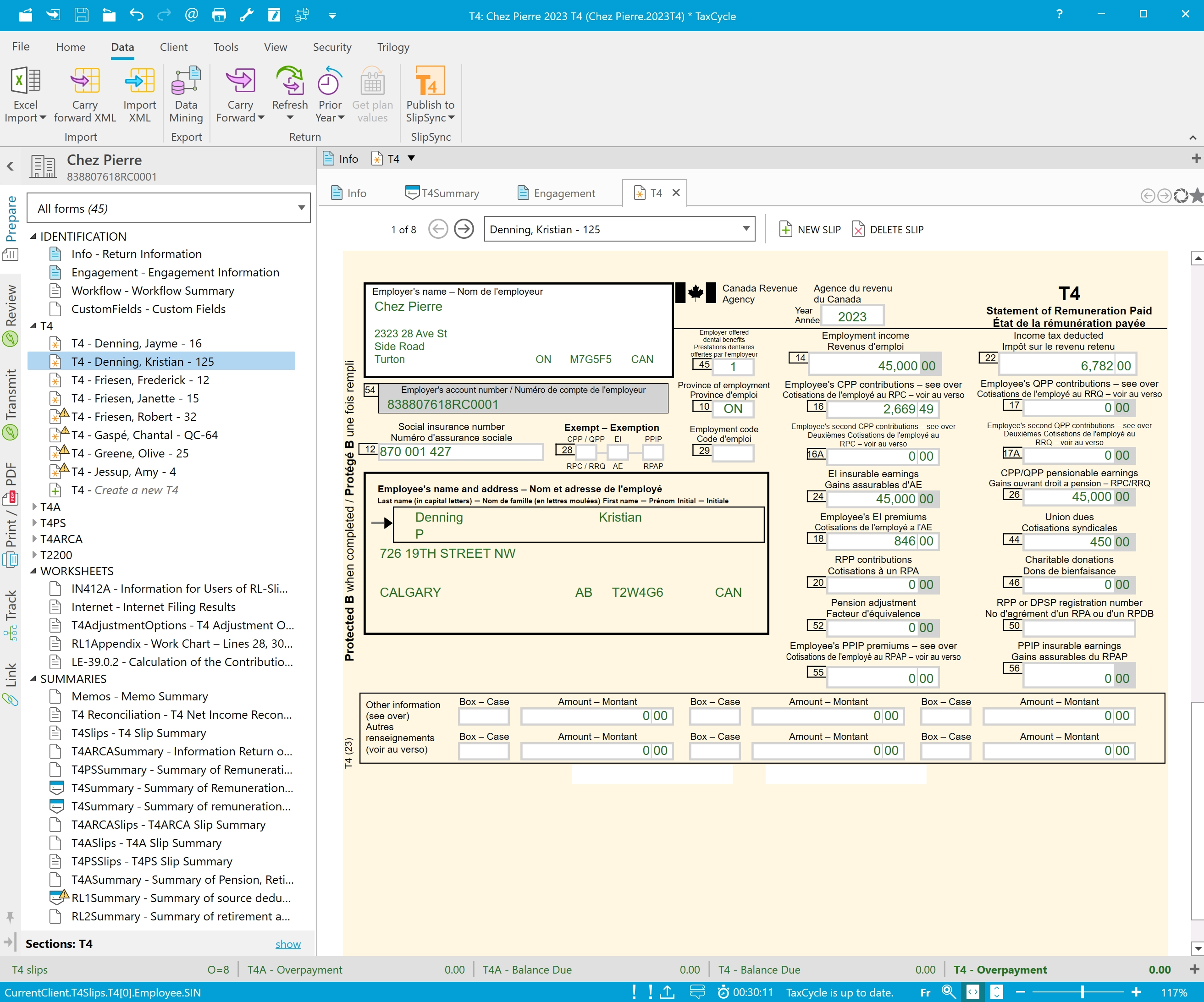

| T4 — Statement of Remuneration Paid |

|

| T4A — Statement of Pension, Retirement, Annuity, and Other Income |

|

| T4PS — Statement of Employee Profit-sharing Plan Allocations and Payments |

|

| T4A-RCA — Statement of Distributions From a Retirement Compensation Arrangement (RCA) |

|

| RL-1 – Employment and Other Income (Québec) |

|

| RL-2 – Retirement and Annuity Income (Québec) |

|

| IN412A – Information for Users of RL-Slip Software (Québec) |

|

| CONDITIONS OF EMPLOYMENT |

| T2200 — Declaration of Conditions of Employment |

|

| TP-64.3-V — General Employment Conditions |

|

| SUMMARIES |

| T4Slips — Slips Summary |

|

| T4Summary — Summary of Remuneration Paid |

|

| T4Reconciliation — T4 Net Income Reconciliation |

|

| T4ASlips — Slips Summary |

|

| T4ASummary — Summary of Pension, Retirement, Annuity and Other Income |

|

| T4ARCASlips — Slips Summary |

|

| T4ARCASummary — Summary of Distributions From a Retirement Compensation Arrangement (RCA) |

|

| T4PSSlips — Slips Summary |

|

| T4PSSummary — Summary of Employee Profit-sharing Plan Allocations and Payments |

|

| RL1Summary — Summary of Source Deductions and Employer Contributions |

|

| RL2Summary — Summary of Retirement and Annuity Income (Québec) |

|

| Memo Summary |

|

| Tape Summary |

|

| TEMPLATES |

| MLetter — Missing Slips Email |

|

| Billing using timer, schedules and forms |

|

| Cover email templates for electronic signatures and client copies |

|

| Mailing labels |

|