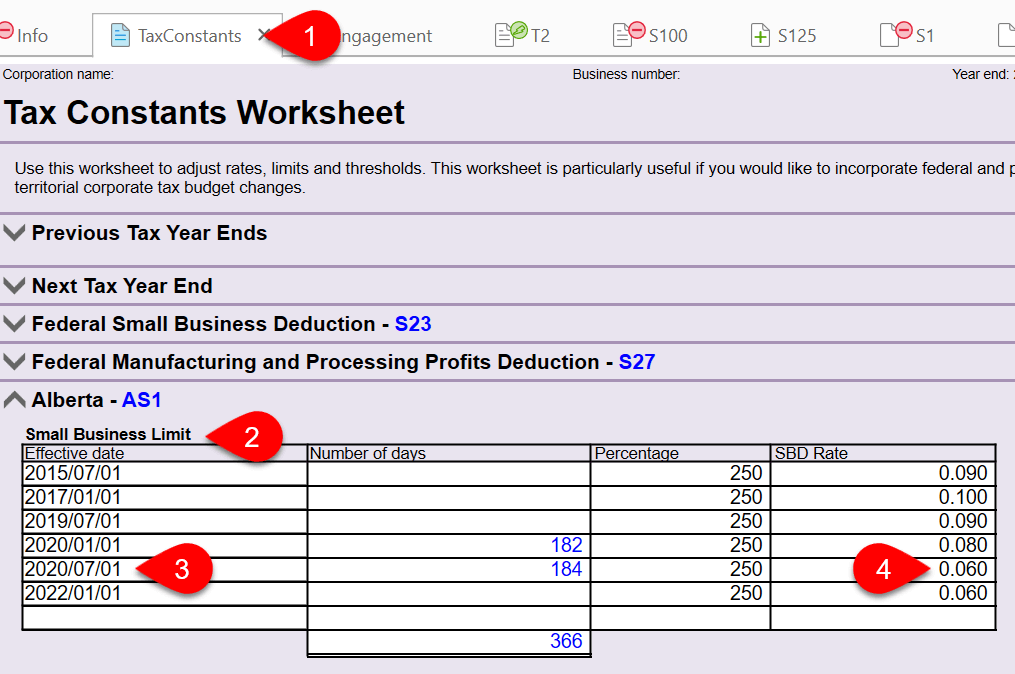

In TaxCycle T2, on the Alberta AT1 Schedule 1, the Alberta small business deduction (SBD) effective date and rate in the current version of TaxCycle T2 has not been revised according to the recent announcement of Alberta’s Recovery Plan. If an Alberta CCPC has days in the tax year on or after July 1, 2020, the correct Alberta SBD effective date and rate should be July 1, 2020, and 0.060, respectively.

This issue was resolved in the latest TaxCycle release.