TaxCycle and TaxFolder offer multiple ways for you to add clients and create and send signature requests to your clients. Choose the method that works best for you and your practice from the three options below.

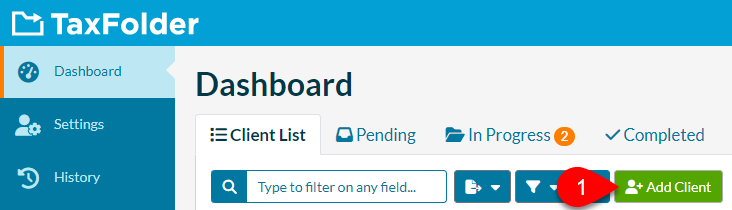

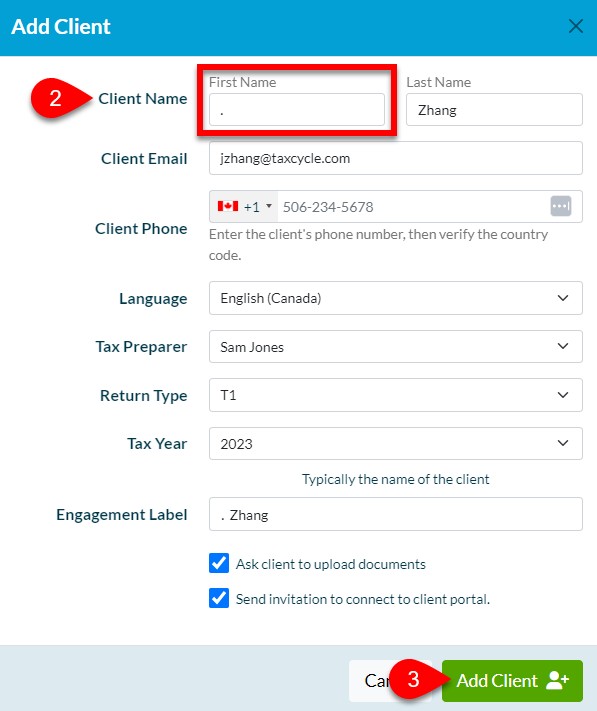

The easiest way to request an electronic signature from a client without a first name is to add the client to your Client List in the TaxFolder Preparer Dashboard and enter a period for the first name. When sending your signature request, TaxCycle will match the request to the client in TaxFolder based on the client’s email address.

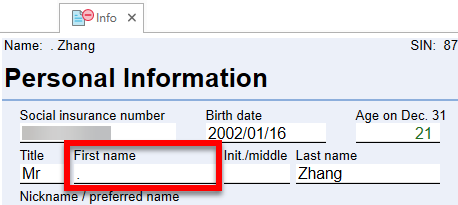

You can also enter a period in the First name field on the Info worksheet in TaxCycle before sending your signature request. Important! Make sure to remove the period before electronically filing your return!

Alternatively, you can create a manual electronic signature request from TaxCycle by printing your document to PDF and then manually creating the request through TaxFolder or DocuSign®.