The measures introduced by the federal government to support employers during the COVID-19 pandemic require employers to complete new forms and report additional information when filing T4 slips. Here are answers to common questions we’ve received from TaxCycle preparers.

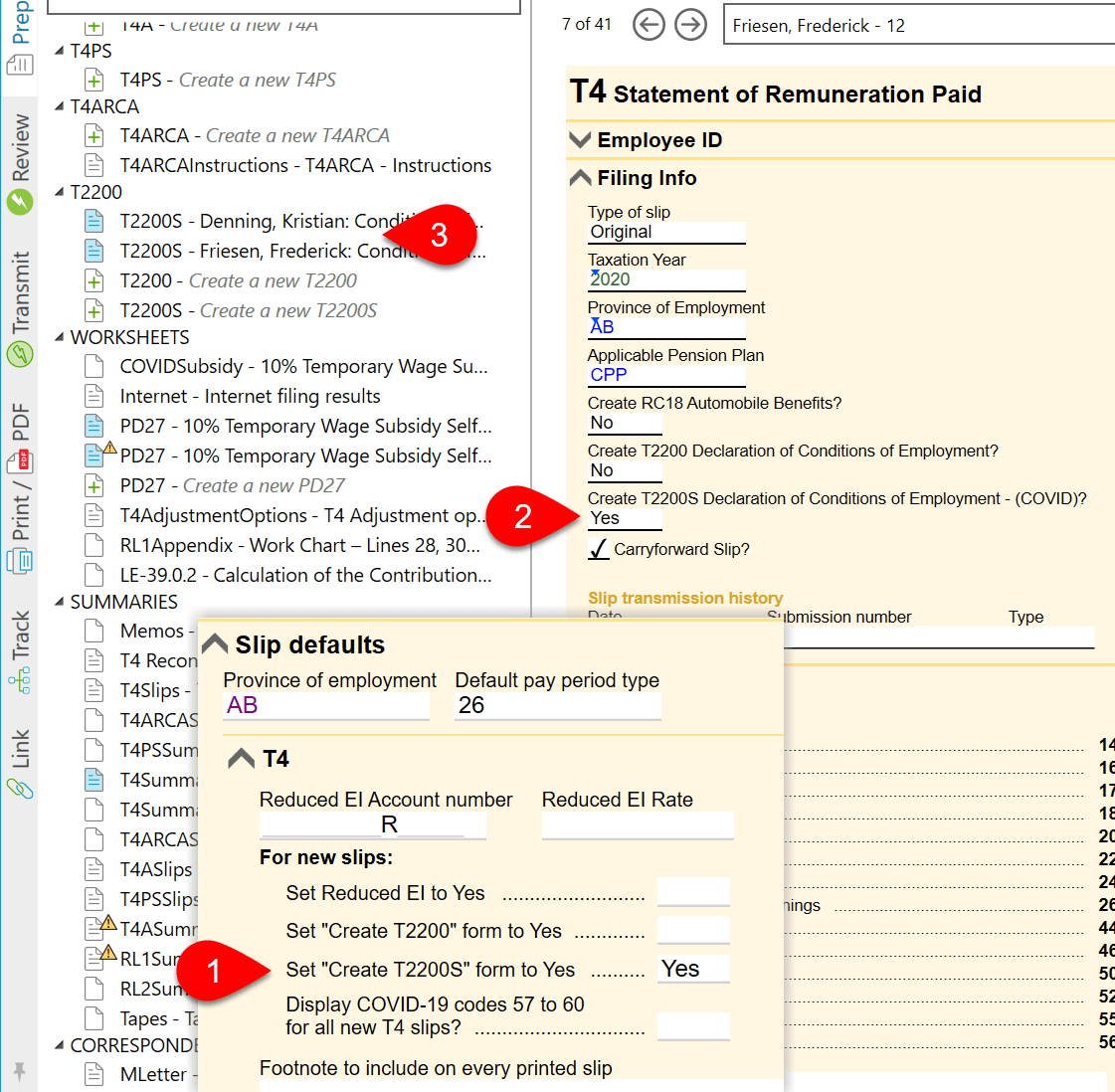

The new "Other information" codes 57 through 60 allow you to report employment income and retroactive payments during COVID-19 pay periods. You can automatically add these as Other information for all new T4 slips in the return by answering Yes to the new question on the Info worksheet in TaxCycle T4.

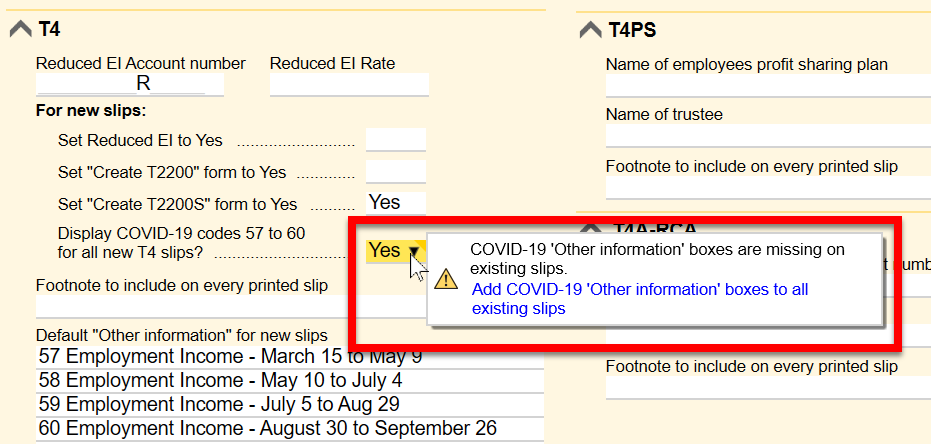

When carrying forward a T4 return from 2019 to 2020, TaxCycle also automatically answers Yes to the question on the Info worksheet. A review message on the same field on the Info worksheet provides a Quick Fix message to Add COVID-19 'Other information' boxes to all existing slips. This allows you to quickly add the boxes to all slips carried forward from the prior year.

The CRA limits the number of Other information codes to six on any T4 slip. For this reason, TaxCycle only allows six rows in the Other Information section of the T4 slips.

If more than six codes apply to the same employee, create an additional T4 slip in TaxCycle. TaxCycle does not create this additional slip automatically. Do not repeat all the data on the additional slip. Enter only the employer’s name and address, and the employee’s SIN and name, and complete the required boxes in the “Other information” area. Report each code, and amount only once. You can enter a note in the Footnote field on the slip to indicate it has two parts.

If a T4 carried forward from 2019 already has other information boxes, TaxCycle will only add as many of the COVID-19 codes as there are available blank rows on that slip. You will need to create a new slip for the excess boxes. Before creating the new slip, we suggest changing the COVID-19 question on the Info worksheet back to No and remove any of the other default additional boxes. Otherwise, you will need to remove those before adding the remaining boxes to the second slip.

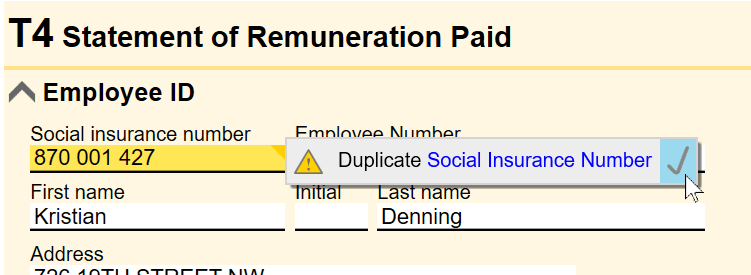

Creating a second slip will trigger a review message alerting you to a duplicate social insurance number. Once you verify the data is correct, sign off this review message.

For more information, see the CRA page on Filling out the T4 slip.

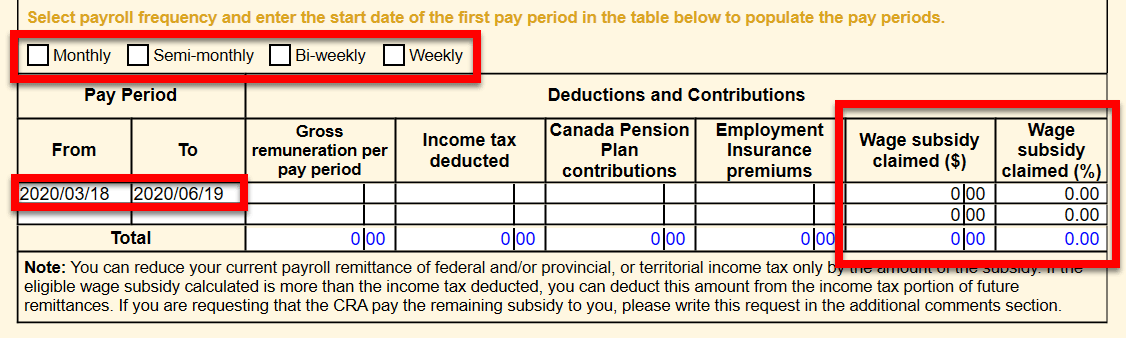

Yes. If an employer claimed the 10% Temporary Wage Subsidy (TWS) in 2020 and reduced their remittance amounts as per the program guidelines, the T4 Summary will show a balance owing in the amount of the subsidy. This is how the Canada Revenue Agency (CRA) expects you to report this amount for 2020 T4 slips. You must also complete and file a PD27. The CRA will use the PD27 information to reconcile the payroll account.

Every eligible employer who claimed or intends to claim the Temporary Wage Subsidy (TWS) and/or the Canada Emergency Wage Subsidy (CEWS) must complete and file a PD27 10% Temporary Wage Subsidy Self-identification Form for Employers.

Please review the following information carefully to help you correctly complete this form:

Refer to the CRA’s 10% Temporary Wage Subsidy for Employers page for full details, along with definitions of eligible income and examples.

You need only complete a T2200S Declaration of Conditions of Employment for Working at Home Due to COVID-19 if an employee intends to use the detailed calculation for employment-related expenses on the T777S when filing their T1 return.

Preparing T4 slips

For details on calculation options for home office expenses, qualification criteria and an online calculator, see the CRA’s Home office expenses for employees page.