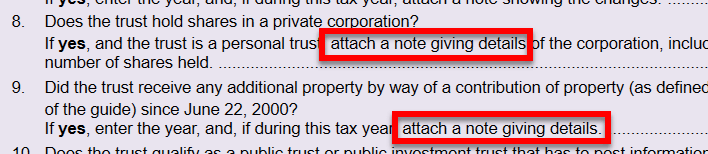

Some questions on the T3RET—such as questions 8 or 9 on page 2—include text asking you to attach the related supporting documents or notes to the return filing. Currently, the T3 EFILE system does not allow for uploading of documents when transmitting a return.

We asked the Canada Revenue Agency (CRA) for clarification on whether you should mail the documents to the CRA, upload them in Represent a Client, or keep them in case the CRA asks to see them.

The CRA told us that you should keep documentation for these questions until requested by the CRA.

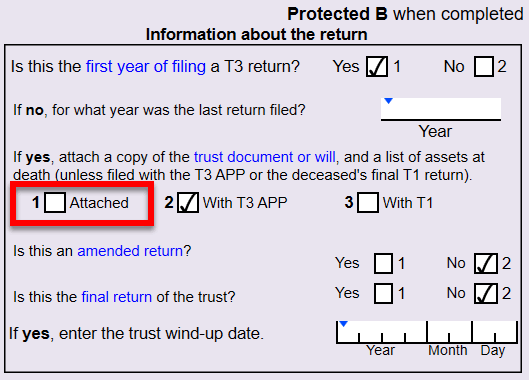

For first-time filers, the current T3 EFILE system does not support transmission of T3RET returns that indicate a copy of the trust document or will, and a list of assets at death, are Attached.

We are waiting for further guidance from the Canada Revenue Agency (CRA) on how to handle that scenario.