This optional, download-only release includes technology changes to TaxCycle and recent customer requests.

Get this version as a full download from our website or a free trial. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Microsoft is discontinuing support for Internet Explorer 11 on its operating systems. From now on, TaxCycle will use Microsoft Edge to sign in to a TaxCycle Account, transmit slips (T4, T5, etc.) to the CRA, and send messages using e-Courier.

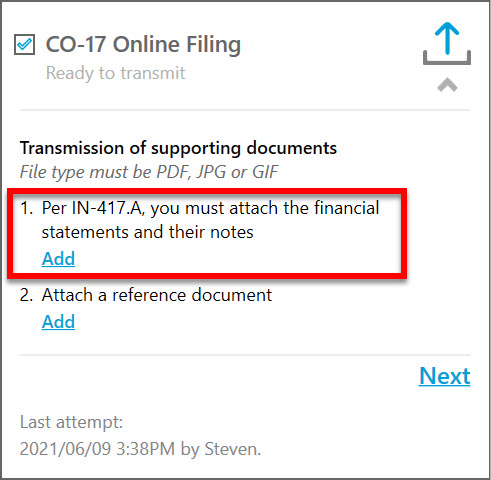

Revenu Québec recently communicated to us that preparers must attach a copy of a corporation’s financial statements and their notes when transmitting a CO-17 return. Previously, preparers were only required to attach the notes.

This new requirement is noted in the latest IN-417.A in section 2.3.

In TaxCycle T2, we have revised the wording in the CO-17 transmission step to reflect this new requirement:

{{Constants.CurrentTaxationYear}} with the corporate year end date, in the T2 client invoice. This applies to the 2020 and 2021 T2 modules.