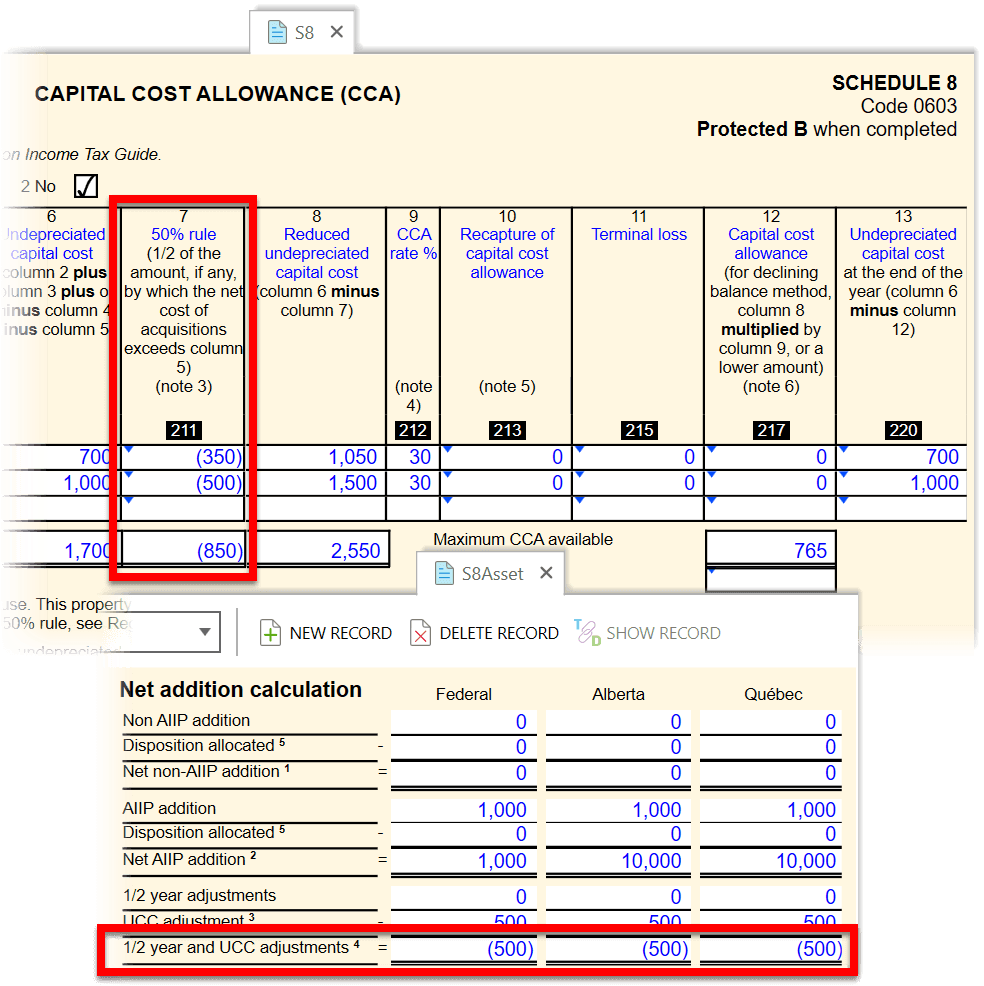

As you know, new capital asset additions are subject to the half-year rule and only 50% of the cost must be added to the undepreciated capital cost (UCC) for purposes of calculating capital cost allowance (CCA). However, you may be wondering why the amount of the half-year adjustment on T2 Schedule 8 and the S8Asset manager may show as a negative amount, resulting in an increased UCC base and CCA for the year.

This occurs because of the new Accelerated Investment Incentive Property rule announced in the November 2018 federal economic update. For more information, please refer to our Accelerated CCA help topic.

In general, if a capital asset was purchased after November 20, 2018 (the transaction date on the S8Asset is after November 20, 2018), the accelerated CCA rule suspends the half-year adjustment and grosses up the UCC by 50% of the cost of the addition.

For example, if you purchased a capital asset ($1,000) for class 10 on November 21, 2018, CCA is calculated as follows for a calendar 2018 tax year:

The UCC gross-up is calculated in the 50% rule column on the S8 and in the 1/2 year and UCC adjustments row on the S8Asset.

| Addition | $1,000 |

| Half-year adjustment | 0 |

| UCC gross-up | $5001 |

| UCC base | $1,500 |

| CCA rate | 30% |

| CCA | $450 |

Notes: 1. $1000 x 50% |

|

Since the UCC gross-up increases the UCC (the opposite of the half-year adjustment), this amount shows as a negative amount (rather than a positive amount) and is added to UCC (rather than subtracted from UCC).