| RETURNS |

| Number of returns |

Unlimited |

| Federal T5013 returns and slips |

2013 onward |

| Québec TP-600 and RL-15 |

2018 onward |

| CARRY FORWARD |

| TaxCycle T5013 |

|

| ProFile® FX |

|

| Cantax® FormMaster |

|

| Taxprep® Forms |

|

| ELECTRONIC FILING |

| T5013FIN |

|

| T5013 Slips |

|

| RL-15 |

|

| Business Authorization/Cancellation Request (formerly RC59 and RC59X) |

|

| Québec MR-69 |

|

| ELECTRONIC SIGNATURES (TaxFolder and DocuSign®) |

| AuthRepBus signature page (formerly RC59/RC59X) |

|

| ELetter — Engagement letter |

|

| T5013FIN |

|

| Summary — Summary of Partnership Income |

|

| DATA IMPORT/EXPORT |

| General Index of Financial Information (GIFI) import from Xero, CaseWare®, QuickBooks®, CCH Engagement, Sage® and CSV |

|

| Microsoft Excel® import into any form |

|

| Create Forms files from a T5013 return |

|

| Export slips to SlipSync (for import into T1 and T3 returns) |

|

| GENERAL INDEX OF FINANCIAL INFORMATION (GIFI) |

| T5013SCH100 — Balance Sheet Information |

|

| T5013SCH125 — Income Statement Information |

|

| T5013SCH140 — Summary Statement |

|

| T5013SCH141 — Notes checklist |

|

| Notes to Financial Statements |

|

| FEDERAL JACKET, SCHEDULES and WORKSHEETS |

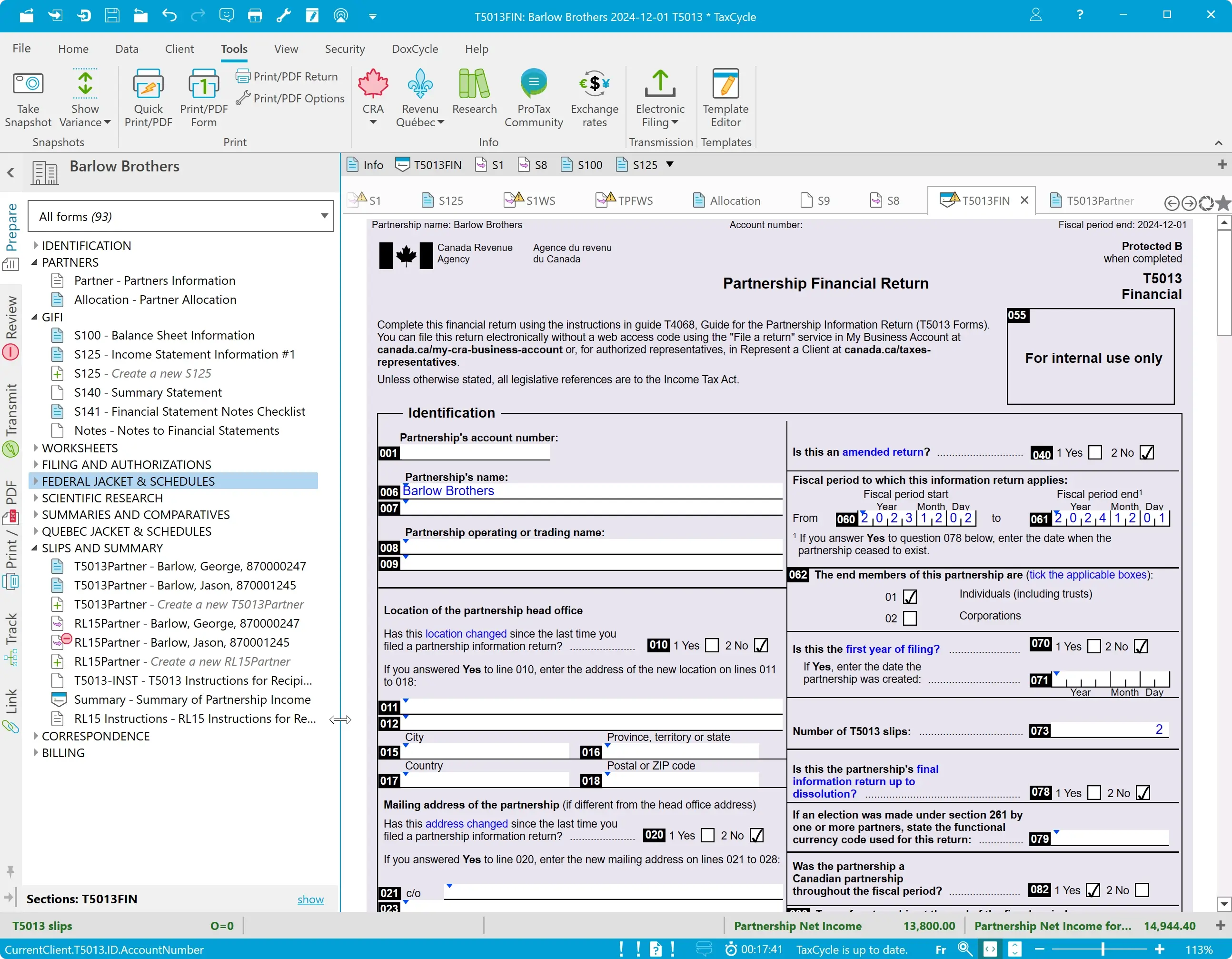

| T5013FIN — Partnership Financial Return |

|

| T5013SCH1 — Net Income (Loss) for Income Tax Purposes |

|

| S1WS — S1 Allocation Worksheet |

|

| T5013SCH2 — Charitable Donations, Gifts, and Political Contributions |

|

| T5013SCH5 — Allocation of Salaries and Wages, and Gross Revenue for Multiple Jurisdictions |

|

| T5013SCH6 — Summary of Dispositions of Capital Property |

|

| S6M — Capital Property Disposition Manager |

|

| T5013SCH8 — Capital Cost Allowance (CCA) |

|

| S8Asset — Asset Manager |

|

| S8Claim — CCA Claim |

|

| S8RecWS — Fixed Asset Reconciliation Worksheet |

|

| T5013SCH9 — List of Partnerships |

|

| T5013SCH12 — Resource-Related Deductions |

|

| T5013SCH50 — Partner’s Ownership and Account Activity |

|

| T5013SCH52 — Summary Information for Partnerships that Allocated Renounced Resource Expenses to their Members |

|

| T5013SCH58 — Canadian Journalism Labour Tax Credit |

|

| T5013SCH65 — Air Quality Improvement Tax Credit |

|

| T5013SCH75 — Clean Technology Investment Tax Credit |

|

| T5013SCH78 — Carbon Capture, Utilization, and Storage (CCUS) Investment Tax Credit |

|

| T5013SCH130 — Partnership Interest and Financing Expenses and Interest and Financing Revenues |

|

| QUÉBEC SCHEDULES and WORKSHEETS |

| TP-600 — Partnership Information Return |

|

| Schedule A — Partners' Interests and At-Risk Amounts |

|

| Schedule B — Capital Cost Allowance (CCA) |

|

| Schedule D — Member Corporations’ Shares of Paid-Up Capital |

|

| Schedule E — Summary of Certain Information to Enter on RL-15 Slips |

|

| Schedule F — Net Income for Income Tax Purposes |

|

| TPSFWS — Schedule F allocation worksheet |

|

| TP-130-EN — Immediate Expensing Limit Agreement |

|

| CO-130.AD — Capital Cost Allowance for Immediate Expensing Property |

|

| CO-771.R3 — Breakdown of business carried on in Québec and elsewhere |

|

| MR69Results — MR-69 Attachments and results |

|

| WORKSHEETS |

| Info — Partnership Information |

|

| Engagement — Engagement Information |

|

| Partner — Partners' Information |

|

| Allocation — Partner allocation |

|

| Rental — Rental Income Worksheet |

|

| RentalSummary — Summary of Rental Income |

|

| Workflow — Workflow Summary |

|

| Internet — Internet Filing Worksheet |

|

| T661PPACapWS — Internet Filing Worksheet |

|

| SLIPS and SUMMARIES |

| T5013Partner — T5013 Partnership Details |

|

| T5013 — Statement of Partnership Income |

|

| T5013-INST — Instructions for Recipient |

|

| RL15Partner — RL-15 Partnership details |

|

| RL-15 — Statement of Partnership Income |

|

| RL15 Instructions — RL-15 Instructions for Recipient |

|

| Summary — Summary of Partnership Income |

|

| SCIENTIFIC RESEARCH |

| T661 — Scientific Research and Experimental Development (SR&ED) Expenditures Claim |

|

| T1145 — Agreement to allocate assistance for SR&ED between persons not dealing at arm's length. |

|

| T1263 — Third-party payments for SR&ED |

|

| FILING and AUTHORIZATION |

| AuthRepBus — Authorizing a representative (previously RC59OnlineConsent) |

|

| AuthRepBusCancel — Cancelling a representative (previously RC59XCancel) |

|

| AuthRepBusResults — History of submissions and results |

|

| T1135 — Foreign Income Verification Statement |

|

| T1135Declaration — T1135 Terms and Conditions |

|

| T1135Results — T1135 Electronic Transmission Results |

|

| T1134 — Information Return Relating to Controlled and Non-Controlled Foreign Affiliates |

|

| T1134Declaration — T1134 Terms and Conditions |

|

| T1134Results — T1134 Electronic Transmission Results |

|

| SUMMARIES and COMPARATIVES |

| 5YearComp S1 — T5013 5 Year Comparative for S1 |

|

| 5YearComp SF — TP-600 5 Year Comparative for Schedule F |

|

| RL15 Slips — Slip Summary |

|

| Slips — Slip Summary |

|

| Memos — Memo Summary |

|

| Tapes — Tape Summary |

|

| TEMPLATES and CLIENT CORRESPONDENCE |

| CLetter — Client Letter |

|

| Engagement letter |

|

| AuthEmailBus — Business Authorization Cover Email |

|

| ClientCopyEmail — Client Copy Cover Email |

|

| EngagementEmail — Engagement Cover Email |

|

| ESignatureEmail — E-Signature Cover Email |

|

| MR69Receipt — Client MR-69 Receipt |

|

| Notes — File notes |

|

| T1135Receipt — T1135 Receipt |

|

| T1135FRRMSReceipt — T1135 FRRMS Submit e-Doc Receipt |

|