| FILES |

| Number of files |

Unlimited |

| Years |

2015 onward |

| CARRYFORWARDS |

| TaxCycle Forms |

|

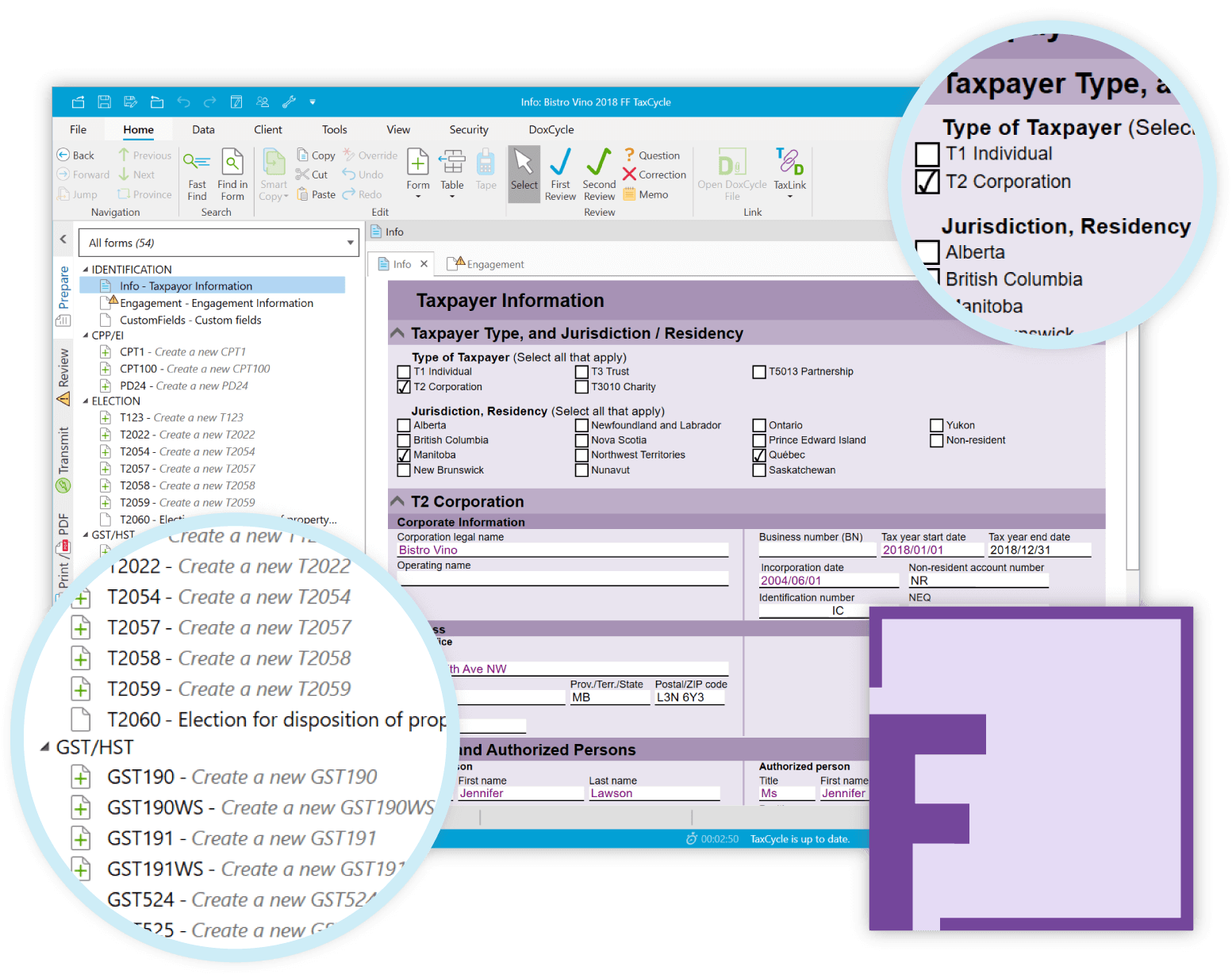

| IDENTIFICATION |

| Info — Taxpayer information |

|

| Engagement — Engagement information |

|

| Workflow — Workflow summary |

|

| CustomFields — Custom fields |

|

| AUTHORIZATION FORMS |

| AUT01 — Authorize a representative for access by phone and mail |

|

| AUT01X — Cancel authorization for a representative |

|

| SERs — Special Elections and Returns transmission service |

|

| SERsSupport — Special Elections and Returns, and Submit E-documents web services |

|

| SERsDeclaration — Special Elections and Returns (SERs) terms and conditions |

|

| CPP/EI FORMS |

| CPT1 — Request for a ruling as to the status of a worker under the Canada Pension Plan and/or Employment Insurance Act |

|

| CPT100 — Appeal of a ruling under the Canada Pension Plan and/or Employment Insurance Act |

|

| PD24 — Application for a refund of overdeducted CPP contributions or EI premiums |

|

| ELECTION |

| T123 — Election on disposition of Canadian securities |

|

| T1521 — Election for a Pertinent Loan or Indebtedness (PLOI) under Subsection 15(2.11) |

|

| T2022 — Election in Respect of the Sale of Debts Receivable |

|

| T2027 — Election to Deem Amount of Settlement of a Debt or Obligation on the Winding-Up of a Subsidiary |

|

| T2054 — Election for a Capital Dividend Under Subsection 83(2) |

|

| T2055 — Election in Respect of a Capital Gains Dividend Under Subsection 131(1) |

|

| T2057 — Election on Disposition of Property by a Taxpayer to a Taxable Canadian Corporation |

|

| T2058 — Election on Disposition of Property by a Partnership to a Taxable Canadian Corporation |

|

| T2059 — Election for Disposition of Property by a Taxpayer to a Canadian Partnership |

|

| T2060 — Election for Disposition of Property Upon Cessation of Partnership |

|

| T2060SA — Schedule A - Election on Disposition of Property by a Taxpayer to a Canadian Partnership |

|

| T2066 — Election for Immediate or Gradual Intergenerational Business Transfer |

|

| T2123 — Dividend Substitution Election Under Subsection 212.3(3) |

|

| T2183 — Information Return for Electronic Filing of Special Elections |

|

| T2311 — Election for Pertinent Loan or Indebtedness (PLOI) under Subsection 212.3(11) |

|

| UHT183 — Authorization to Electronically File the Underused Housing Tax Return and Election Form |

|

| UHT-2900 — Underused Housing Tax Return and Election Form |

|

| GST/HST FORMS |

| GST20 — Election for GST/HST Reporting Period |

|

| GST44 — Election Concerning the Acquisition of a Business or Part of a Business |

|

| GST60 — GST/HST Return for Acquisition of Real Property |

|

| GST66 — Application for GST/HST Public Service Bodies' Rebate and GST Self-Government Refund |

|

| GST70 — Election or Revocation of an Election to Change a GST/HST Fiscal Year |

|

| GST71 — Notification of Accounting Periods |

|

| GST74 — Election and Revocation of an Election to Use the Quick Method of Accounting |

|

| GST159 — Notice of Objection |

|

| GST190 — GST/HST New Housing Rebate application for houses purchased from a builder |

|

| GST190A — GST/HST New Housing Rebate, appendix A |

|

| GST190NovaScotia — GST190 Nova Scotia rebate schedule |

|

| GST190Ontario — GST190 Ontario rebate schedule |

|

| GST190WS — GST190 calculation worksheet |

|

| GST191 — GST/HST New Housing Rebate application for owner-built houses |

|

| GST191Ontario — RC7191-ON, Ontario New Housing Rebate schedule |

|

| GST191WS — GST191 Construction summary worksheet |

|

| GST524 — GST/HST New residential rental property rebate application |

|

| GST524Ontario — GST524 Ontario rebate schedule |

|

| GST525 — GST525 Supplement to the new residential rental property rebate application (co-op and multiple units) |

|

| RC4616 — Election or Revocation of an Election for Closely Related Corporations and/or Canadian Partnerships to Treat Certain Taxable Supplies as Having Been Made for Nil Consideration for GST / HST Purposes (formerly GST25) |

|

| RC7066 — Provincial schedule - GST/HST public service bodies' rebate |

|

| NON-RESIDENT |

| NR6 — Undertaking to file an income tax return by a non-resident receiving rent from a real or immovable property or receiving a timber royalty |

|

| NR73 — Determination of Residency Status (Leaving Canada) |

|

| NR7-R — Application for Refund of Part XIII Tax Withheld |

|

| NR301 — Declaration of eligibility for benefits (reduced tax) under a tax treaty for a non-resident person |

|

| NR302 — Declaration of eligibility for benefits (reduced tax) under a tax treaty for a partnership with non-resident partners |

|

| NR302WorksheetA — Part XIII effective rate of withholding |

|

| NR302WorksheetB — Exempt income worksheet |

|

| NR303 — Declaration of eligibility for benefits (reduced tax) under a tax treaty for a hybrid entity |

|

| NR303WorksheetA — Part XIII effective rate of withholding |

|

| NR303WorksheetB — Exempt income worksheet |

|

| R102-R — Regulation 102 waiver application |

|

| R105 — Regulation 105 waiver application |

|

| R105-S — Regulation 105 Simplified Waiver Application for Non-resident Artists and Athletes Earning No More Than CAN $15,000 |

|

| RC473 — Non-resident employer certification |

|

| Rental worksheet |

|

| T106 — Information return of non-arm's length transactions between non-residents (slip) |

|

| T016S — Information return of non-arm's length transactions between non-residents (summary) |

|

| T1261 — Application for a Canada Revenue Agency individual tax number (ITN) for non-residents |

|

| T2062 — Request by a non-resident of Canada for a certification of compliance related to the disposition of taxable Canadian property |

|

| T2062A — Request by a non-resident of Canada for a certificate of compliance related to the disposition of taxable Canadian property |

|

| T2062A Schedule 1 — Disposition of Canadian resource property by non-residents |

|

| OTHER FILING |

| RC1 — Request for a business number and certain program accounts |

|

| RC65 — Marital Status Change |

|

| RC66 — Canada Child Benefits Application |

|

| RC66SCH — Status in Canada / Statement of Income for the Canada Child Benefits Application |

|

| RC145 — Request to Close Business Number Program Accounts |

|

| RC199 — Voluntary disclosures program (VDP) taxpayer agreement |

|

| RC243 — Tax-Free Savings Account (TFSA) Return |

|

| RC312 — Reportable Transaction and Notifiable Transaction Information Return |

|

| RC681 — Request to Activate Paper Mail for My Business |

|

| T400A — Objection to a notice of assessment or a notice of determination |

|

| T1134 — Information return relating to controlled and not-controlled foreign affiliates |

|

| T1134Sup — Information return relating to controlled and not-controlled foreign affiliates worksheet |

|

| T1141 — Information return in respect of contributions to non-resident trusts, arrangement or entities (2007 or later taxation years) |

|

| T1141Sup — Information return in respect of contributions to non-resident trusts, arrangement or entities (2007 or later taxation years) worksheet |

|

| T1142 — Information return in respect of distributions from indebtedness to a non-resident trust |

|

| T1142Sup — Information return in respect of distributions from indebtedness to a non-resident trust worksheet |

|

| T1158 — Registration of Family Support Payments |

|

| UHT0001 — Objection – Underused Housing Tax Act |

|

| BRITISH COLUMBIA |

| FIN146 — Authorization or cancellation of a representative |

|

| FIN196 — Application for a refund of logging tax |

|

| FIN542P — Logging return of income for processors |

|

| FIN542S — Logging tax return of income |

|

| QUÉBEC |

| CO-502 — Election in respect of a dividend paid out of a capital dividend account |

|

| FP-2074 — Election or revocation of election respecting the quick method of accounting |

|

| LM-1.A-V — Request for Cancellation or Variation of Registration |

|

| TP-518 — Transfer of property by a taxpayer to a taxable Canadian corporation |

|

| TP-529 — Transfer of property by a partnership to a taxable Canadian corporation |

|

| TP-614 — Transfer of property to a Canadian partnership |

|

| TP-1097 — Notice of disposition or proposed disposition |

|

| TP-1086.R.23.12 — Costs incurred for work on an immovable |

|

| SUMMARIES |

| Memos — Memo summary |

|

| Tapes — Tape summary |

|