| RETURNS |

| Number of returns |

Unlimited |

| Number of slips |

Unlimited |

| Federal T3 returns |

2014 onward |

| Québec TP-646 returns |

2017 onward |

| CARRYFORWARDS |

| TaxCycle T3 |

|

| ProFile® T3 |

|

| Cantax® FormMaster |

|

| Taxprep® T3 |

|

| ELECTRONIC FILING |

| CRA Internet File Transfer (XML) for T3 slips, T3RET, T3P, T3ATH-IND, T3M, T3S and T2000 |

|

| Business Authorization/Cancellation Request (formerly RC59 and RC59X) |

|

| ELECTRONIC SIGNATURES (TaxFolder and DocuSign®) |

| AuthRepBus signature page |

|

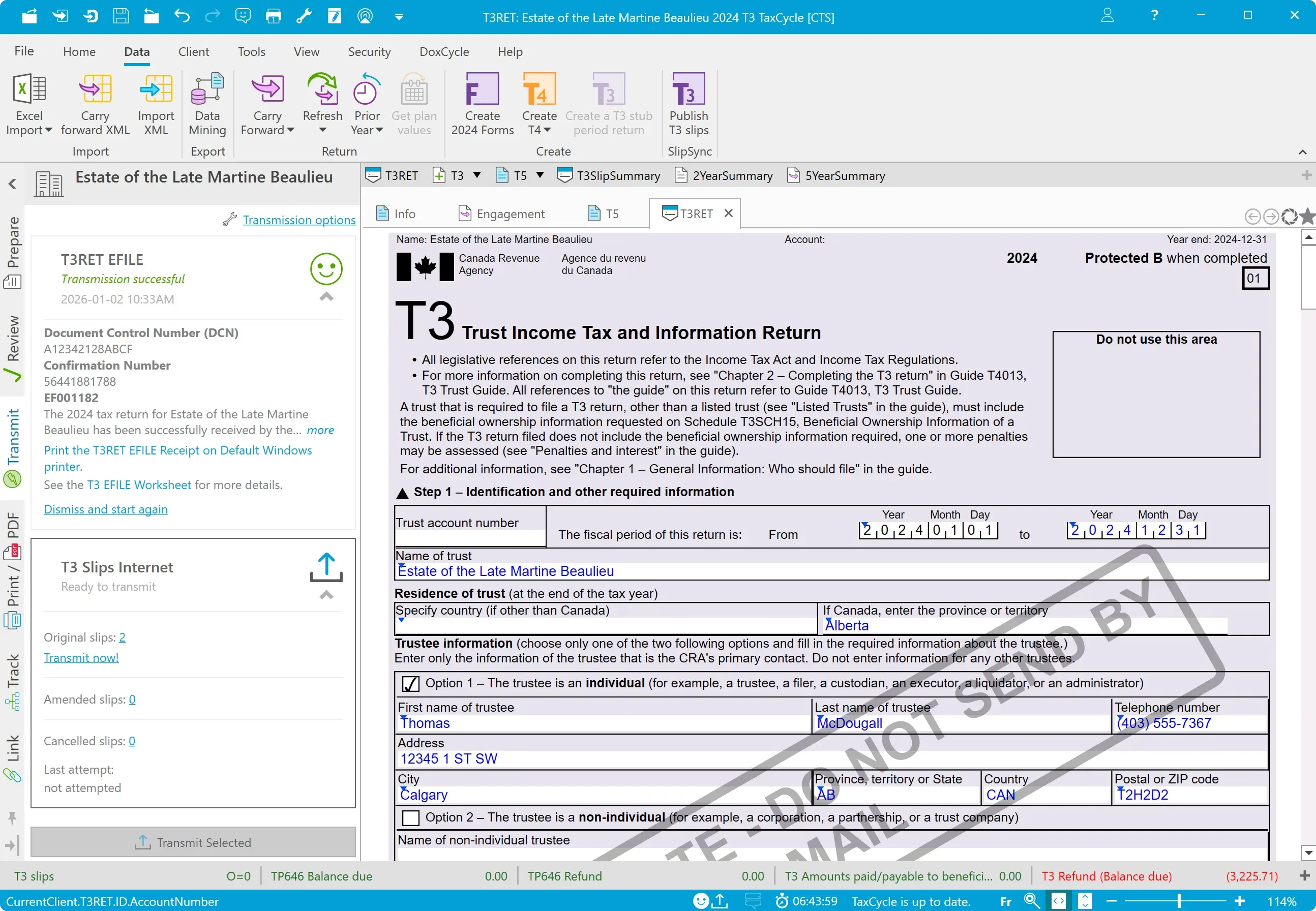

| T3RET — T3 Trust Income Tax and Information Return |

|

| T1135 — Foreign Income Verification Statement |

|

| MR-69 — Authorization to Communicate Information or Power of Attorney (Québec) |

|

| TP-646 — Trust Income Tax Return |

|

| ELetter — Engagement letter |

|

| BENEFICIARY SLIPS AND SUMMARIES |

| T3Ben — T3 Allocations and Designations to a Beneficiary |

|

| Allocation — Beneficiary Allocation |

|

| Beneficiary — Beneficiary Information |

|

| T3 — Statement of Trust Income Allocations and Designations |

|

| T3SlipSummary — Summary of Trust Income Allocations and Designations |

|

| NR4 — Statement of Amounts Paid or Credited to Non-Residents of Canada |

|

| NR4Summary — Summary of Amounts Paid or Credited to Non-Residents of Canada |

|

| INCOME SLIPS AND RELEVÉS |

| T3 — Statement of Trust Income |

|

| RL-16 — Trust Income (Québec) |

|

| T5 — Statement of Investment Income |

|

| T5008 — Statement of Securities Transactions |

|

| T5013 — Statement of Partnership Income |

|

| T101 — Statement of Resource Expenses |

|

| Foreign Income |

|

| FEDERAL/PROVINCIAL SCHEDULES AND FORMS |

| T3RET — T3 General |

|

| T3P — Employees' Pension Plan Income Tax Return |

|

| T3-RCA — Retirement Compensation Arrangement (RCA) Part XI.3 Tax Return |

|

| T3ATH-IND — Amateur Athlete Trust Income Tax Return |

|

| T3D — Income Tax Return for Deferred Profit Sharing Plan (DPSP) or Revoked DPSP |

|

| T3FFT — Federal Foreign Tax Credits |

|

| T3GR — Group Income Tax and Information Return for RRSP, RRIF, RESP, or RDSP Trusts |

|

| T3GR-WS — Worksheet for Part XI.1 Tax on Non-Qualified Property of an RRSP, RRIF, or RESP trust |

|

| T3M — Environmental Trust Income Tax Return |

|

| T3PRP — T3 Pooled Registered Pension Plan Tax Return |

|

| T3RI — Registered Investment Income Tax Return |

|

| T3S — Supplementary Unemployment Benefit Plan Income Tax Return |

|

| T3SIFTWS — SIFT (specified investment flow-through) Worksheet |

|

| T1061 — Canadian Amateur Athlete Trust Group Information Return |

|

| T2000 — Calculation of Tax on Agreements to Acquire Shares (section 207.1(5) of the Income Tax Act) |

|

| T244 — Registered Pension Plan Annual Information Return |

|

| S1A — Capital Gains on Gifts of Certain Capital Property |

|

| S1M — Capital property disposition manager |

|

| S1 — Dispositions of Capital Property |

|

| S2 — Reserves on Dispositions of Capital Property |

|

| S3 — Eligible Taxable Capital Gains |

|

| S4 — Cumulative Net Investment Loss |

|

| S7 — Pension Income Allocations and Designations |

|

| S8 — Statement of Investment Income |

|

| S9 — Income Allocations and Designations to Beneficiaries |

|

| S10 — Part XII.2 Tax and Part XIII Non-Resident Withholding Tax |

|

| S11 — Federal Tax |

|

| S11A — Donations and Gifts Tax Credit Calculation |

|

| S12 — Minimum Tax |

|

| S15 — Beneficial Ownership Information of a Trust |

|

| S130 — Excessive Interest and Financing Expenses Limitation |

|

| T184 — Capital Gains Refund to a Mutual Fund Trust |

|

| T1055 — Summary of Deemed Dispositions |

|

| T1098 — Clean Technology Investment Tax Credit |

|

| T2223 — Election to Defer Payment of Income Tax |

|

| Provincial Tax and Credits: T3AB, T3BC, T3MB, T3NB, T3NL, T3NS, T3NT, T3NU, T3ON, T3PE, T3SK, T3YT |

|

| T3MJ — Provincial and Territorial Taxes, Multiple Jurisdictions |

|

| T1129 — Newfoundland and Labrador Research and Development Tax Credit |

|

| T1232 — Yukon Research and Development Tax Credit |

|

| T1241 — Manitoba Mineral Exploration Tax Credit |

|

| T3PFT — Provincial Foreign Tax Credits |

|

| WORKSHEETS |

| Info — Trust Information |

|

| Engagement — Engagement Information |

|

| CustomFields — Custom Fields Worksheet |

|

| Workflow — Workflow Summary |

|

| ABIL — Allowable Business Investment Losses |

|

| AIIPNote — Variables for Accelerated Investment Incentive Property |

|

| Beneficial — Beneficial ownership information |

|

| BeneficialOnFile — Beneficial Owners on File |

|

| Donations — Charitable donations worksheet |

|

| FTC — Foreign Tax Credits |

|

| IncomeDeduction — Details of Various Income and Deduction Amounts |

|

| Instalments Worksheet |

|

| Interest & Late-Filing Penalty Worksheet |

|

| Internet File Worksheet |

|

| NetCapLoss — Net Capital Losses |

|

| NonCapLoss — Non-Capital Losses |

|

| Optimizations — Optimizations Worksheet |

|

| Payments — Payments Worksheet |

|

| S9WS — S9 Allocation Worksheet |

|

| T3ALossCB — Loss carryback worksheet |

|

| T3RETEFILE — T3RET EFILE Worksheet |

|

| TaxConstants — Tax Constants Worksheet |

|

| INCOME STATEMENTS |

| T1163/T1273 — AgriStability Statement A, plus related CCA/asset manager worksheets, farming inventory adjustment and 5-year summary |

|

| T1164/T1274 — AgriStability Statement B, plus related CCA/asset manager worksheets, farming inventory adjustment and 5-year summary |

|

| T776 — Real Estate Rentals, plus related CCA/asset manager worksheets and 5-year summary |

|

| T2042 — Farming Activities, plus related CCA/asset manager worksheets, farming inventory adjustment and 5-year summary |

|

| T2121 — Fishing Activities, plus related CCA/asset manager worksheets, and 5-year summary |

|

| T2125 — Business or Professional Activities, plus related CCA/asset manager worksheets, and 5-year summary |

|

| QUÉBEC TP-646 SCHEDULES AND FORMS |

| TP-646-V — Trust Income Tax Return |

|

| Schedule A (TPA) — TaxCycle Capital Gains and Designated Net Taxable Capital Gains |

|

| TPASUM — Schedule A - Summary of dispostions |

|

| Schedule B (TPB) — Investment Income, Gross-Up of Dividends Not Designated and Adjustment of Investment Expenses |

|

| TPBSUM — Schedule B - Summary of investment income |

|

| Schedule C (TPC) — Summary of Allocations and Designations |

|

| Schedule D (TPD) — Carry-Back of a Loss |

|

| Schedule E (TPE) — Income Tax on the Taxable Distributions Amount and Calculation of Eligible Dividends to Be Designated |

|

| Schedule F (TPF) — Income Tax Payable by a Specified Trust for a Specified Immovable |

|

| Schedule G (TPG) — Additional Information — Trust Resident in Québec That Owns a Specified Immovable |

|

| Schedule H (TPH) — Recovery tax |

|

| TPF-646.W — Keying Summary for the Trust Income Tax Return |

|

| TPF-646.X — Keying Summary for Schedules A, F, G and H of the Trust Income Tax Return |

|

| TPF-646.Y — Keying Summary for Forms TP-80-V and TP-128.F-V Filed with the Trust Income Tax Return |

|

| TPF-646.Z — Keying Summary for Forms Filed with the Trust Income Tax Return |

|

| TPF-1026.0.1.P — Balance Due – Trusts |

|

| TP-80 — Business or Professional Income and Expenses |

|

| TP-128.F — Income Earned by a Trust from the Rental of Immovable Property |

|

| TP128CCA — Rental Capital Cost Allowance |

|

| TP-21.4.39 — Cryptoasset Return |

|

| TP-274.F — Designation of Property as a Principal Residence of a Personal Trust |

|

| TP-653 — Deemed Sale Applicable to Certain Trusts |

|

| TP-668.1 — Taxable Capital Gains of a Trust That Give Entitlement to a Deduction |

|

| TP-729 — Carry-Forward of Net Capital Losses |

|

| TP-750 — Income tax payable by a trust resident in Québec that carries on a business in Canada or outside Québec |

|

| TP-772 — Foreign Tax Credit |

|

| TP-776.42 — Alternative Minimum Tax |

|

| RL-16 — Revenus de fiducie |

|

| TPIncomeDeductions — Details of various income and deduction amounts |

|

| TPABIL — Québec Allowable Business Investment Losses |

|

| TP-646 2 Year Variance Summary |

|

| TP-646 5 Year Summary |

|

| MR69Results — MR-69 Attachments and results |

|

| FILING AND AUTHORIZATION |

| AuthRepBus — Business Authorization/Cancellation Request (former RC59) |

|

| AuthRepBusResults — History of Submissions and Results |

|

| AuthRepBusCancel — Cancelling a Representative (former RC59X) |

|

| AUT01 — Authorize a Representative for Offline Access |

|

| MR-69-V – Power of Attorney, Authorization to Communicate Information, or Revocation |

|

| S9Ben – Beneficiary Income Allocation Statement |

|

| T3A — Request for Loss Carryback by a Trust |

|

| T3ADJ — T3 Adjustment Request |

|

| T3AO — Trust Amount Owing Remittance Voucher |

|

| T3APP — Application for Trust Account Number |

|

| T3DD — Direct Deposit Request for T3 |

|

| T3F — Investments Prescribed to be Qualified Information Return |

|

| T3PreferredBen — Preferred Beneficiary Election |

|

| T3QDT — Joint Election for a Trust to be a Qualified Disability Trust |

|

| T733 — Application for a Retirement Compensation Arrangement Account Number |

|

| T735 — Application for a Remittance Number for Tax Withheld from a Retirement Compensation Arrangement (RCA) |

|

| T1079 and T1079WS — Designation of a Property as a Principal Residence by a Personal Trust |

|

| T1135 — Foreign Income Verification Statement |

|

| TX19 — Asking for a Clearance Certificate |

|

| SUMMARIES |

| 2-Year Client Summary |

|

| 2-Year Variance Summary |

|

| 5-Year Summary |

|

| FTCSum — Foreign Tax Summary |

|

| StatementSum — Summary of Business, Farming, Fishing and Rental Income |

|

| Memos — Memo Summary |

|

| T3 Summary for Trust |

|

| Slips — T3 Beneficiary Slip Summary |

|

| T3RETSummary — T3 RET Summary |

|

| Slips Summary |

|

| Tape Summary |

|

| TEMPLATES AND CLIENT CORRESPONDENCE |

| Client letter |

|

| Engagement letter |

|

| Electronic filing confirmation templates for all transmission types |

|

| Cover email templates for electronic signatures and client copies |

|

| File notes |

|