The Minister of Finance’s Economic and Fiscal Update on December 14, 2021, included:

These are included in Bill C-8, Economic and Fiscal Update Implementation Act, 2021 which has passed second reading in the House of Commons and is currently at report stage. We do not know how long it will take to obtain Royal Assent. The Canada Revenue Agency (CRA) has indicated that any return filed with these credits will not be processed until the supporting legislation has received Royal Assent.

Meanwhile, you should inform affected clients that there will be a significant delay before they receive their notice of assessment and refund if applicable. If they have a balance owing, they should pay it on or before the due date to avoid interest charges.

If your client does not want to wait to receive their refund (the portion remaining if they file without claiming these credits), you can override the credit amounts, then file an adjustment once the legislation passes. You will need to sign off this field override before filing, but TaxCycle will retain the values and calculation, so you can remove the override and file an adjustment later.

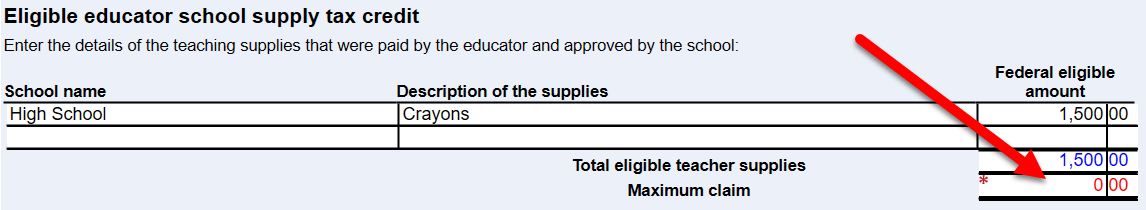

To file a return without claiming the Eligible Educator School Supply Tax Credit, override the Maximum claim field on the Credits worksheet to zero. This field flows to line 46900 on the T1 return.

To override the Return of Fuel Charge Proceeds to Farmers Tax Credit, you must determine where the credit is calculated. This depends on the ownership structure of the farm.

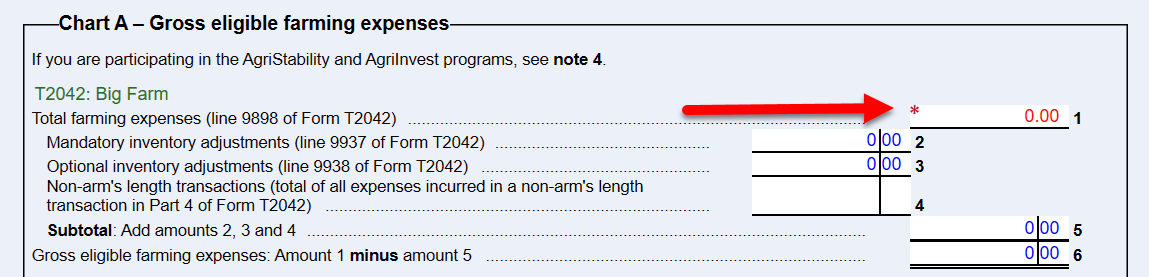

For a farm where the client owns 100% of the farm, go to form T2043. Scroll down to Chart A on page 4. Override line 1 to remove the credit.

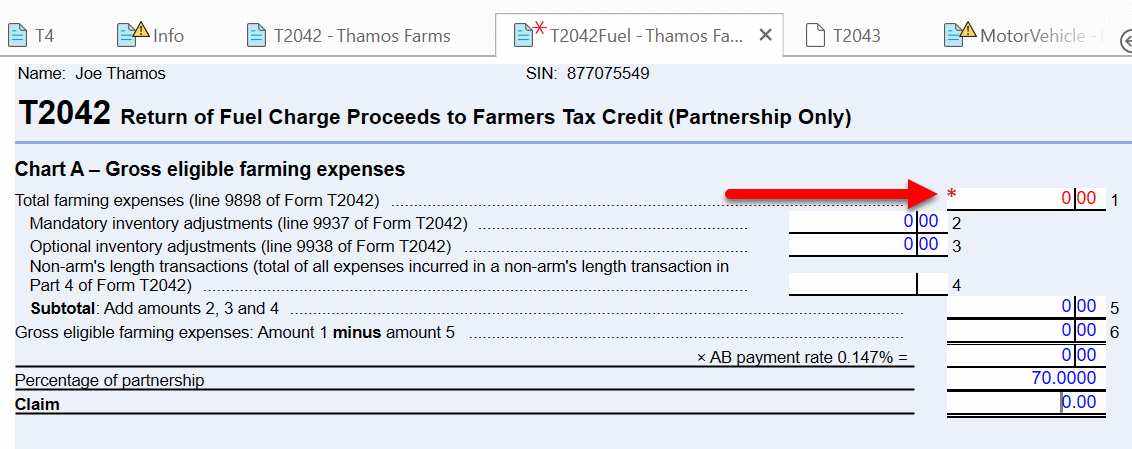

For a farm with shared ownership (as indicated on the T2042 or T1163/4), go to Chart A on the T2042Fuel or T1163Fuel/T1164Fuel worksheet. Override line 1 to remove the credit.

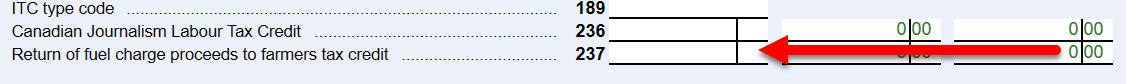

For a farming partnership that issued a T5013 slip to the taxpayer, the amount appears in box 237 of the T5013 data entry slip. Change this amount to zero before filing.

This is not an override. You will need to add it back before filing an adjustment.