EFILE Error Y80010 for Shared T2042, T1163/4 or T1273/4 Statements

The Canada Revenue Agency (CRA) has informed us that some 2021 T1 returns trigger EFILE error Y80010 when the taxpayer has a partnership farming operation and claims the Return of Fuel Charge Proceeds to Farmers Tax Credit.

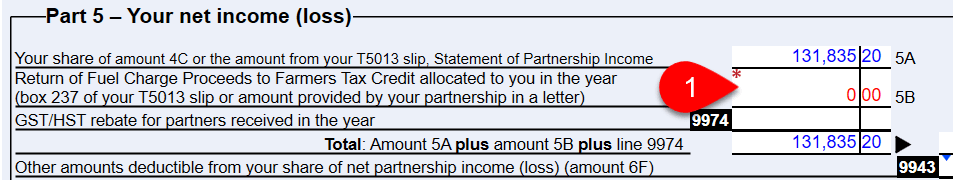

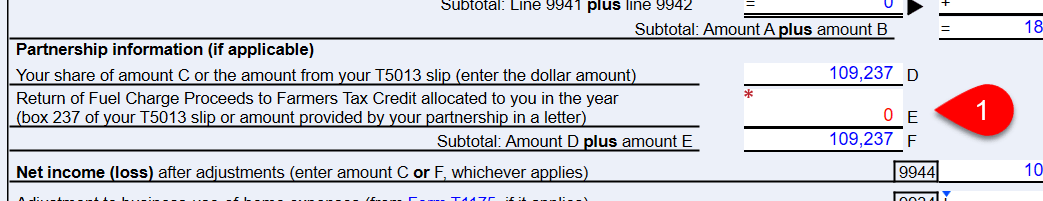

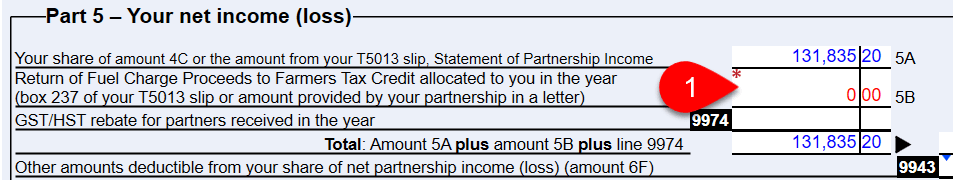

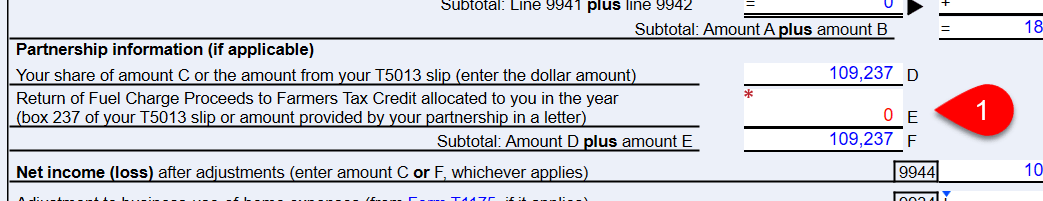

This only occurs for returns where the portion of the credit related to the shared farm is included in income at

- Line 5B in Part 5 of form T2042, or

- Line E in the Summary of income and expenses section of forms T1163/4 or T1273/4.

This does not affect returns claiming the credit from a T5013 slip nor those where the taxpayer owns 100% of the farm.

Error Y80010 Only Affects Some Returns

Error Y80010 can occur for returns that meet the following criteria:

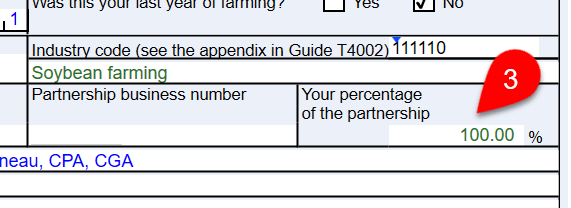

- Farming income declared through a farming statement (T2042, T1163/4 or T1273/4) that is shared (taxpayer does not have 100% ownership) with other partners (spouse, sibling or any other related/not related party).

- The shared farming operation qualifies for the Return of Fuel Charge Proceeds to Farmers Tax Credit on form T2043.

This situation triggers error Y80010 for only some of these returns because the amount on the above lines are not transmitted through EFILE (as per CRA specification). When processing the return, the CRA system tries to validate the addition of amounts transmitted for income and expenses through to the bottom line 9946. However, the system allows a certain tolerance in the validation, which is why only some returns with shared farms receive error Y80010.

Workaround—T2042

Override the amount of the credit to zero then create a new T2042 statement with 100% ownership and enter the amount on line 9600, other income. In TaxCycle, follow these steps.

- Override line 5B to zero to remove the income inclusion from the shared statement (removing the client’s portion of the credit).

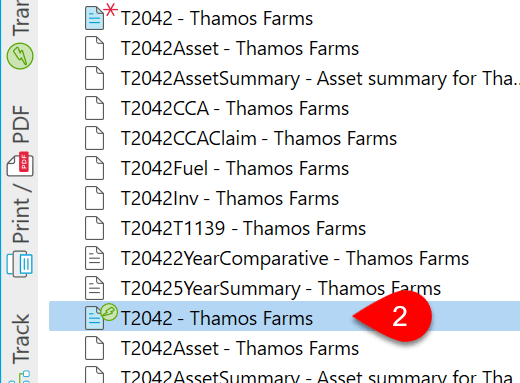

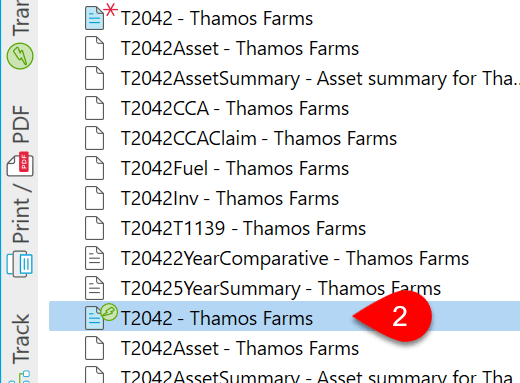

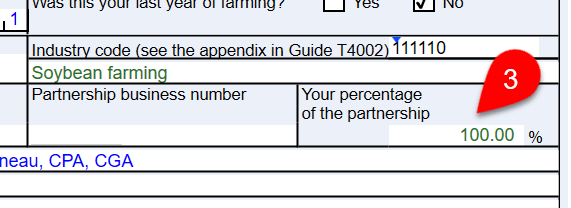

- Create a new T2042 farming statement and enter the same farm name, address, fiscal period, industry code, etc., on the new statement.

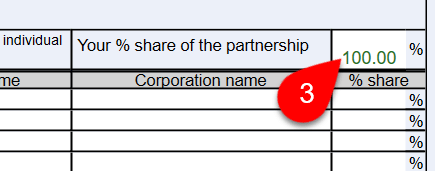

- Do not enter any partner information so the percentage of ownership stays at 100%.

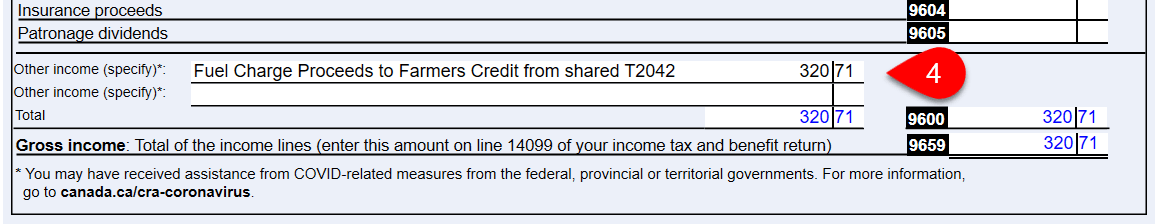

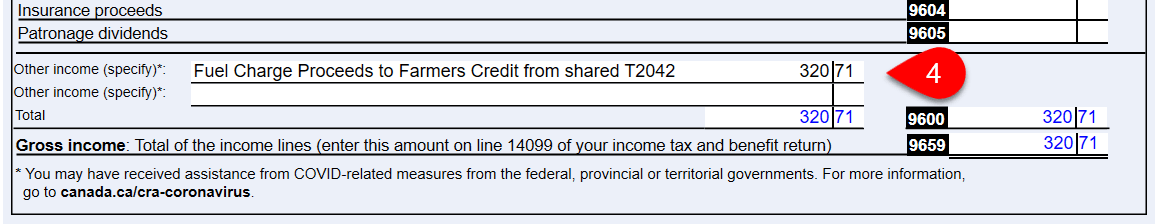

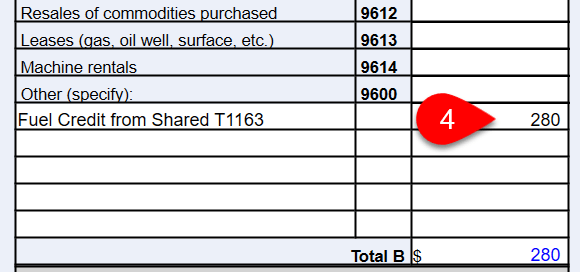

- Enter the amount of the credit that you overrode on the first statement as Other income line 9600 on the new statement.

Workaround—T1163/4 or T1273/4

Override the amount of the credit to zero then create a new T1163/4 or T1273/4 statement with 100% ownership and enter the amount on line 9600, other income. In TaxCycle, follow these steps.

- Override line E to zero to remove the income inclusion from the shared statement (removing the client’s portion of the credit).

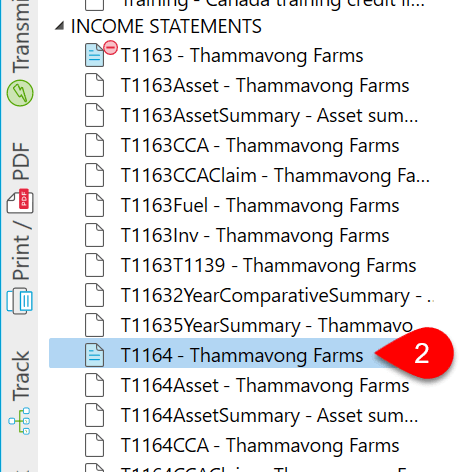

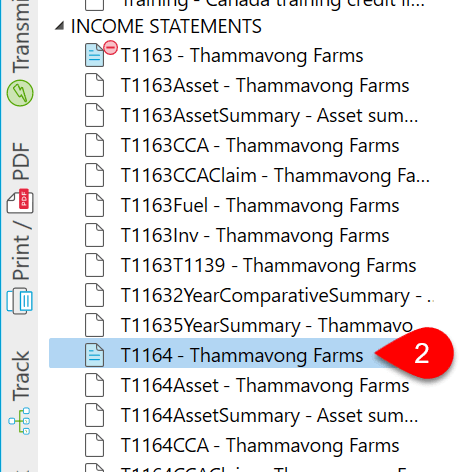

- Create a new T1164 or T1274 and enter the same farm name, address, fiscal period, industry code, etc., on the new statement.

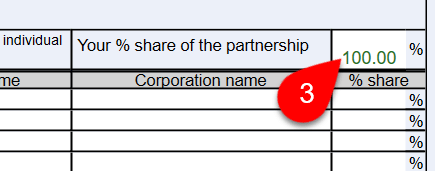

- Do not enter any partner information so the percentage of ownership stays at 100%.

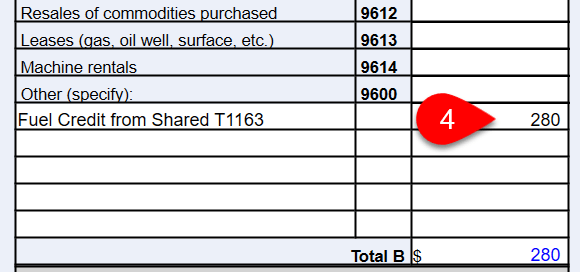

- Enter the amount of the credit that you overrode on the first statement as Other income line 9600 on the new statement.

Anticipated Resolution

The above approach will only apply to the 2022 filing season. The CRA plans to implement a more desirable solution for next season.