The 10% Temporary Wage Subsidy for Employers (TWS) is a three-month measure that allows eligible employers to reduce the amount of federal, provincial, or territorial income tax withheld they have to remit to the Canada Revenue Agency (CRA). The subsidy is equal to 10% (or a lower percentage the employer elects to claim) on the remuneration paid from March 18 to June 19, 2020, up to $1,375 for each eligible employee. The maximum for each employer is $25,000.

The CRA has released a new form for self-identifying as an employer claiming the wage subsidy, the PD27 10% Temporary Wage Subsidy Self-identification Form for Employers. We will include this form in TaxCycle T4 in an upcoming release.

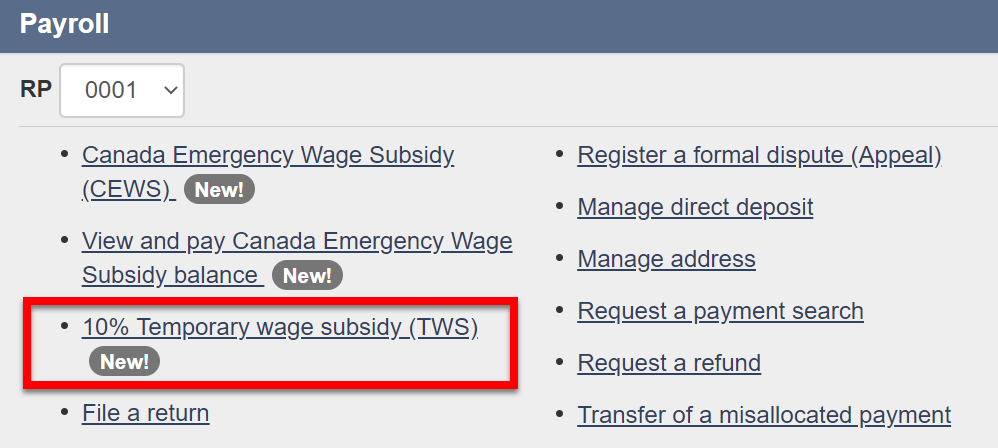

In addition, the CRA has added an online form in the Payroll section in Represent a Client and My Business Accounts.