Starting October 17, 2022, the Canada Revenue Agency (CRA) process for authorizing a new representative for business accounts will include an additional step.

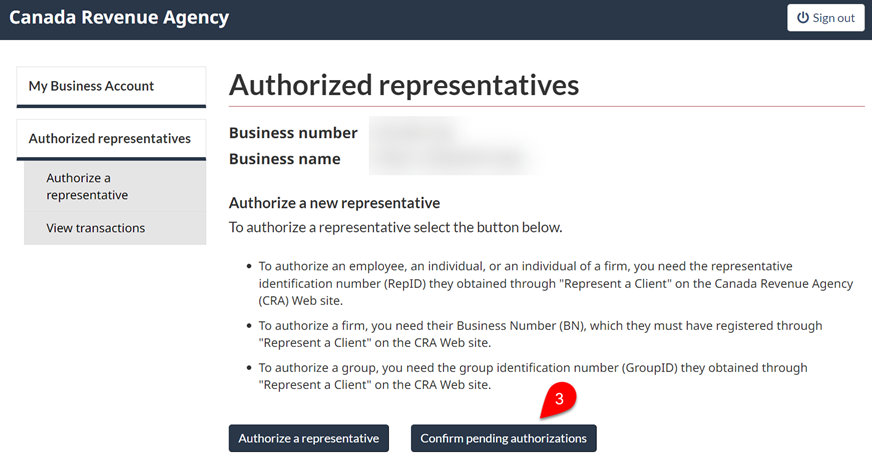

After you transmit a new request from TaxCycle (using the AuthRepBus form), that request will go into a “pending” state until your client—the business owner or their delegate—confirms the authorization through their My Business Account. You will not have access to your client’s account until they activate the request.

This change only applies to new authorization requests. Business consents already on file with the CRA will remain active. You do not need to submit a new business consent for these clients.

The CRA sent a detailed email regarding this change to all registered EFILErs on October 3, 2022.

To activate the request, your client will need to:

The CRA will cancel any request that is not activated within ten (10) business days. If this happens, you will need to transmit a new AuthRepBus request from TaxCycle.

Your client must register for My Business Account and enable email notifications before you submit the business consent request. Clients who are already registered for My Account can sign into My Business Account using the same username and password.

For more information on how to register and enable email notifications, please refer to the following links on the CRA website:

Once your client registers, they must add their business number to their account. Clients can only add the business number if their name and social insurance number (SIN) match the information the CRA has on file for the business.