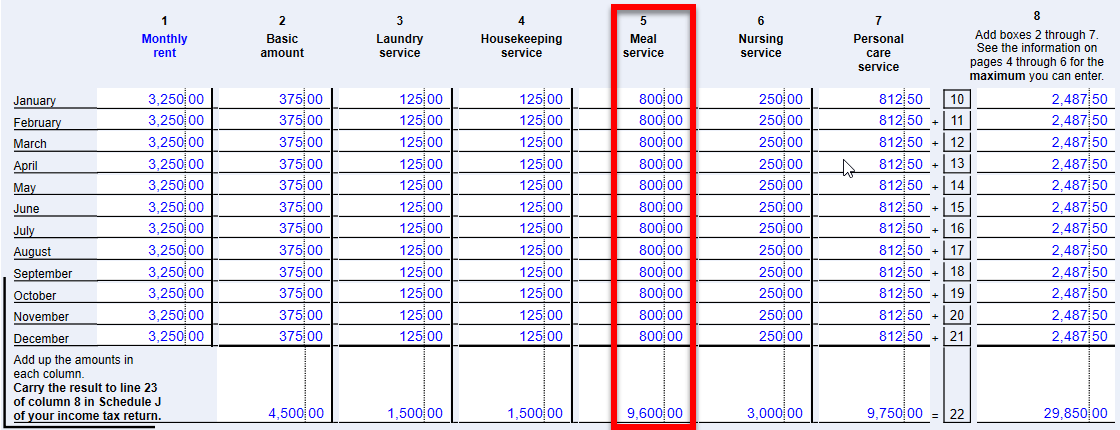

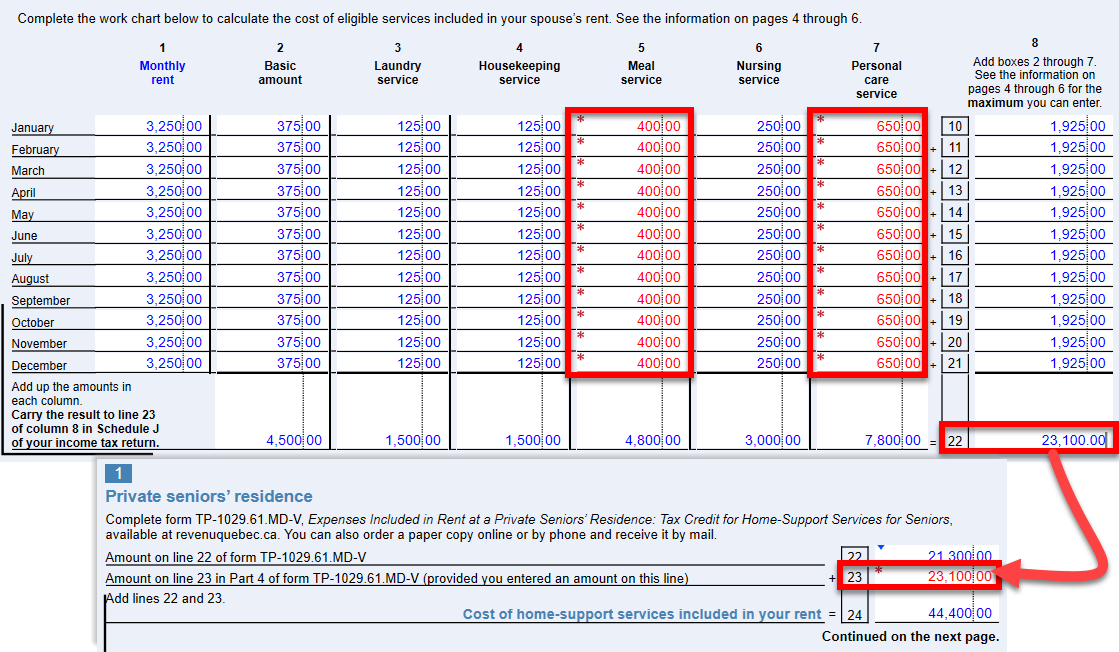

We have learned that TaxCycle version 13.1.52895.0 is not correctly calculating the amounts on line 23 of the TP1 Schedule J (Tax Credit for Home-Support Services for Seniors) and may not be calculating the correct amounts in Part 4 of the TP-1029.61.MD (Expenses Included in Rent at a Private Seniors’ Residence), such as the Meal service amount.

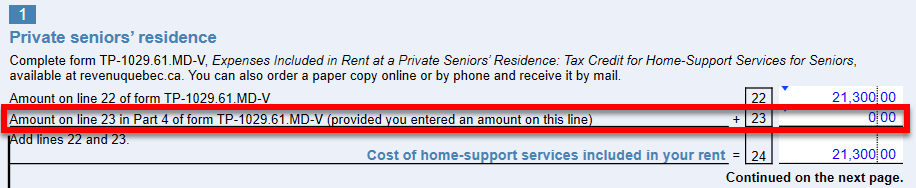

Validate the amounts in the Part 4 table of the TP-1029.61.MD and override any amounts that are incorrect. Then, copy the amount from column 8, line 22, and override line 23 of the Schedule J with that amount.

We resolved this issue in the latest TaxCycle release.