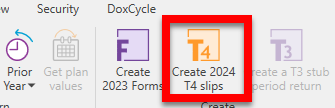

This TaxCycle release rolls over the T3/TP-646 module to 2024 and adds several customer requests to TaxCycle T3.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

We originally released version 13.1.53134.0 on May 13, 2024, with the changes below. On May 14, 2024, we released version 13.1.53204.0 to resolve the following issues:

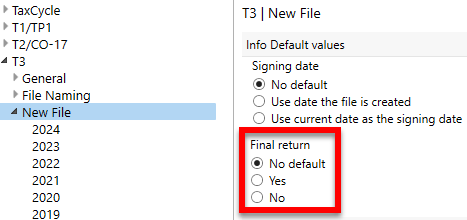

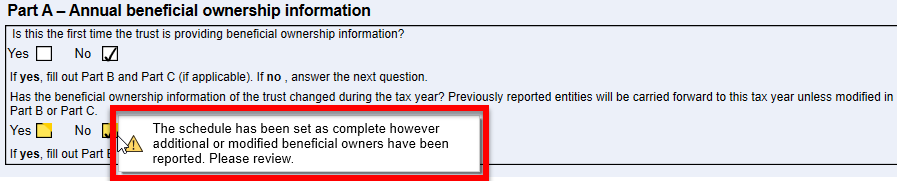

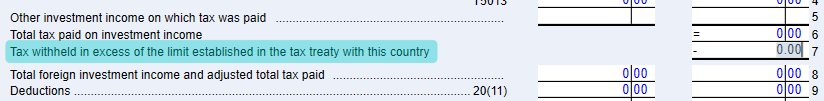

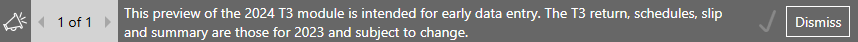

The new module for TaxCycle T3 allows you to begin data entry for 2024 federal and Québec trust income tax and information returns. Please note the following:

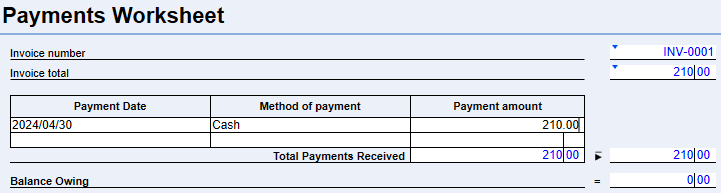

This release adds a new Payments Worksheet to the 2024 T3 module. The Payments Worksheet allows you to manage and enter payment information for your client invoice without unlocking the Billing worksheet.

We will add the Payments Worksheet to other 2024 TaxCycle modules in a future release.