We have discovered an issue where, in specific circumstances, the Return of fuel charge proceeds to farms tax credit (claimed on the T2043) is included in income twice. This issue affects both the T2042 and the T1273/4 farming statements.

The income inclusion doubles when the taxpayer has a farming statement for a farm they own 100%, and one for a farm that is a partnership.

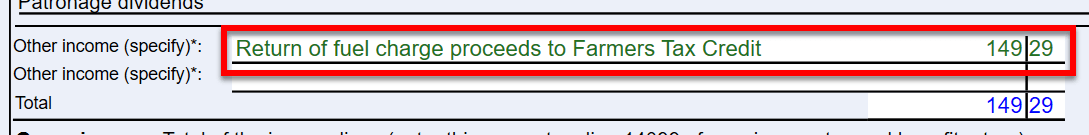

Under these circumstances, the amount of the credit is included in income in the following places on the farming statement:

This effectively includes the amount as income twice for the same taxpayer.

This issue was resolved in the latest TaxCycle update.