On September 12, 2022, we deployed an update to www.taxfolder.com. Please note that some features will only work after the next TaxCycle release.

Documents sent for approval or signature can now show all of the following states in the badges next to the document request. (Note that these states are separate from the email notification states that show whether or not links in the email were clicked on.)

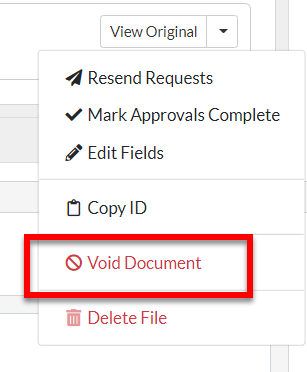

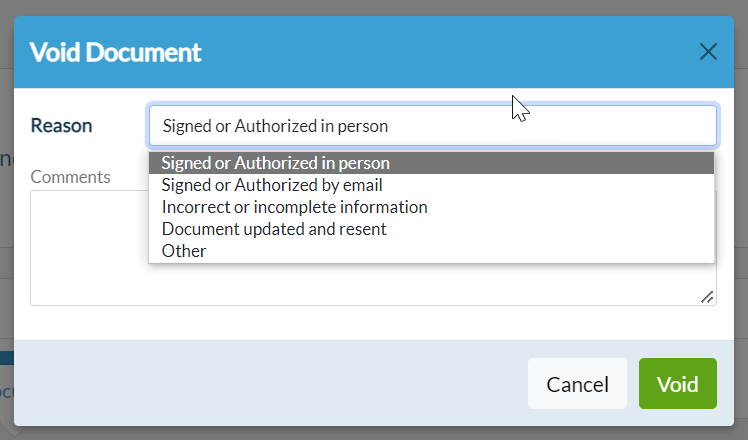

When a document is Voided or Declined, TaxFolder asks for a reason and provides the opportunity to add a comment. These details then appear in the email notification sent to the preparer and client.

You can also view any comments in the Client Dashboard. Select Void Comments or Declined Comments from the menu next to the document.

We are making the first step toward French language support in TaxFolder by offering client and preparer email notifications in French. As of this update, the following email notifications respect the client and preparer's language preference, and include the preferred language from TaxCycle templates and for the body of the email notification. Language preference is set on a per-user basis and will eventually be applied globally for all areas of TaxFolder. (See below for instructions on setting the language preference.)

We will continue adding French in other areas over the next six to twelve months, focusing on the client-facing areas first, including the client portal, public web pages and client-facing document processing.

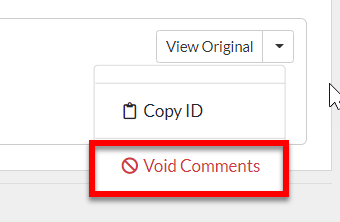

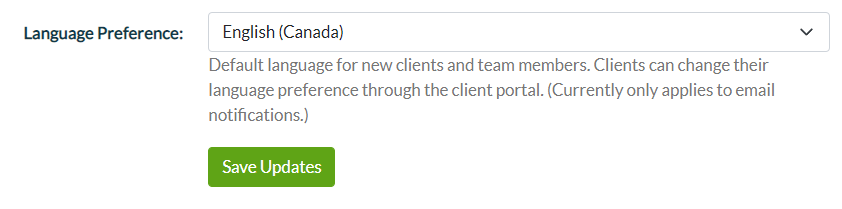

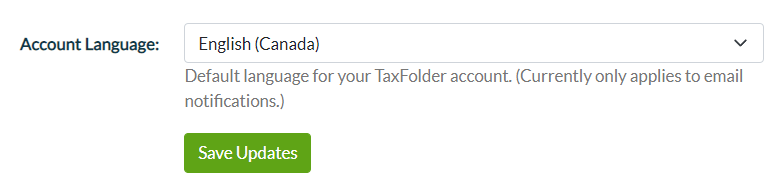

Set a default language preference for your firm and new clients/preparers on the Organization page in Account Settings:

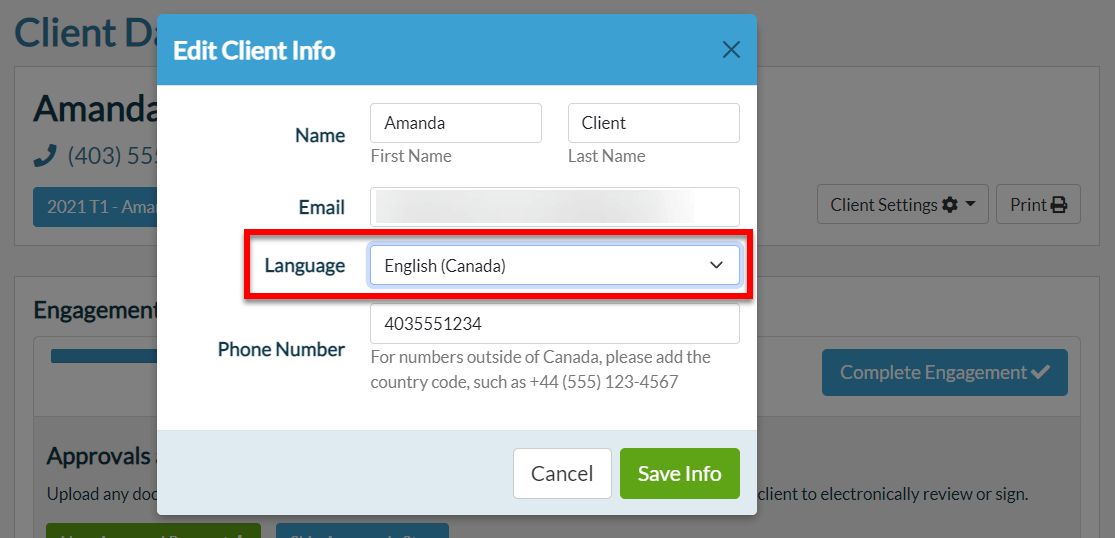

Preparers can update the language preference for a client in the Client Settings:

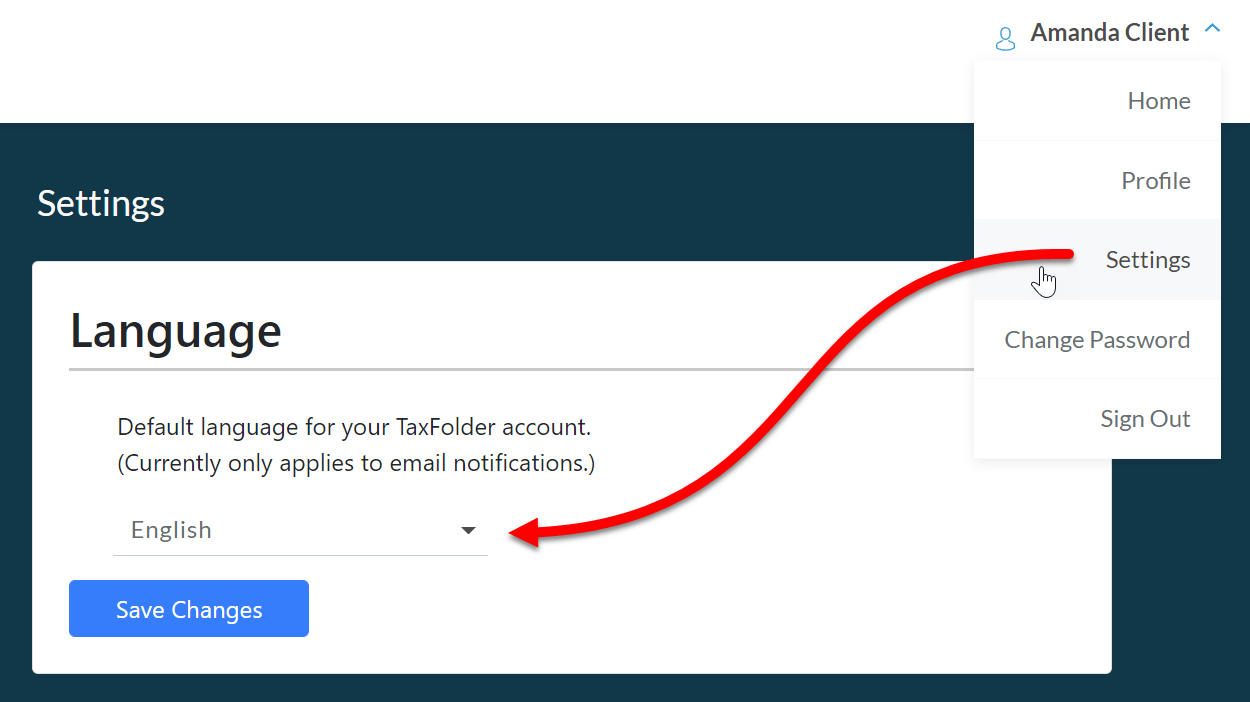

Clients can manage their own language preference on the Settings page in the Client Portal:

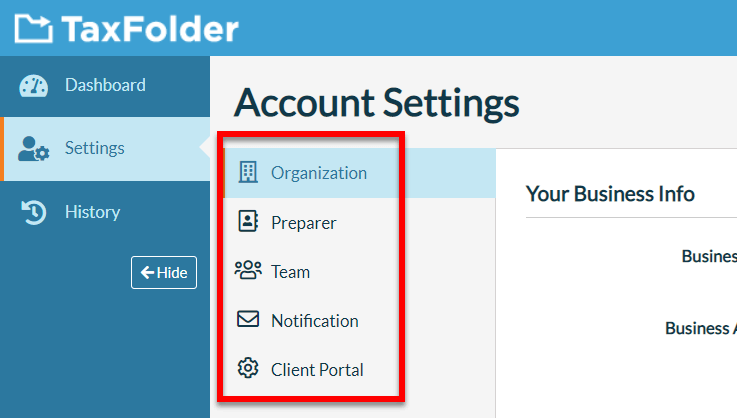

Preparers can update their language preference on the Preparer page in Account Settings:

To provide more flexibility and improve the frequency that messages from TaxFolder land in the primary inbox, clients can now unsubscribe from the following types of email notifications by clicking the link in the footer of the message:

Unsubscribed emails will show a status of Dropped in the Client Dashboard.

We reorganized some items under the Account Settings menu. Please review your settings.

A new Undo button below the signature box allows clients to undo the last part of the signature they wrote. The user does not have to redraw the whole signature if they make a mistake—just the last portion drawn.

The following changes will become available in the next TaxCycle release.