The Canada Revenue Agency (CRA) and Revenu Québec both require that the full social insurance number (SIN) or business number (BN) appear on forms sent to them by mail for processing.

You cannot mail documents with fully or partially masked SINs to the CRA or Revenu Quebec for processing, as they require the full SIN or BN in order to identify the taxpayer.

Revenu Québec currently only accepts masked SINs or identification numbers on the TP-1000, CO-1000 and the MR-69 (under certain circumstances).

Earlier this year, the CRA required that all certified software, including TaxCycle, produce paper copies of forms T1134 and T1135 showing the full SIN or BN. This was to address the long delay in processing these forms when received with illegible SIN or BN, if they are able to process them at all.

An upcoming release will include a similar change to all TP1 forms, except the TP-1000 and MR-69.

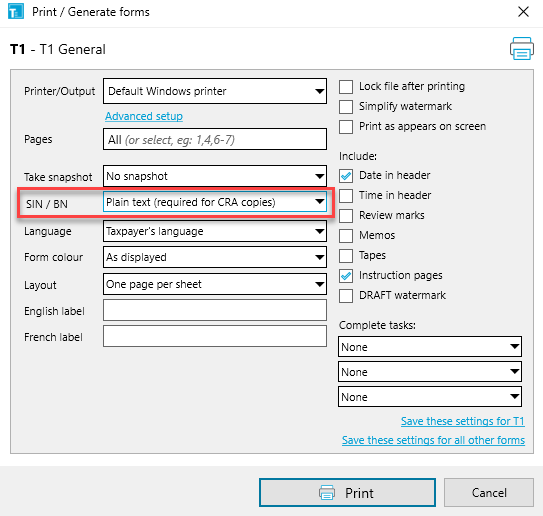

You can change the print settings in the print dialog box to display the full SIN or BN.

In Printer and PDF Output Options, select Plain text (required for CRA copies) from the drop-down menu next to SIN / BN.